Despite Bernie Sanders' best efforts, the banking industry managed an ever so slight rise in popularity this year.

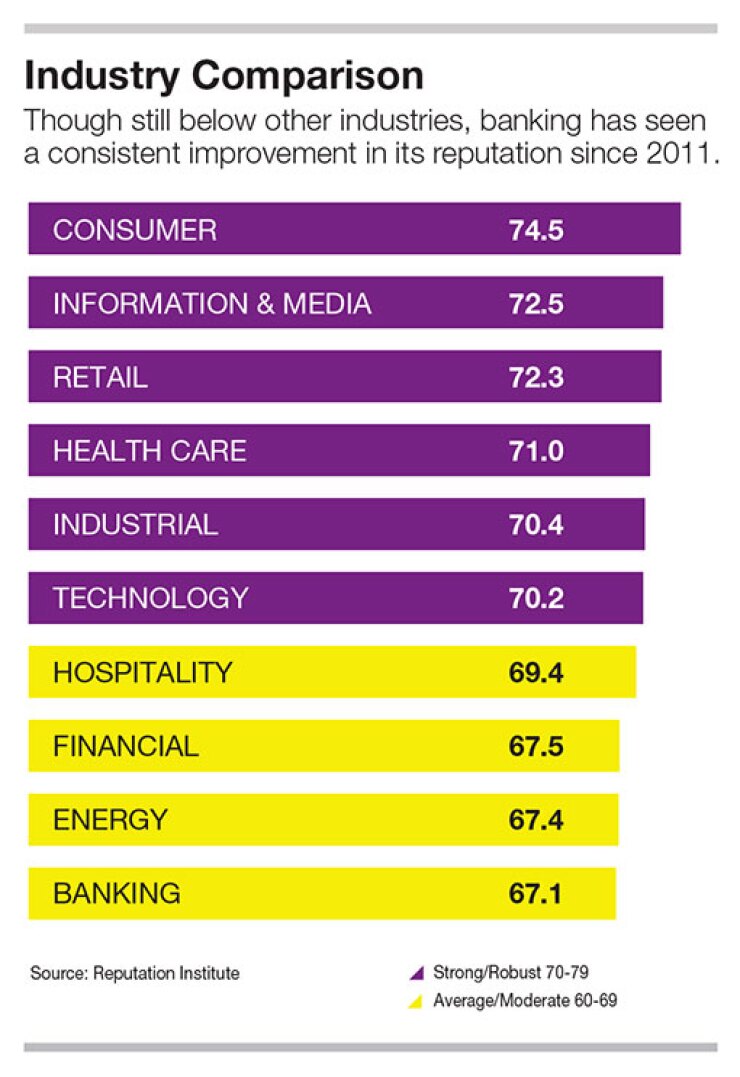

The reputation of the industry as a whole nudged up to 67.1 on a 100-point scale, helped by an improving economy. The score is just average, by the Reputation Institute's reckoning, but that is not so bad for an industry devastated by the financial crisis in recent memory.

"We've seen some improvements broadly around financial services, but there's still a hangover effect from the Great Recession," said Stephen Hahn-Griffiths, a vice president at the Reputation Institute. "I think it's still a work in progress in many ways."

-

Synovus Financial struggled along with its customers during the financial crisis. Now that it's healthy again, it credits the strong ties it built with those customers, and the involvement of its executives in the communities they serve, with helping restore its status as one of banking's most reputable brands.

June 27 -

Is being customer-centric a goal at your bank? Youll need to master these five practices to align employee behavior with your desire to improve the customer experience.

July 1 -

In a milestone for our annual reputation survey, eight regional banks achieved 'excellent' scores, partly because of a renewed focus on doing what's best for the customer, even at the expense of their bottom lines. Big banks lost some of the momentum they had, but none remain in the 'weak' zone.

June 25

To put things in perspective, banking is still below other industries the Reputation Institute tracks, including health care and energy.

But it has seen a consistent rise in reputation since 2011 and its increase of 1.5 points this year is slightly better than the average increase of one point across all industries.

