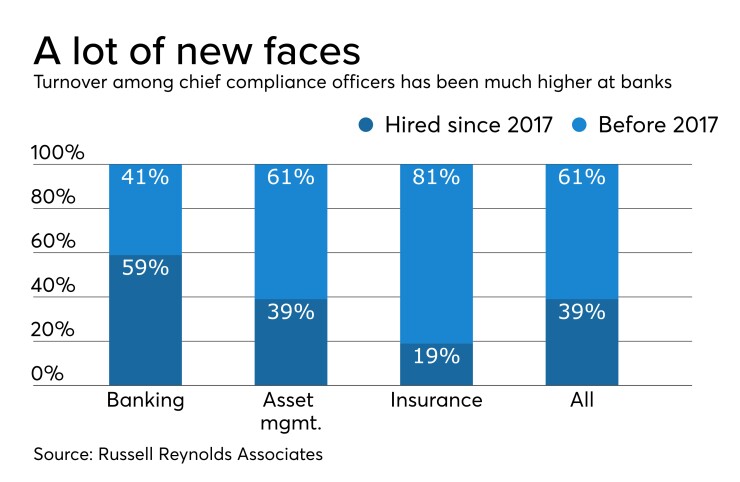

Nearly 60% of the largest banks have changed chief compliance officers in the last three years, according to a recent study by an executive recruiting firm.

Russell Reynolds Associates said that 59% of banking chief compliance officers had been named to the role since 2017, compared with 39% in asset management and 19% in insurance. That turnover is largely a function of the way the role has evolved within the changing regulatory environment, said Cynthia Dow, a Russell Reynolds consultant who leads its legal, regulatory and compliance officers practice.

“A couple years is like dog years in these big leadership roles,” said Dow, co-author of a report on the study. “It’s the scale and complexity of the compliance challenges that they have, the technology underpinning the operations of the bank and a move towards more of an operational and process orientation in compliance. It’s not just a regulatory advisory role, which you still see in insurance. It’s much more of an operational role.”

Demographic changes play a role, but greater regulation since the financial crisis means the job has become more important and complex. Chief compliance officers are likelier to sit on the executive committee and have a say in strategic decisions in banking than in other financial services industries. It is a high-pressure role, Dow said.

Those demands may be part of the reason that larger banks have done a comparably better job of developing their own compliance talent, according to the analysis. Banks overwhelmingly promoted chief compliance officers from within in the past three years: 78% were internal appointments in the banking industry, compared with 43% in asset management and 41% in insurance.

“Outside of banking, it’s far more typical for people to have to go outside" the industry, Dow said. “Sometimes even asset management will look to the banking industry to find compliance talent, but in the case of banking, they will often be able to promote from within.”

Russell Reynolds’ study looked only at the 100 largest financial services firms worldwide (including 32 banks), but other recruiters said they have noticed some of the same dynamics elsewhere in the industry.

Stewart Goldman, Korn Ferry’s head of risk and compliance for North America, said he has witnessed firsthand that turnover is higher in banking than in asset management or insurance. Changes are usually made for either strategic or situational changes, including regulatory problems. Retirement of an existing chief compliance officer is sometimes a factor, but Goldman said, “I don’t see that as the big driver.”

More fintech firms and online lenders are recruiting compliance staff from banks, too, he said.

“Whether they are regulated by a bank regulator now or not, they want to make sure they’ve got reasonable controls in place and a population for them to pull from is that bank compliance officer,” Goldman said. “That is not the only driver, but it’s one of the drivers.”

Compliance turnover is not uniformly high across banking, recruiters say. Smaller banks tend to hold onto their chief compliance officers for longer, and replacing them is tougher. While community banks face greater regulatory scrutiny than they might have a decade ago, they do not have as many resources at their disposal as larger banks do.

Susan Pardus, a partner at KLR Executive Search Group in Boston, said that smaller institutions often lack the depth of compliance talent that larger banks possess. Frequently, they will end up recruiting a new chief compliance officer from a larger bank, she said.

When chief compliance officers at small banks want to retire, "it’s become very difficult for the bank to find a replacement and the smaller banks can’t afford to have that real strong No. 2 from a cost perspective,” she said.

Banks are also moving away from strictly technical expertise in their top compliance roles, recruiters said. That often means looking for candidates who may have business-line experience and strong communication skills in addition to compliance.

“The elevation of the role means that we have seen, in banking in particular, that the chief compliance officer is more likely to sit on the executive committee, and that points to the need for people to have these general leadership capabilities,” Dow said.

As compliance has become more important, the largest banks have expanded their compliance staffs, Russell Reynolds said. The firm highlighted Citigroup as an example, where the compliance, risk and other control functions grew to 15% of the bank’s employees at the end of 2018, from 4% in 2008.

While that example is “representative” of the industry more broadly, Dow also said that trend is reversing itself as more technology comes onto the market to help compliance officers in their daily work.

“You do see the early signs of a swing in the other direction,” she said. “If you invest in technology and outsource certain pieces of a compliance function, we might start to see the number of people [in compliance] come down.”