-

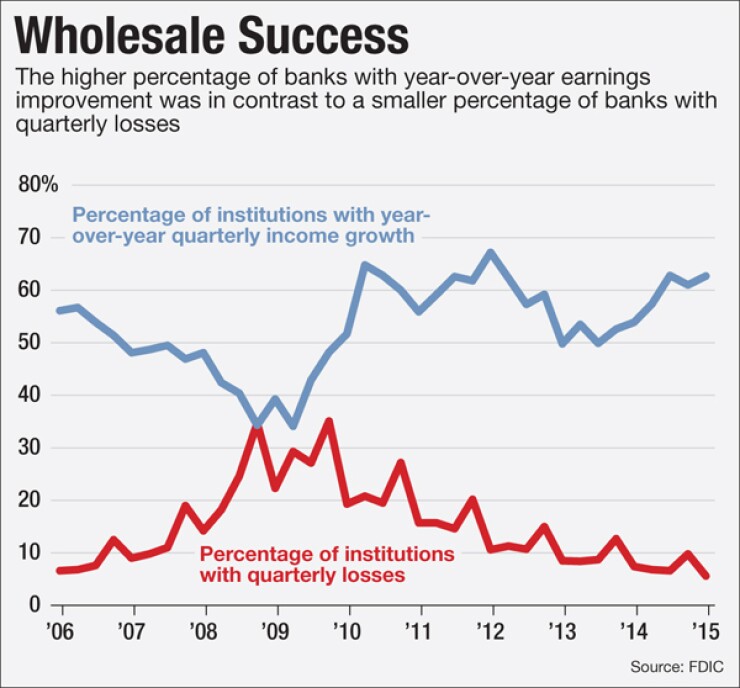

U.S. banks rebounded in the first quarter as earnings rose 6.9% from a year earlier, to $39.8 billion, and nearly two-thirds of institutions reported higher profits from a year earlier, the Federal Deposit Insurance Corp. said Wednesday.

May 27 -

WASHINGTON An increase in litigation costs at a few large banks and lower noninterest income led to a year-over-year decline in earnings, the Federal Deposit Insurance Corp. said Tuesday.

February 24 -

Since the crisis, banks have relied on lower loan-loss provisions to make a profit. But banks actually made money in the third quarter. Here's how.

November 25 -

Following a prolonged stretch of modest loan growth, the Federal Deposit Insurance Corp.'s Quarterly Banking Profile showed loan balances shooting to a level not seen since 2007.

August 28

WASHINGTON Community banks had a banner first quarter, federal regulators said Wednesday but it may come at a problematic time, politically speaking.

Lawmakers have mostly lined up to support granting regulatory relief for small banks, yet a few have raised questions as to whether it's still necessary, particularly as industry profits have rebounded since the dark days of the financial crisis.

The analysis of bank earnings released by the Federal Deposit Insurance Corp. may only deepen that concern. Earnings at community banks grew 16.4% to $4.9 billion on a yearly basis in the first quarter, compared to 6.9% for the industry overall, which saw earnings rise to $39.8 billion. Loans at small banks also grew faster than the industry at large.

Yet that is no reason to pump the brake pedal on regulatory relief, said FDIC Chairman Martin Gruenberg.

"I am not sure that there is a contradiction or a conflict there," he said during a briefing with reporters after the release of the Quarterly Banking Profile. "That doesn't really conflict with the issue that there are regulatory burden challenges that community banks, particularly small community banks have to deal with and I think the regulators are very focused on that issue."

Banking industry representatives agreed, saying that small banks are still facing outdated and burdensome regulations that are holding them back.

"Don't underestimate the impact that the regulation has had over the past seven years," said Jim Chessen, chief economist for the American Bankers Association.

At least for now, the push to help small banks appears likely to continue on Capitol Hill. The Senate Banking Committee passed a bill last week that would make a number of key changes designed to help small and mid-sized banks. But the bill was approved without any Democratic support and is unlikely to be approved by the full Senate without a bipartisan deal.

One key voice in the debate remains Sen. Elizabeth Warren, D-Mass., who infuriated bankers in February by suggesting that small bank earnings

"The financial performance of the community banks shows that Congress and the regulators, I think, have done a pretty good job of tailoring the rules to protect community banks," Warren said. "We should be very skeptical of regulatory relief bills that are promoted as helping small banks, but are pushed by ABA lobbyists for big banks."

Still, it was undeniably a good report for small banks in other respects. Community banks continued to hold 44% of small loans to businesses and saw loan balances increase 1.3%, or $17.4 billion, in the first quarter. That compared to the industry as a whole, which experienced a loan balance increase of 0.6% or $52.5 billion.