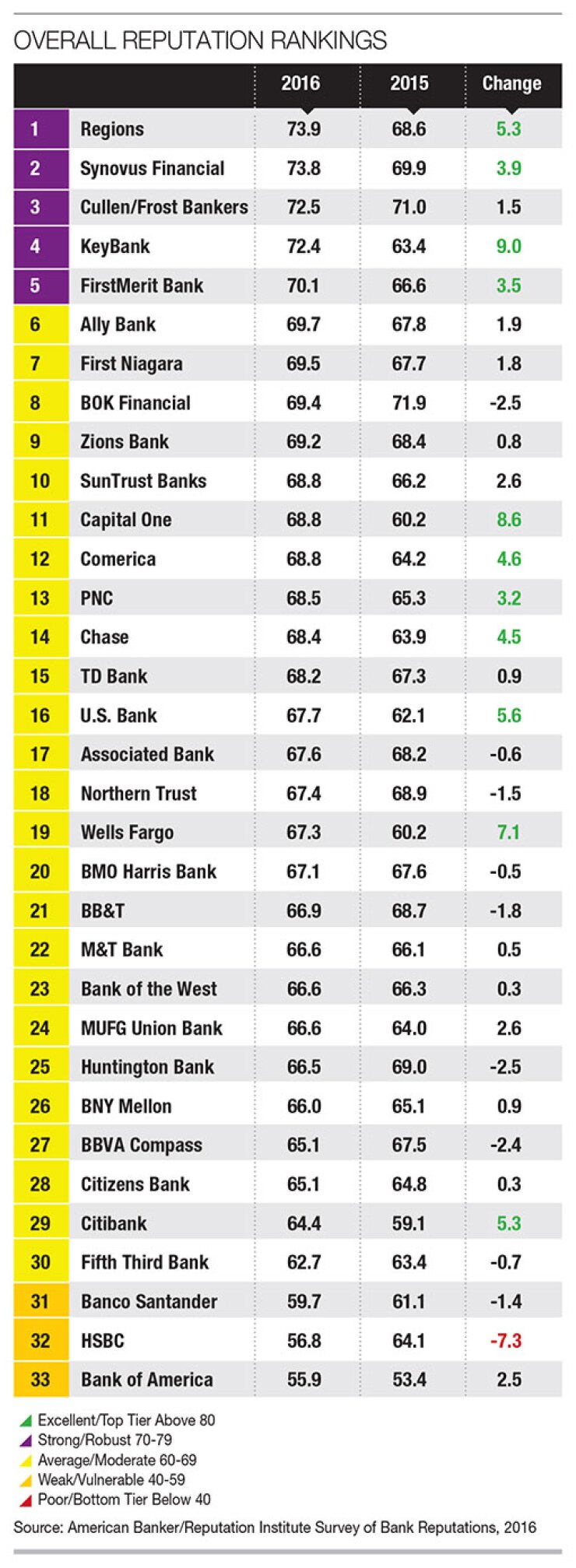

Some standout banks are doing far better than average. Of the 33 banks evaluated in the American Banker/Reputation Institute Survey of Bank Reputations this year, five have strong overall reputations, when taking the perceptions of both customers and noncustomers into account.

That's up from just two last year.

