Want unlimited access to top ideas and insights?

BB&T and SunTrust are moving full speed ahead with plans to complete their merger this year, but executives said Thursday it is possible the closing could slip to 2020.

The biggest remaining hurdles are regulatory approvals. The Justice Department has yet to decide on the companies' divestiture plan, a move that historically precedes action by the Federal Reserve.

While reiterating his confidence in a fourth-quarter closing, Kelly King, chairman and chief executive of the $237 billion-asset BB&T, said that the final steps are “beyond our control” and that a delay is possible.

“This is in the regulatory framework, and they move at their own pace,” King said during a quarterly earnings call dominated by questions about the deal's progress.

“We feel good about where things stand with the regulators,” he added. “They’re being deliberate, given the size and significance of this deal, as they should be and as we are being. So everybody has the same goal of making sure that, when we move forward with this, we've dotted all the i's and crossed the t's.”

Bill Rogers, SunTrust’s chairman and CEO, struck a similarly cooperative tone during his company's earnings call.

“We'll continue to work closely with regulators to answer their questions and finalize various processes,” Rogers said. “The dialogue has been extremely constructive and, given all that we know today, we're targeting a close at some point in the fourth quarter.”

Several numbers in the companies' third-quarter results offered a glimpse of how much they have riding on the $28.2 billion deal. The companies incurred $119 million in direct or indirect merger expenses.

BB&T reported $39 million in personnel expenses largely tied to retention payments to key employees. The $227.4 billion-asset SunTrust had one-time costs tied to retention payouts and write-offs on certain technology development projects.

BB&T said it expects to incur $60 million to $80 million in merger-related expenses in the fourth quarter, largely tied to personnel and professional costs.

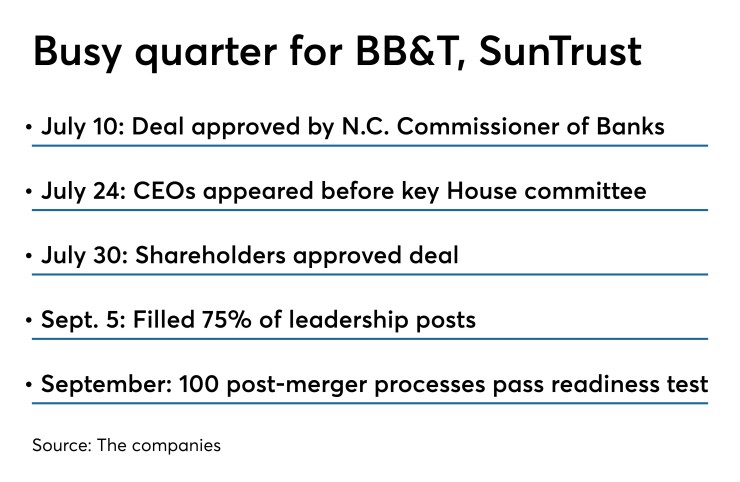

About 8,000 employees have accepted posts that would exist at the combined company, which would be called Truist Financial and would be based in Charlotte, N.C. Three-fourths of the executive positions have been filled, and King said the remainder are expected to be set by Nov. 1. (BB&T is based in Winston-Salem, N.C., and SunTrust is in Atlanta.)

“These leaders reflect great talent in both companies,” Rogers said. “It's a tremendous balance between both BB&T and SunTrust — great levels of diversity by traditional definitions but also by backgrounds, experiences and perspectives. We just simply have a superior team.”

The total workforce at both companies is down only 2% since March 31, based on each company's quarterly disclosures.

“Our teams are 100% aligned," King said, adding that the new bank’s leadership is planning a roadshow once the deal closes to meet with employees and promote a smooth transition.

King said he and Rogers have an agreement to deal with issues “promptly, quickly and decisively.” While the executives have an understanding to “get on the phone immediately” to discuss any disagreements, nothing of significance has surfaced so far.

Technology initiatives are said to be meeting expectations. The companies conducted a “dress rehearsal” in September for about 100 processes, King said. “They all passed very, very well, so we have that ready for that legal day one close."

While the companies did not factor revenue opportunities into its forecast, Rogers and Chris Henson, BB&T’s president, have been identifying ways to boost the amount of post-closing business for Truist.

Henson said he and Rogers have singled out more than 20 opportunities, such as offering SunTrust’s strategic advice services to smaller commercial clients. SunTrust also has a strong estate planning business, while BB&T has a big insurance operation and a commercial deposit program that can be offered to all Truist customers.

Those efforts will have increased importance if BB&T sticks with its goal of a 51% efficiency ratio.

King acknowledged that “the market is substantially different than it was back in February” when the deal was announced. Net income “is under a lot of pressure,” making it harder to guarantee that efficiency target, he said. “Whether we hit 51 or not, we believe we’ll be top-in-class in terms of our efficiency ratio."

Economic uncertainly has forced BB&T to take a wait-and-see approach to major strategic moves, though it sold $4.3 billion in mortgages in the quarter — which created a $4 million gain and a $16 million release from the loan-loss allowance — to improve overall loan yields and reduce exposure to the yield curve.

Still, King said he believes U.S. trade disputes with China, Mexico and Canada will be resolved by the end of the year.

“But I could be wrong, and that’s why we're being very cautious in terms of everything we do in terms of capital liquidity and diversification,” King said. “We simply are in an environment where to place a high bet on any one scenario, up or down, is not a smart bet.”

BB&T’s third-quarter earnings, including merger-expenses, fell by 6.8% from a year earlier to $735 million. Revenue rose by 2.6% to $3 billion. Total loans increased by 3% to $152 billion, helping offset a net interest margin that fell 10 basis points to 3.37%.

At SunTrust, net income fell by 17.7% to $597 million. Revenue increased by 2.6% to $2.4 billion. Total loans increased by 7.7% to $158.5 billion, while the margin narrowed by 21 basis points to 3.01%.