Consumer finance may have been the unsung hero of Citigroup’s fourth-quarter results.

Big gains in investment banking and fixed-income trading were front and center when Citi reported its quarterly earnings, but returns from credit cards and an ongoing digital expansion are giving executives more confidence about the New York banking giant’s 2020 prospects.

Citi expects to gain more traction with consumers, where it has seen “good client engagement across the portfolio,” Mark Mason, the $2 trillion-asset company’s chief financial officer, said during a quarterly call with analysts.

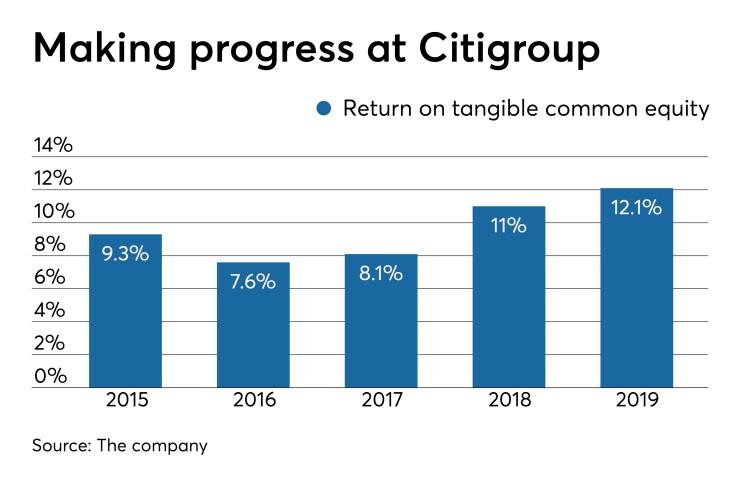

Executives were confident enough to state they could meet last year’s 12.1% return on tangible common equity — which surpassed a goal some analysts thought to be aggressive — with the potential of pushing the metric as high as 13%.

Doing so will require Citi to lean even more on its consumer business, industry experts said.

“The U.S. consumer is clearly the opportunity to grow loans, especially in credit cards,” said Mike Matousek, a trader at U.S. Global Investors who tracks big banks.

“It makes sense as long as this economic expansion continues,” Matousek added. “But is it sustainable? And, if not, does growth go away and do defaults rise? It’s not without risk.”

Citi’s fourth-quarter profit rose by 16% from a year earlier, to $5 billion, or $2.15 a share. Excluding a gain from a tax benefit, results of $1.90 a share topped FactSet's average analysts’ estimate by 9 cents.

Revenue in the quarter rose by 7%, to $18.4 billion, fueled by a 49% surge in fixed-income trading and solid gains in debt underwriting.

Still, revenue in the consumer bank increased by 5%, to $8.5 billion, while profit in the segment rose by 12%, to $1.6 billion.

Citi is investing in digital services and promotions to attract more card customers and, by extension, online deposits.

Average loans in retail banking were up 5%, while average deposits were up 6%. Digital deposits totaled $6 billion at Dec. 31.

“We continue to attract digital deposits from both existing and new customers,” CEO Michael Corbat said during the call with analysts.

Revenue from credit card products increased by 6%, topping $5.3 billion, while retail banking revenue rose 3%, to $3.1 billion. The company’s U.S. Citi-branded credit business grew by 10%.

Citi’s loan-loss provision increased by 15%, to $1.9 billion. Executives said the increase was primarily due to loan growth and “seasoning” in the company’s North American consumer portfolio. They described overall credit quality as stable.

“Any new trends, negatively, on credit will stick out” in 2020, Matousek said.

Citi steadily gathered “strong momentum,” with card use building over the course of 2019, Mason said.

Fourth-quarter average loans in the card business rose 3% from a year earlier; card purchases were up 5%. More customers converted promotional balances to interest-earning balances last year, and executives said they expect that trend to continue.

Loan growth helped offset pressure on yields that developed after three rate cuts in the second half of 2019. Citi’s net interest margin widened by 7 basis points during the fourth quarter, to 2.63%, setting it apart from JPMorgan Chase and Wells Fargo.

Citi executives said the company’s improved digital capabilities, which include data analysis and more automation, are boosting productivity and offsetting new costs. Fourth-quarter noninterest expenses, while up 6% from a year earlier, fell slightly from the third quarter.

The company is targeting flat expense levels for 2020.

“We enter 2020 in a strong competitive position,” Corbat said.