Should he stay, or should he go?

That's the question being raised by a shareholder about William Wagner, the chairman and chief executive of Chicopee Bancorp in Massachusetts, which

Wagner will receive

-

After two failed attempts to find a buyer, New England Bancorp in Massachusetts agreed to close all four of its offices before selling to Independent Bank. Independent ultimately decided to keep one branch open.

May 10 -

Delaware Bancshares in New York thought it was set to grow and diversify after buying six Bank of America branches. Instead, the deal led to the company selling itself.

April 22 -

Kearny Financial completed its IPO less than a year ago and already it has found itself in the crosshairs of Lawrence Seidman. The well-known activist is pushing for the resignation of several board members he says are overcompensated and is urging shareholders to vote against a proposal on director pay this fall.

April 8

"Change-of-control contracts are designed to provide a payment to executives in exchange for giving up their jobs and providing material cost savings to the buyer," Terry Maltese, president and CEO of Maltese Capital Management, wrote in an April 28 letter to Wagner obtained by American Banker. "Their purpose should not be to offer a financial windfall to executives who keep their jobs."

Maltese, whose fund owns about 4.5% of Chicopee's stock, did not single out Wagner by name, but referred to unnamed "senior executives" at the company who are to receive such buyout payments. Maltese pressed Chicopee executives to give up their change-of-control payments so the $1.4 billion-asset Westfield could pay more to shareholders.

Maltese, who also wants the deal restructured to include an even split of cash and stock, pressed Wagner to consider accepting new bids from other banks.

The issue shows that investors are paying more attention than ever to the details of merger agreements, and they are willing to second-guess practices that have been commonplace in the past.

Wagner, for his part, said he is limited on what he can say about the payments since the companies have yet to file their proxy statement with the Securities and Exchange Commission. "I've spent my whole life being totally candid with people, and it is awkward to talk about an issue when I can't tell them what I really know," he said.

"I understand the sentiment" of investors upset about the change-of-control payment, Wagner said. The new position "is not the job I have," he said, adding that the matter would be addressed in the proxy.

Efforts to reach other key players, including James Hagan, Westfield's president and CEO, and Johnny Guerry, managing partner at Clover Partners, which owns nearly 10% of Chicopee's stock, were unsuccessful.

Still, some industry experts brushed off the notion that the payment to Wagner is inappropriate.

"Nothing sticks out here in the terms" as suspicious, said David Baris, a partner at the law firm BuckleySandler and president of the American Association of Bank Directors, who read the change-in-control agreements and related documents. "Often there isn't one right or wrong call when negotiating a deal's terms."

Typically there are two triggers for a change-of-control payment, said Martin Nussbaum, a partner at the law firm Dechert. First, there must be a change of control such as a company's sale, followed by the executive losing his or her job or taking a new post with "substantial diminution in salary or responsibility," he said.

Larry Seidman, an activist investor in New Jersey who owns about 1% of Chicopee's stock, said he believes bankers should give up their change-of-control payment if they keep their jobs. Seidman, however, said he has no problem with Wagner's payment since he is taking a different job that pays considerably less.

Wagner, for instance, faces a 20% pay cut, based on regulatory filings.

"In banking today, you don't get what you deserve, you get what you negotiate," said Rod Taylor, president of Taylor & Co., an executive search firm in Atlanta. "And sometimes what you negotiate is what you deserve."

Change-of-control agreements are "a de facto incentive for the CEO to get a good deal for the bank," Taylor said, adding that it makes sense to have executives stay at acquirers if they can retain or bring in new business.

Therein lies another issue for Maltese, who claimed in his letter that the Westfield deal has done nothing to improve value for Chicopee's shareholders.

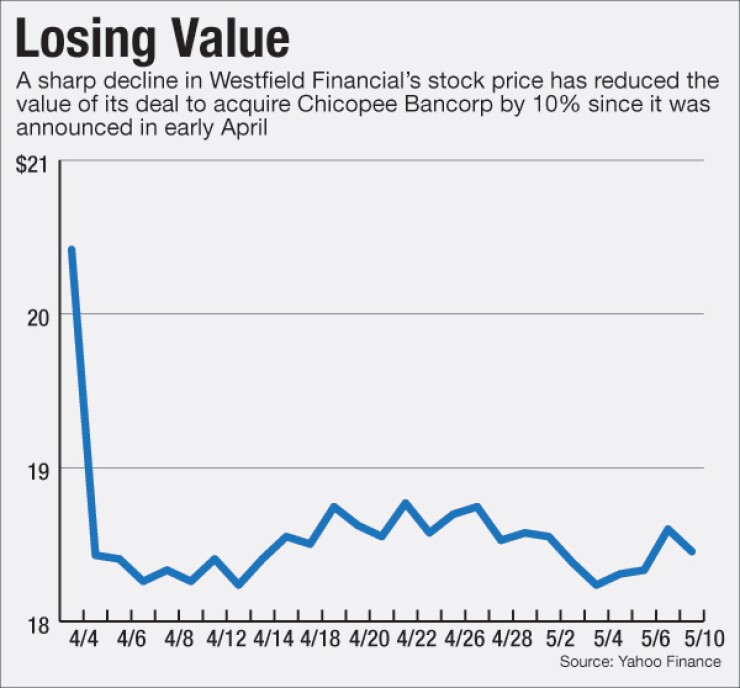

Westfield's stock is off by about 10% since the deal was announced on April 4. Maltese argued in his letter that the weakened stock and the lack of a cash cushion have been bad for investors.

Paying half the sale price in cash would make the deal less dilutive to Westfield's tangible book value and shorten its nearly five-year earn-back period, which in turn would help the buyer's sagging stock price, the letter said.

Seidman said he agreed with Maltese on that point. "Having the deal structured 50-50, with cash and stock, makes sense," he said.

Maltese, in a follow-up interview, said the drawbacks of an all-stock deal and the change-of-control payments were more than he could stomach. "Each of those things is pretty bad, but together they are really bad," he said.

Wagner defended the all-stock deal, while asserting that Chicopee's board is committed to the deal's original terms. "It is very common to have an all-stock deal in a strategic merger, which this is," he said.

"While we recognize Maltese's concerns, given the drop in the stock price, we don't know what the price will be when the deal closes," Wagner added. "We remain very enthusiastic and many shareholders like the deal. There are important decisions that need to be made when you structure a strategic merger, and we haven't done anything outside the box."

It is unclear whether Maltese, or any other investors, will actively oppose the merger. Maltese, Seidman and Clover collectively own about 14% of Chicopee's stock, based on regulatory filings. Company insiders, in comparison, hold about 12% of the stock, according to a 2015 proxy statement.

Seidman, for his part, said he wanted more information before discussing any future moves.

It is also unclear what Maltese might do next, though he did urge Wagner to share his letter with the rest of Chicopee's board.

"We do not object to a sale transaction, but we believe this transaction was structured poorly," he wrote.