-

Our fifth annual survey shows encouraging signs for banks on the long road back to reputational redemption.

June 22 -

It's been five years since the financial crisis began, and banking still has a weaker reputation than the airline industry, big pharma and the energy sector. At least there's someone out there who more likely than not has a decent impression of you: your customer.

June 25 -

Hot topics like cybersecurity, M&A and Operation Choke Point caused a lot of debate at American Banker's annual regulatory symposium. But in just about every case, the conversation inevitably circled back to a common theme: reputation is everything. So some, including U.S. Bancorp's Richard Davis, contend playing it safe is just plain playing it smart.

October 26

It's a breakout year for bank reputations.

Of the 32 banks evaluated in the American Banker/Reputation Institute Survey of Bank Reputations this year, none have a weak reputation with customers which is a first.

Even better, eight scored above 80 on our 100-point scale based on how their customers perceive them, vaulting into "excellent" territory.

"Banks are clearly focusing on their customers, and those retention strategies are paying off," says Rob Jekielek, a vice president at Reputation Institute, a reputation management consultancy.

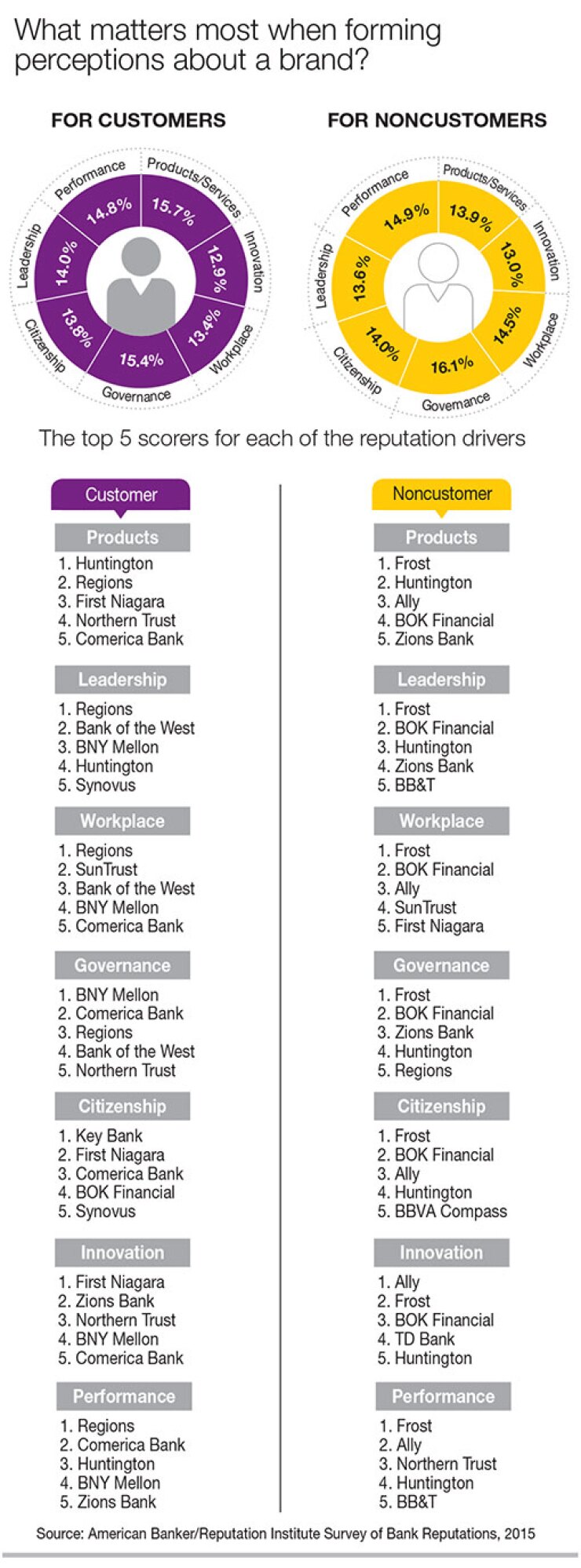

Reputation Institute calculates that improving reputation by five points among customers increases the likelihood they'll recommend the bank by 6.2%. That same improvement among noncustomers increases their likelihood of making a purchase by 4.6%.

But any momentum banks had in improving their reputations among noncustomers stalled this year. "It's really on the customer side where you are getting pretty significant equity build," Jekielek says.

