-

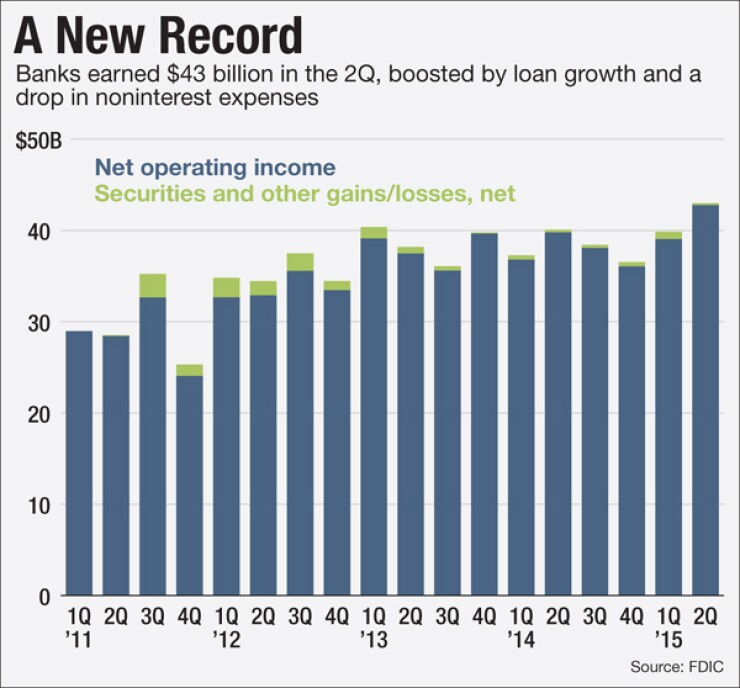

U.S. banking earnings in the second quarter rose 7.3% from a year earlier to $43 billion as institutions enjoyed higher revenues and lower noninterest expenses, the Federal Deposit Insurance Corp. said Wednesday.

September 2 -

Community banks had a banner first quarter, federal regulators said Wednesday but it may come at a problematic time, politically speaking. The Quarterly Banking Profile may only deepen some lawmakers concern that small banks do not need regulatory relief if they are performing so well.

May 27 -

WASHINGTON An increase in litigation costs at a few large banks and lower noninterest income led to a year-over-year decline in earnings, the Federal Deposit Insurance Corp. said Tuesday.

February 24

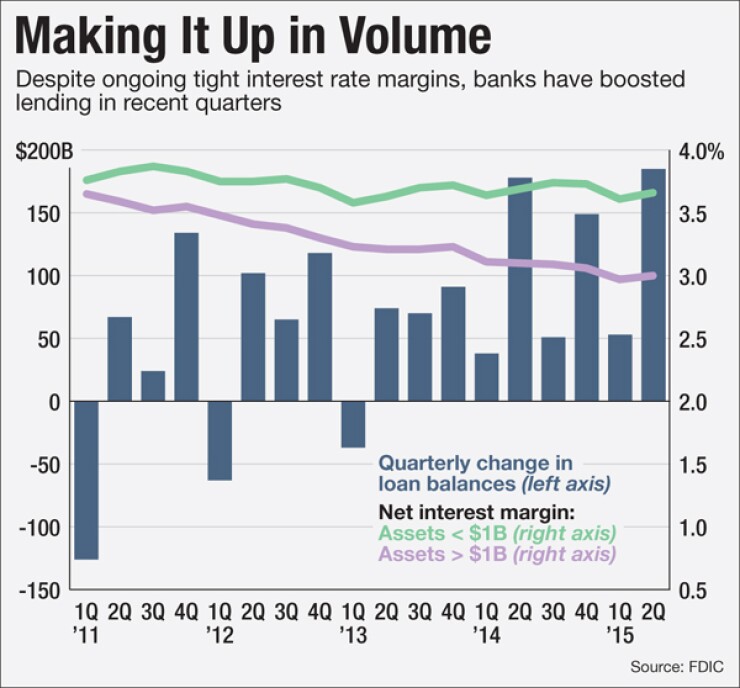

WASHINGTON — Banks continue to feel the pinch from historically low interest rates, but institutions appear to be turning to higher loan volume to pick up the slack.

That was a key takeaway from the Federal Deposit Insurance Corp.'s second-quarter industry earnings report, which effectively showed the highest dollar-amount increase in loans since before the crisis.

