-

A funding option reopens to smaller banks.

May 27 -

ConnectOne Bancorp in Englewood Cliffs, N.J., has issued $50 million in subordinated debt and intends to exit the Small Business Lending Fund program.

July 1 -

Xenith Bankshares in Richmond, Va. has issued $8.5 million in subordinated debt and plans to use the proceeds to exit the Small Business Lending Fund.

June 29 -

Bank debt is back in vogue. The question is for how long.

December 4

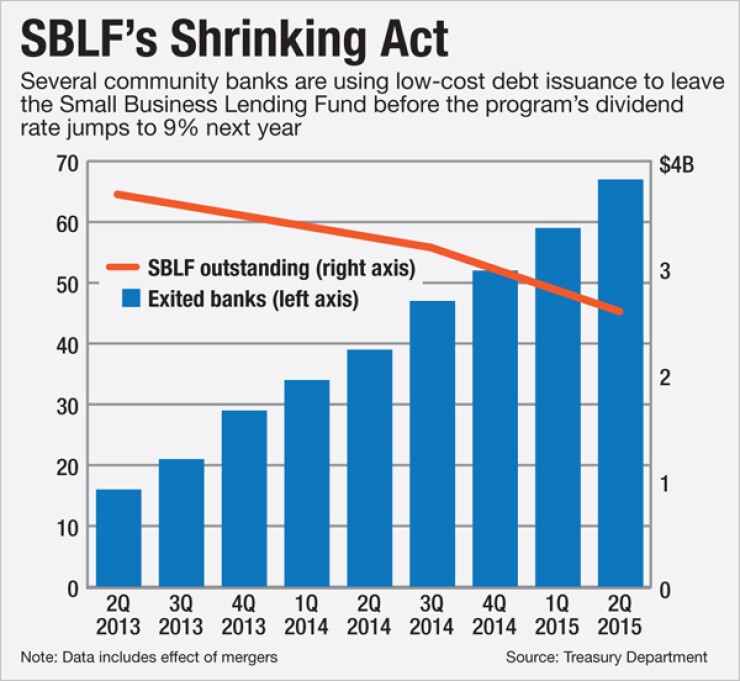

The low interest rate environment may be challenging for lending, but it is also providing smaller banks with an affordable way to exit the Small Business Lending Fund.

A steady stream of community banks have been redeeming shares they issued the Treasury Department in order to participate in the SBLF. The program, launched

About a fifth of the 332 institutions that participated in the program

"It was just a matter of being proactive and getting it done," said Thomas Osgood, chief financial officer at Xenith Bankshares in Richmond, Va. The $989 million-asset company decided to issue subordinated debt

Xenith used the proceeds from its debt issue to redeem $8.3 million in SBLF stock.

"We thought we just shouldn't run it too close" to the dividend rate increase, Osgood said.

The program's dividend rate

The higher rate will be "a very burdensome cost" for remaining participants, said Collyn Gilbert, an analyst at Keefe, Bruyette & Woods.

At least 15 banks have left the program in the past six months. Several of them, including

"I think it's just the cost and potential return of alternative sources of capital," Gilbert said. "The rates on some of the sub debt have been attractive, assuming banks can really leverage it."

The refinancing activity comes

Xenith, for instance,

Coupon rates on community bank debt hovered around 10% just a few years ago, de Saint Phalle said. "Broadly speaking, for the last two years the majority of the buy-side market has been caught off guard on where [coupon] rates were going," he added.

Rates are expected to remain low into the foreseeable future, though they've edged up slightly in the last year. "My personal view is that the market is going to stay very stable for these banks," de Saint Phalle said.

That's encouraging news for small banks keen on refinancing their SBLF shares.

Senior debt is another option for banks eager to leave the SBLF.

Hilltop Holdings

"The market for debt issuance was attractive," said Jeremy Ford, the $12.5 billion-asset company's president and chief executive. "We knew that the [rate increase] was coming."

The recent wave of departures draws more attention to the SBLF, which has been the target of criticism from policymakers in Washington since its creation. A special investigator's report two years ago

The program was also criticized in its early years for having a

Additionally, Treasury

In retrospect, however, a number of bankers are willing to give the SBLF some credit, and a

"I think it was very beneficial," said Alan White, Hilltop's vice chairman. "It was cheap funding, and the more money we loaned the better."

"I found Tarp and SBLF to be useful capital tools for our growing community bank," said William Marsh, chief executive of Emclaire Financial in Emlenton, Pa., though he admitted that the Treasury's capital-injection programs especially Tarp included some "bad political connotations."

The $589 million-asset Emclaire, which initially used the $10 million it received from the SBLF to fund its exit from Tarp, has redeemed half of its SBLF funding. It plans to fully exit the program before the rate jumps from 2% to 9%.

Emclaire also credits SBLF funds for allowing it to help small businesses in rural Pennsylvania, Marsh said.

"The program had specific criteria for the types of loans that qualified," he said. "We took our normal potential business targets and narrowed it with respect to those characteristics."