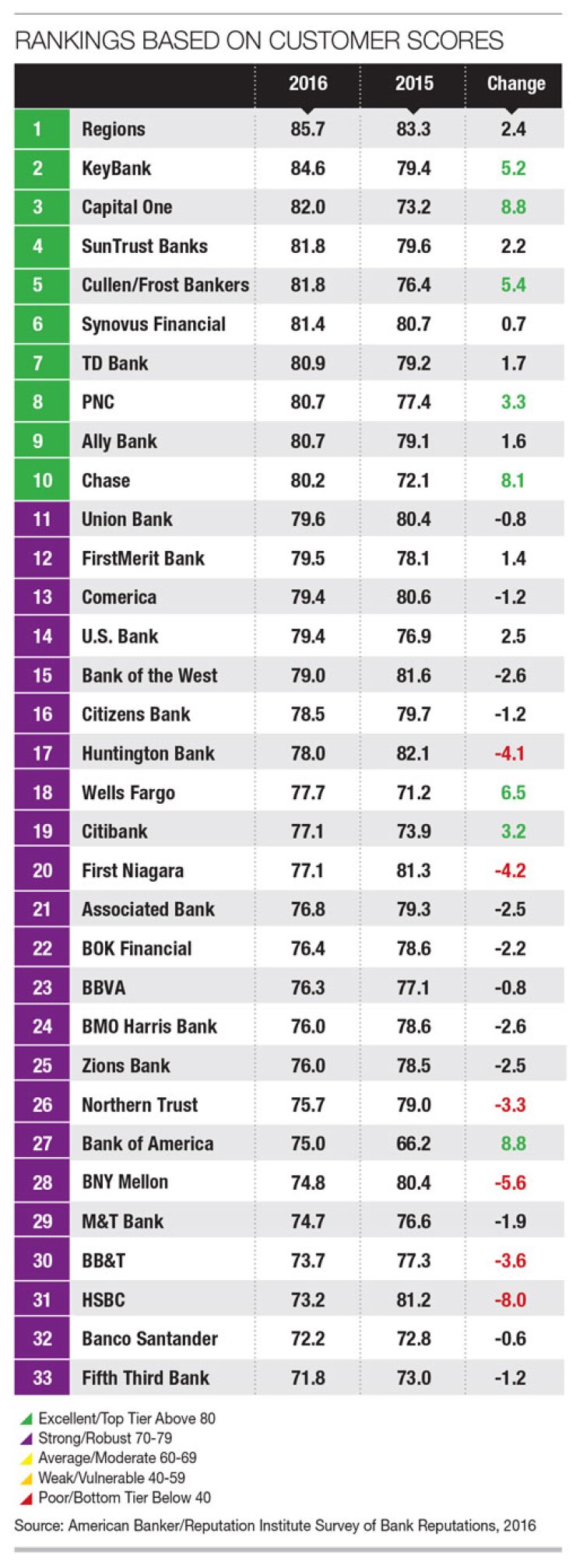

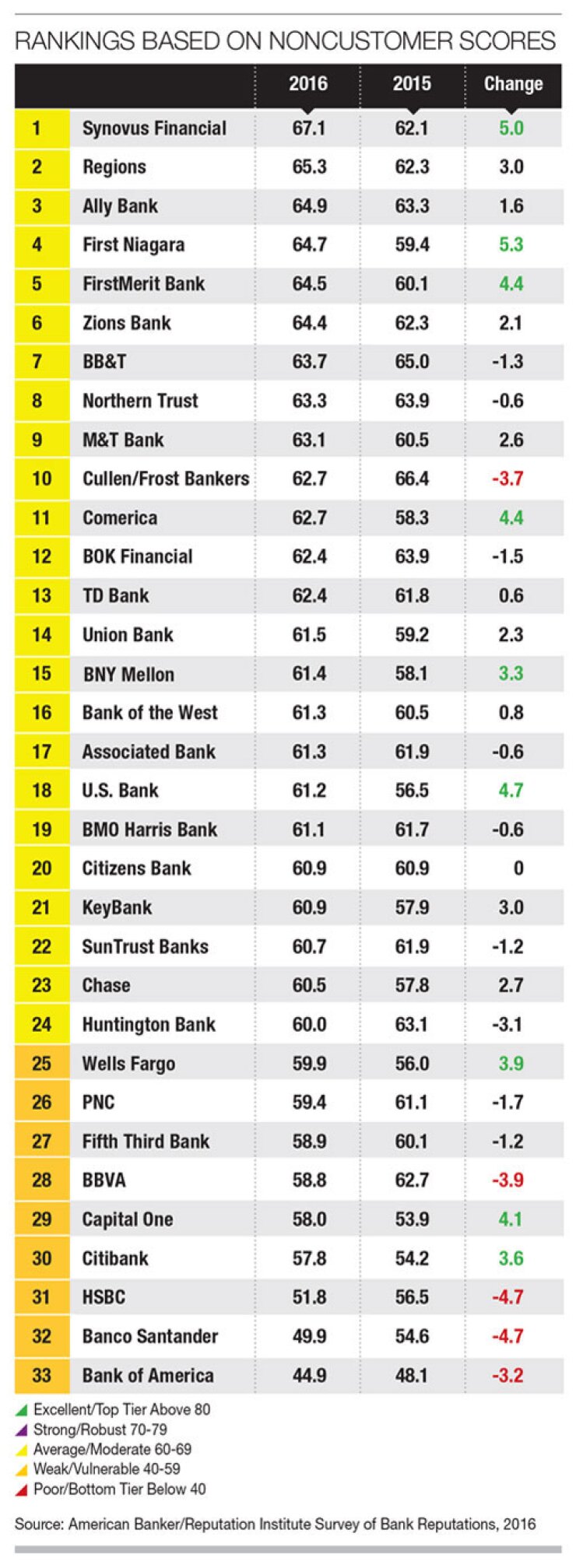

Breaking down the overall scores to separate customers from noncustomers shows how much harder banks have to work to create a favorable impression with the latter group.

Banks generally have a strong reputation among customers, with a score of 78.4. But their reputation is just barely average among noncustomers, with a score of 60.5. The gap of 18 points between the two scores is unchanged from last year.

"If you're not an everyday customer, your opinion is formed by what others tell you, what you hear and read and observe. And right now the general sentiment around banks is still in recovery mode," Hahn-Griffiths said. "There's still some skepticism out there."

Even so, a dive into the rankings yields some success stories. A handful of regional banks are showing significant progress with improving their reputations. Another noteworthy trend in the data is how large banks have improved as a group.

Regionals at the Top

All five of the institutions with strong overall reputations are regional banks —

KeyBank, which is fourth in the overall rankings, had a whopping nine-point increase, the largest improvement of any bank.