With net interest income gaining and noninterest expenses dropping, banks boosted revenues and earned a record $43 billion in the quarter, according to the FDIC report. Yet revenue was up despite lower net interest margins from a year earlier and an overall drop in assets due to smaller trading accounts and a decline in Federal Reserve balances.

Despite continued pressure from seven years of low interest rates, loan production is emerging as a significant revenue booster. The $185 billion quarterly uptick in loan balances was the highest since 2007, except for a higher jump in 2010 that was primarily due to a change in accounting rules.

"We have been seeing increases in loan balances and that is what is driving the revenue growth," FDIC Chairman Martin Gruenberg said at a press briefing to release the Quarterly Banking Profile. "That is in some sense overcoming the narrow interest margins we are seeing and if the margins were higher you would see even stronger growth."

Total loans were 5.4% higher than a year earlier, rising to $8.55 trillion. Overall net operating revenue — the sum of net interest income and noninterest income — grew by 2.1% to $173 billion. The revenue was helped by 2.3% growth in net interest income, to $107.8. Noninterest income also rose, by 1.9% to $65.1 billion, boosted by a surge in servicing revenue that outweighed a drop in trading gains. Noninterest expenses declined 1.1% from a year earlier to $103.8 billion. Yet those positive indicators were in contrast with a 9-basis point dip in the average net interest margin, to 3.06%, from a year earlier. The margin, however, rose slightly from last quarter's 30-year low of 3.02%.

"Having rates well below normal levels ends up creating all kinds of problems and banks have been dealing with this for many years," James Chessen, the American Bankers Association's chief economist, told reporters after the briefing. But, he added, "The good news is that loans are increasing, demand for loans is increasing. … That is top-line bread and butter for banks."

Still, even though it is widely expected that the Fed will raise interest rates soon, the rate environment may be a continual challenge for banks.

"The older assets that are maturing and running off are higher-yielding; they were booked in a higher interest-rate environment and they are being replaced … by investments that carry lower interest rates," Ross Waldrop, the agency's senior banking analyst, said at the briefing.

Yet Chessen said the growth in loan production will also likely continue. As credit quality and economic conditions improve, he said, banks are becoming more comfortable making more loans and going further out on the yield curve to improve earnings. That could continue even if a sudden rise in interest rates might make some assets on their books less valuable.

"A bank has to balance the need to get money to its customers at the risk [that] interest rates rise," Chessen said. "The key component is: What is the credit worthiness of those borrowers? In an improving economy you are willing to go a little further."

Meanwhile, the report continued to show improving asset quality. The average net charge-off rate fell 8 basis points from a year earlier to 0.42%, the lowest level since the third quarter of 2006. Noncurrent loans also declined, falling more than 20% from a year earlier, to $144.7 billion.

As the industry continues its recovery, the FDIC's own finances are also on the mend. For the first time since late 2007, only one bank failed in the quarter. The Deposit Insurance Fund's reserve ratio grew 3 basis points to 1.06%. But the fund's growth brings new policy implications for the agency. The Dodd-Frank Act requires that the DIF reach a minimum reserve ratio of 1.35% by 2020. However, when the reserve ratio reaches 1.15%, the FDIC is required to make up the 20-basis point difference by imposing greater cost on institutions with more than $10 billion in assets.

Gruenberg said the FDIC is anticipating that the DIF reserve ratio could reach 1.15% next year and that they are working on a proposal "that we think we may be able to release before the end of this year" which would bridge the gap.

Community bank earnings also continued to outpace the industry. Earnings at community banks rose 11.8% from a year earlier — to $5.3 billion — which was nearly double the 6.5% increase for larger banks.

At the same time long-term assets represented 34.1% of total assets at community banks during the second quarter, significantly higher than the 24.5% for the rest of the industry. The FDIC report noted that "long-term funding has not grown at the same rate" and "this imbalance may lead to an increase in interest rate risk."

Loan growth for the industry was diverse across several categories. Residential mortgages increased 2% from the second quarter of last year to $1.88 trillion. Nonfarm nonresidential loans rose 4.3% for the same time period and commercial industrial loans increased 8.3% to $1.8 trillion. Construction and development loans had the largest increase, rising 14.8% $255.8 billion.