Many American cities are suffering from a shortage of housing, and nowhere is the problem more severe than in the Pacific Northwest.

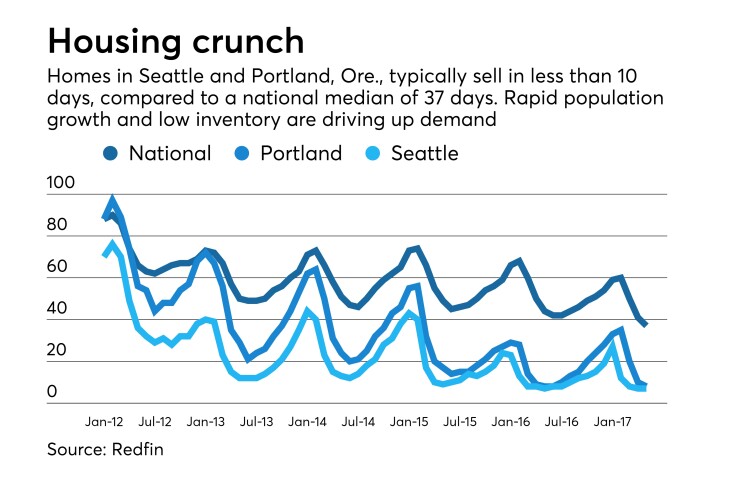

Thanks to a potent combination of rapid population growth and a paucity of housing inventory, homes for sale in Seattle and Portland, Ore., are being snapped up in a matter of days, compared with a month or more elsewhere.

That’s created a quandary for banks that make home loans in those markets: With relatively few new mortgages to originate, how can they participate in the sizzling housing market without taking on too much risk?

As home values skyrocket, some traditional lenders are responding by making more jumbo loans. Others are cautiously jumping into multifamily lending or offering bridge loans to help customers win bidding wars on properties. How these banks fare in these ventures could offer lessons for banks in other markets where inventory is scarce and home values are soaring.

Of course, low housing inventory is a

Adding to the problem is that many community banks, still spooked by last decade’s real estate bust, have been reluctant to re-enter the market for making loans to homebuilders, said Jeff Rulis, an analyst at D.A. Davidson in Portland.

The shortage is particularly severe in Seattle and Portland because geographic constraints limit the amount of land for building new homes. In the month of May, for example, the median number of days a house in Seattle sat on the market was seven, compared with the national median of 37 days, according to the real estate firm Redfin. In Portland, the median was eight days.

Meanwhile, prices are soaring. In Seattle, home values in April were up nearly 13% from the same period a year earlier, according to the S&P CoreLogic Case-Shiller 10-City Compositive Home Price index, compared with 4.91% nationally. In Portland, home values were up more than 9.3% year over year.

“It’s starting to be an affordability issue,” said Tom Potiowsky, director of the Northwest Economic Research Center at Portland State University. “The jobs that have been created are relatively high-paying jobs, and that gives people the ability to bid prices up on these houses.”

Seattle and Portland have become magnets for Silicon Valley tech firms to open satellite offices, largely because the cost of living, while high, is still lower than in the San Francisco Bay area, said Charlie Guildner, chief lending officer at the $1.6 billion-asset Peoples Bank in Bellingham, Wash. The online retailer Amazon has also continued to hire at a fast clip in both its hometown of Seattle and in Portland.

One solution is to build apartment or condominium buildings on lots that once held a single-family home, said Brent Beardall, CEO of the $15 billion-asset Washington Federal in Seattle. Beardall has encouraged his lenders to pursue this business; Washington Fed’s multifamily loan portfolio rose 17% to $1.3 billion in the first quarter from a year earlier.

“There’s just not the available land,” Beardall said. “You tear down one house and put up three or four individual houses on the same lot, or a multifamily unit.”

Regulators have been warning banks for months, however, that

“We learned a valuable lesson during the last cycle that it takes so long to go through the permitting process" for acquisition/development/construction loans, "you can be stuck holding the bag when the music stops” and the market turns south, Beardall said.

Peoples Bank also favors the multifamily market because there is a surplus of outdated apartment and condo buildings in Seattle that are in need of refurbishment, Guildner said. The bank’s target loan in this niche is between $10 million and $12 million for the renovation of a building with between 40 and 50 units.

“There are so many older apartment complexes from the 1980s that are in poor shape,” Guildner said. “You have to upgrade them to take advantage of the significant increase in rent.”

Peoples Bank’s multifamily portfolio rose 40% to $99 million in the first quarter from a year earlier.

The $575 million-asset Sound Financial Bancorp in Seattle has opted to emphasize speed instead of multifamily lending. CEO Laurie Stewart came to that conclusion after a recent personal experience.

Stewart owned an investment property in Seattle and put it up for sale on a Friday. By Monday, she had received multiple offers. She closed on Tuesday with a full-price offer in which the buyer waived his right to an inspection and appraisal. The buyer had to include those concessions to beat out an all-cash offer, she said.

“That’s how crazy this market is right now,” Stewart said.

Stewart decided it was a good time to resurrect Sound Financial’s dormant bridge loan program. In the past 12 months, the bank has originated about $30 million of bridge loans. During the same period, Sound Financial’s multifamily portfolio shrunk 15% to $55 million.

Sound Financial is making bridge loans to buyers who need every advantage they can get in the fiercely competitive landscape to buy a home in Seattle. “Our focus has been on how we can get these bridge loans closed as quickly as we can,” Stewart said.

Bridge loans allow Sound Financial to participate in the housing market without having to loosen underwriting standards on residential mortgages, such as lowering its loan-to-value ratios. But not all banks are comfortable allowing borrowers to carry two mortgages simultaneously.

“That’s just a risk position that we’ve decided to avoid,” said Peoples Bank’s Guildner.

Peoples Bank is instead staying active in the mortgage market by making more jumbo loans and immediately selling them to Fannie Mae and other investors.

The bank had only been working with Fannie, but found it can get better pricing by expanding its pool of borrowers. It now sells its loans to Wells Fargo and JPMorgan Chase, among others.

“We have to try to make those big banks compete with each other,” Guildner said.