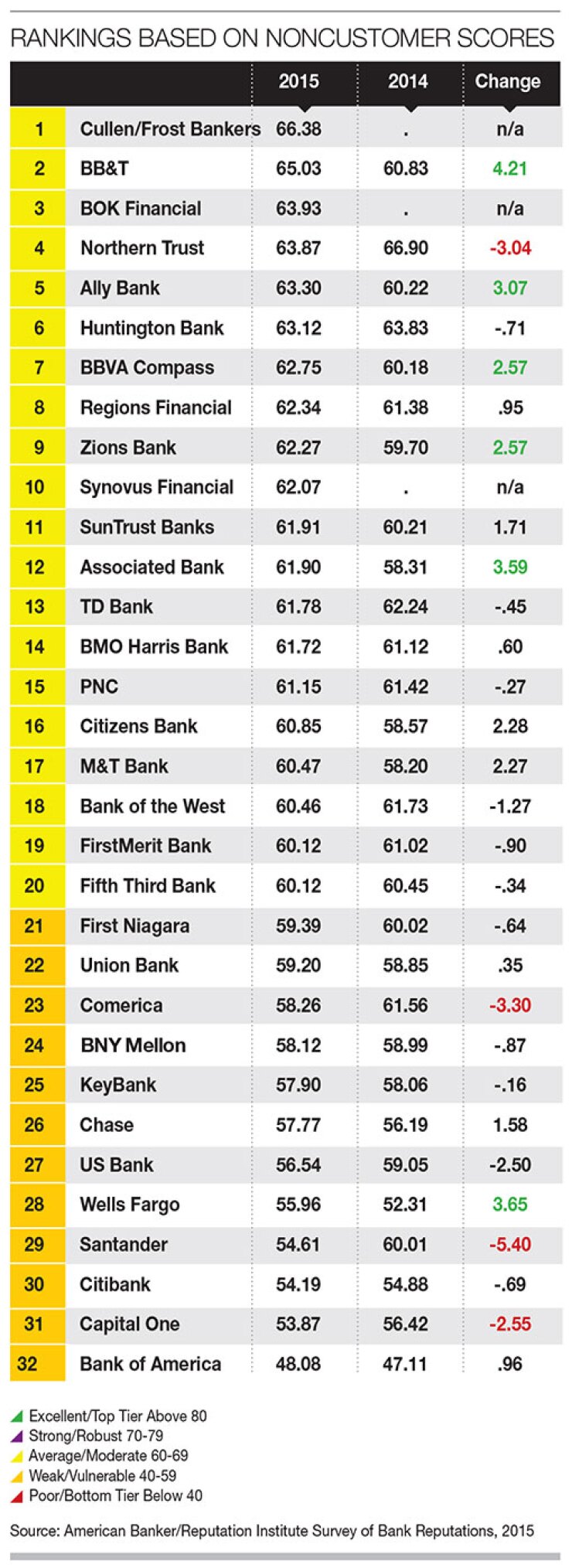

Most of the banks in the survey have average reputations among noncustomers. A dozen scored below 60, which puts them in a weak or vulnerable position.

Even so, Jekielek says, the industry is doing well given the massive loss of trust caused by the financial crisis.

"With financial services broadly, but with banks in particular, that average range with noncustomers is a great place to be, if you're comparing that to a few years ago," he says. "You can think of it as both risk and opportunity. For an organization that has the wherewithal to be thinking about brand and reputation, it's certainly an opportunity. The average range indicates not skepticism, not crazy support, but just being somewhat neutral and having a couple of question marks. And those question marks can differ depending on whether you're a regional bank or national bank."

Reputation Institute divides the banks in the survey into three categories: large, regional and nontraditional.

Last year all three categories showed improvements with both customers and noncustomers, and large banks as a group made the greatest gains, though they still had the lowest scores overall.

This year customer perceptions improved again, boosting the overall score for each of the three categories. But regional banks advanced to a much greater degree than either the large banks or the nontraditional ones. The gain of 6.5 points for the regional group is nearly double that of the other groups.

The overall score for the regionals is 78.8, the highest among the three categories of banks. Previously the nontraditional banks had been the reputation leaders.

Three banks all of them regionals have the distinction of being in the top 10 among both customers and noncustomers. Regions Financial Corp., which leapfrogged to the top of the customer rankings this year, shares the dual top 10 distinction with Synovus Financial Corp. and Huntington Bancshares' banking unit.

All three embrace a similar corporate philosophy of doing what is in the best interest of their customers and making a difference in their communities, though they express it in different ways.

Kessel Stelling, the chairman and chief executive of Synovus, mentions investments in technology, a branding campaign and community outreach among the initiatives that likely contributed to the excellent reputation his company earned from customers in the survey.

But Stelling says ultimately what matters more than anything else is treating people well. So the customer covenant Synovus adopted in 2007 which reads, in part, "we will treat our customers like we want to be treated" is what underscores everything else that it does. "Our employees carry that customer covenant card around and I've seen leaders reward people with cash for having that card with them," Stelling says.

David Clifton, Huntington's chief customer and marketing officer, says he is

"The things that we are advantaged to as a regional bank, they're disadvantaged by, because, one, we are more connected with the community for sure. That in and of itself is going to give you a little bit more of the heart of the community, the heart of a person. That's going to matter. You're not going to feel quite as disassociated, as disenfranchised," Clifton says.

"The second thing is that we are large enough to make a difference. We have enough of an asset base that we can act like a big bank in terms of the things we can offer customers. Our remote deposit is every bit as good as any of the big banks."

But big banks handed one more whopping advantage to the regionals, in the form of all the negative headlines arising from the financial crisis, Clifton says.

"They can't get out of the way of themselves," he says. "Libor manipulation? Are you kidding me? How do you recover from that?"