Dennis Devine, co-president of Key Community Bank and head of Key Consumer and Small Business, attributes this to a focus on

Devine pointed out Key has eight consecutive outstanding ratings under the Community Reinvestment Act — which, he said, "is unequaled by almost every one of our peers."

Key also recently made

The agreement Key signed with the National Community Reinvestment Coalition essentially doubles its lending to low- and middle-income borrowers and expands its community development lending by $4.5 billion, among other benefits.

The Reputation Institute credits Key's corporate social responsibility initiatives with helping drive its improvement in the rankings, along with its strong community presence and exceptional customer service.

As a group, regional banks' reputation score with customers is strong at 78.5 —

The stalled momentum for the regionals makes Key stand out all the more.

Hahn-Griffiths said the best way for banks to pull ahead of their peers is to put effort into the reputation drivers that matter most.

This year the three factors most heavily influencing how people perceive banks are products and services, governance, and leadership, according to the Reputation Institute's calculations.

"If you succeed on those fundamentals, the chances are you'll probably outperform" on reputation compared with the rest of the industry, Hahn-Griffiths said. "Why? Because you're focusing on the stuff that's most important."

Leadership has replaced performance as one of the top three reputation drivers since last year.

So Hahn-Griffiths recommends banks make their top executives more visible in the community and demonstrate thought leadership on social issues.

"Presenting a more human face for your banking organization and what it stands for has become more important," he said. "We'll see banks that do a better job of elevating their leadership and making them more front and center as part of the rhetoric are probably the ones that are going to do better."

Large Banks Start to Win Some Love

Among the three categories of banks — large, regional and nontraditional — the scores for large banks still put them in third place. And in the overall rankings, the three banks with weak reputations are all large ones.

But Hahn-Griffiths said it is the large banks that are the bigger story this year, thanks to an improvement with their customers.

Their customer score is at 75.8, up five points. And Hahn-Griffiths said the changes they've made to rack up that increase are notable.

"All the action is around the bounce-back of large banks. In the court of public opinion, I think the larger banks have done a better job of engendering themselves to their customer base, meaning within the footprints of where they operate and where they have core customers," Hahn-Griffiths said.

"They've just done a better job of romancing those customers, taking better care of them, whereas you don't see that continuing momentum at the regional banks."

JPMorgan Chase's bank unit is a case in point.

Chase posted a customer score of 80.2, the highest of any large bank, and its improvement of 8.1 points is one of the biggest increases with customers among the 33 banks in the survey. It vaulted to No. 10 on the customer ranking this year, up from No. 30 last year.

It is also the only large bank that enjoys an excellent reputation with customers.

Barry Sommers, the chief executive of consumer banking at Chase, credits the improvement to efforts that have been underway for years.

"We're spending massive time with our customers, getting feedback, taking bus trips, listening to employees," Sommers said. "Those conversations have led to hundreds of changes to the way we do business."

The bus trips started six years ago, with Jamie Dimon, the company's chairman and CEO, spending about a week on the road visiting branches, talking to employees in local markets and hosting town halls.

"We pull branch employees on to the bus — we take hostages, as a fun thing, and we say, 'Tell us everything,' " Sommers said.

Last year the bus went to three states — Wyoming, Utah and Colorado. This summer it will travel through California.

"The feedback we've gotten from the trips really changed this place," Sommers said.

Now the listening has expanded to a constant thing, with an "ear" icon on the bank's employee website that they can click on to offer feedback and suggest improvements.

All of the feedback is reviewed and acted on. "We get thousands of comments, and they all go to a central group that makes sure they get to the right areas and literally, without exception, we respond to every single one of those emails," Sommers said. "And it's not always a 'yes.' Sometimes we actually find that it's a great opportunity for us to communicate why we can't do certain things. One of the things we learned from this whole process is, sometimes the second best answer is to give a quick 'no' and to really explain to our customers and our employees why."

One example of a change Chase has made because of customer feedback is its decision to increase the limits for its Quick Deposit and Quick Pay products, Sommers said. "Customers loved our new technology, but one of the frustrations they had was with the limits, so we addressed that and raised the limit," he said.

Though he appreciates the validation provided by the Survey of Bank Reputations, Sommers said it is actual business results that really underscore how well Chase is doing in polishing its reputation.

In the first quarter of the year, its consumer banking business achieved record deposit growth of $41 billion, a 10% increase from a year earlier. Attrition also is at an historic low of 8.6%.

"We haven't see attrition this low ever," Sommers said.

He thinks it is likely not a coincidence that the reputation and business results coincide for Chase.

"The best way to gauge how you're doing with customers is by customers making you their primary bank, giving you more money and staying around longer," he said.