-

The transformation of brick-and-mortar offices into high-tech sales centers has become an urgent matter as consumers increasingly transact through digital alternatives, yet branches still generate more sales than any other channel.

October 30 -

Kansas City's UMB Bank has rolled out an in-house tech support program to help get its less-tech-savvy customers comfortable with digital channels. It also hopes the initiative will help it boost retention rates and perhaps even capture a larger share of the customer's wallet.

March 25 -

People and processes are just as essential as technology as banks strive to save on costs in newer store models, say branch-makeover specialists.

October 9

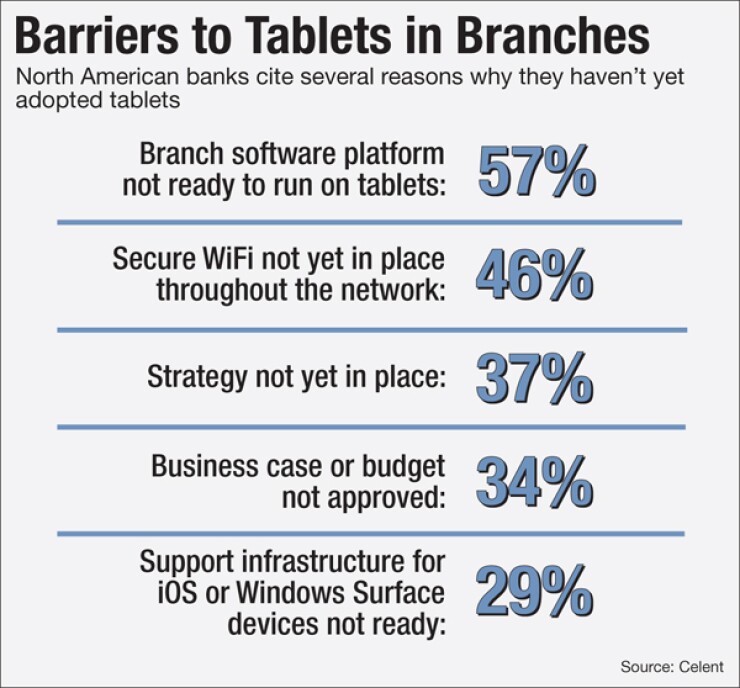

Among the many spirited debates about the ways bank branches will change amid a digital age, there's one consensus: there will be tablets. According to a recent survey by Celent, 92% of 37 institutions polled said the use of tablets for front-line staff was "highly or extremely likely."

"Everybody is thinking tablets," said Bob Meara, senior analyst in the banking group at Celent and co-author of the report.

The vision of how the devices will be used in branches, however, varies. Some see a branch greeter using a concierge app that can handle customer service needs like making appointments and reordering credit cards. Others see the device as a way to do away with pesky paper slips sometimes required of new customers or as the canvas for universal bankers to

But though it sounds innocuous, it's not that easy to implement.

The hitches range from the smaller details, like having secure Wi-Fi, to obstacles outside of the bank's control. Many branch software vendors — which many banks depend on — have yet to sell tablet-friendly offerings, for instance. And some institutions have to figure out how to motivate employees to use tablets, how to avoid theft of mobile devices and how to create customized in-branch apps that integrate into other devices like ATMs and instant-issue debit card machines.

"It's clearly top of mind," said Meara. "The wheels of progress move slowly in branches. A relatively straight-forward project becomes large and complex when it touches every branch, employee and workflow."

That doesn't mean banks are sitting and waiting for the magic moment. Institutions are initially using tablets in branches to show off money management features to customers. They're also using them to streamline the onboarding process, which often gets bogged down with physical paper.

Trial, Error…Success?

TD Bank is among the banks testing iPads in about 40 of its so-called stores. Of those locations, one store is piloting ways to use the device to improve customer sign up.

There are customizations to be ironed out.

Unlike when someone is signing up for an account online from his home, the branch employee using a tablet app can verify the person face to face rather than require him to answer the types of challenge questions that

The bank also wants to connect iPads to other in-branch devices, like instant-issue debit machines, so the new customer can get their cards in the store immediately. It also aims to connect any applicant data the consumer may have already supplied the bank through another channel to the in-branch experience.

For now, most of TD Bank's tests with in-branch tablets — which began in July — involve teaching employees to use iPads to demo digital features to new or existing customers.

"We are a human bank," he said. "We don't just want to send a brochure and show an ad on TV screens."

The bank's in-branch adjustment underscores a big trend: in a digital age, banks can tout more than just their products or long business hours.

"The definition of convenience is changing," said Immaneni. "Digital offerings are a big part of convenience."

Like TD Bank, PNC Bank uses tablets in its branches to demonstrate digital capabilities to would-be customers and existing customers. Unlike TD, PNC has iPads in all of its branches.

"We are now at the point every branch needs one," said Linda Morris, director of sales and service for retail banking at PNC Bank. "We need to visually show and demo how to use those tools," said Morris.

To be sure, not all of PNC's almost 2,700 branches have Wi-Fi. However, the institution's iPads have content on them that can be used to educate employees and customers with or without internet access.

More recently, the bank is beginning to test using the iPads to open new accounts primarily with its out-of-branch employees.

It's not alone.

USAlliance Federal Credit Union, for instance, introduced tablets into its branches this spring to upgrade the consumer experience of signing up for checking, savings accounts and credit cards.

Using software from Gro Solutions, the Rye, N.Y. institution's native app on its in-branch tablets already has features that save people from repetitive input: it refrains from asking someone out-of-wallet questions since an associate is looking at his face to face, for example.

"It's a lot more engaging," said Kristi Kenworthy, assistant vice president of eCommerce at USAlliance.

This onboarding experience is an improvement from what had previously either required the would-be customer to fill out paperwork or wait and stand behind a desktop computer while an employee manually typed in the data needed. What had been a 40-minute process can be accomplished in four minutes.

The tablets are used in the institution's branches and at field events. Some of the institution's tablets have data plans to accommodate those times when Wi-Fi connections may not be strong.

Sure, branch transactions continue to be on the decline and banks have and will continue to close locations. But PNC, USAlliance and TD say the branch — which continues to be the No. 1 place for sales — still has an important role for many people, even tech-savvy ones.

"High tech doesn't mean giving up high touch," said TD Bank's Immaneni. "There are customers who want both and we can deliver both."