"While this appears modest relative to recent quarters, loan growth tends to be weaker in the first quarter due to seasonal factors," Gruenberg said.

On a year-over-year basis, the loan growth was even more impressive, increasing 5.4% for all banks in the first quarter the highest 12-month growth rate since mid-2008. Community banks outpaced that figure, however, growing by 9.1%.

Loan growth for one- to four-family residential mortgages was also particularly strong for community banks, which saw a 7.4% increase in the first quarter compared to a year earlier. The industry overall saw a 1.7% increase in one- to four-family residential mortgage lending.

"The performance we are seeing from community banks really underscores the continued viability and strength of the community bank business model which is really defined by careful relationship lending, funded by stable core deposits, focused on a local geographic community that the bank knows well," Gruenberg said.

The FDIC said the improvement in loan growth and noninterest income helped grow net operating revenue, which jumped by $4.3 billion, or 2.6%, on a year-over-year basis in the first quarter. Noninterest income rose 4.6% totaling $62.7 billion for the same time period as trading revenue surged 23.9% to $1.5 billion and income from selling, securitizing and servicing of residential real estate loans rose 15.6% or $545 million.

"Our hope is if we can see continued improvement in the performance in the economy as a whole we can really see a continuation and even improvement on these general trends," Gruenberg said.

Regulators do see signs of potential trouble ahead, however.

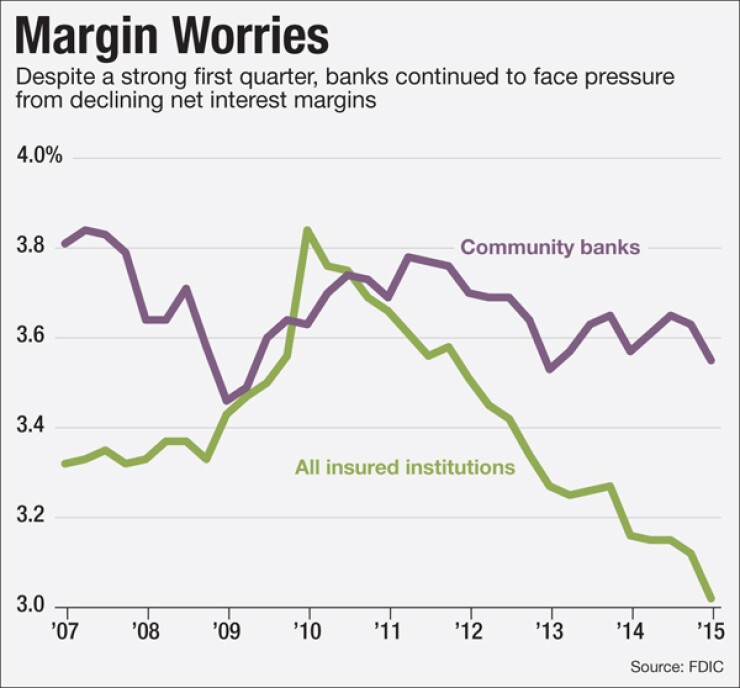

Gruenberg cited net interest margins, which "continued to decline during the quarter, even as banks reached for yield to offset the impact of low rates."

The average net interest margin at community banks fell 2 basis points to 3.55% in the first quarter versus the same quarter a year ago and compared to a 14-basis-point decrease for the industry where the average net interest margin stood at 3.02%.

Community banks have been able to stave off some of the interest margin erosion by going further out on the yield curve, while larger banks have felt the squeeze as they continue to park reserves at the Federal Reserve banks.

"There is a general increase for the industry in terms of the term on assets and particularly among community banks and it is something we have identified in a substantial number of banks so we do think it is a significant issue," Gruenberg said.

He added that interest rate risk continues to be an area of supervisory focus.

But the ABA's Chessen said concerns about interest rate risk could be overblown.

"Interest rate risk is certainly a concern of the regulators, but it is not a surprise to any bank out there," Chessen said. "Even the smallest banks are aware of what that interest rate risk means, they are prepared for the Fed to raise rates, they are expecting them to raise them very slowly and it gives them the opportunity to take a little more risk and meet the demands of their borrowers."

The FDIC also said the prospects for the Deposit Insurance Fund improved during the quarter with the number of institutions on the agency's "Problem List" falling by 38 to a total of 253, marking the 16th consecutive quarterly decline.

The DIF balance also rose by $2.5 billion to $65.3 billion as of March 31. The ratio of that balance to insured deposits grew by 2 basis points to 1.03%, which is the highest it has been since March 2008.