Richard Moore is willing to buck convention.

Moore, who became CEO of First Bancorp in Southern Pines, N.C., in May 2012, saw the post as a second act of sorts

It was challenging time to start a new career.

First Bancorp, at the time a largely rural bank, lost $26 million in 2012 as Moore and his team raised capital and aggressively tackled bad credits. Things began to turn the bank’s way the next year; profitability returned and nonperforming assets fell from 4.3% of total assets at the end of 2011 to just 1.35% earlier this year.

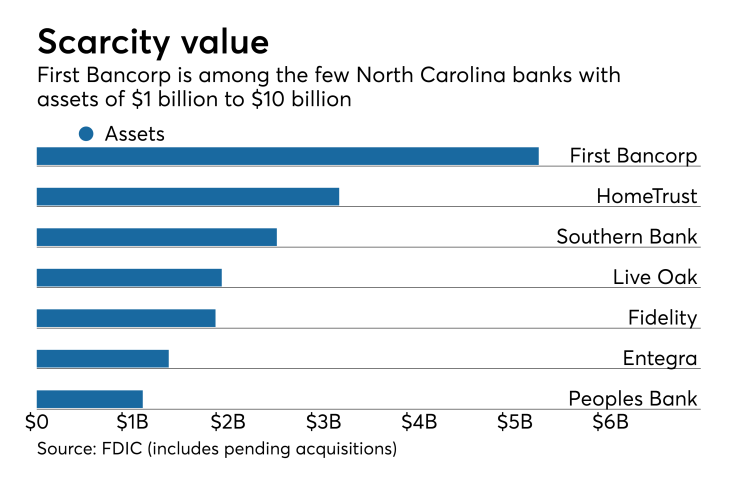

Moore is again going against a trend in North Carolina, emerging as an acquirer when many other homegrown institutions, including BNC Bancorp, Yadkin Financial, Park Sterling and Paragon Commercial, have agreed to sell to out-of-state banks.

First Bancorp recently bought Carolina Bank Holdings in Greensboro, N.C. It agreed on Monday to

First Bancorp will become North Carolina’s second-largest community bank, with assets of more than $5 billion, when the ASB deal closes later this year. (Capital Bank in Charlotte, N.C., has $10.1 billion of assets, though more than half of its branches are outside the state.)

Moore, in an interview ahead of First Bancorp’s annual meeting and his fifth anniversary as CEO, discussed the company’s transformation, consolidation in the state and the likelihood of meaningful regulatory reform. Here is an edited transcript.

First Bancorp is a buyer in a state filled with sellers. How do you put that into perspective?

RICHARD MOORE: There’s certainly room for every business model, and each company has to maximize shareholder value in a way that they and their board see fit. We have a very different view of things. We believe we can serve the people of the Carolinas by making sure they have a local bank that lends money in the same markets where it takes deposits without making those customers sacrifice anything in terms of financial products, quality and the digital experience. And do it while remaining highly profitable. That’s what we’re trying to do.

Most of the banks [that have sold themselves] were part of roll-ups and had a lot of private-equity dollars involved. There’s nothing wrong with that, but anyone who has invested in a PE vehicle understands its life cycle. So there was a need to maximize shareholder value in an artificial period of time. We’ve never felt that pressure from our shareholder base. We really do think we can stay below the mid-market and service the businesses that are the backbone of the Carolinas — businesses with $1 million to $30 million in annual revenues. Those are smaller companies in the eyes of big banks. We can be their partner and make a nice return for shareholders

What’s the point of getting big enough and being taken out if you can maximize shareholder value another way? Our company has gone from a market cap of about $120 million in July 2012 to nearly surpassing $800 million this week. And that was before the Asheville deal.

First Bancorp has come a long way financially since the financial crisis.

I’m really proud of the team we’ve put together. I am proud of the overhaul in products and the added emphasis on customer service. Mike Mayer, our bank CEO, and I built our own service-excellence program from within. No matter what branch you walk into we have a corporate identity. Lots of folks say they have the best people, but we have looked at how to objectively measure it. We have focused on the customer experience. When you roll that together, we’ve had a really nice run. If a good, well-run financial institution in the Carolinas decides that it doesn’t want to be independent anymore, we want to be there to show them that they can retain their community bank identity and still give their shareholders the premium and the liquidity they feel they need to have.

How would you define the bank’s corporate identity?

Customer first. We are a high-touch organization that tries to have an extremely experienced and knowledgeable association on the other side of the conversation with a customer. Everything grows from there. We’re one of the smallest banks in the country with its own credit card. It’s not white labeled. It is our book and our call center. If you have a problem with it, you’re probably talking to someone who might even know who you are. That’s been a huge advantage. The customer doesn’t have to sacrifice tools and rates. It is the same with our wealth management, insurance and mortgage products.

If given the opportunity would you do more deals?

I don’t know how much of an appetite we have now because we have to perform and bring these companies onto our platform and make sure our customers are looked after. We’re probably at the end of our bandwidth right now, and that’s before the conversation we might have with regulators in terms of slowing down. We want to do this right.

We want to be there if possible. I have to believe that over the next five years that while we’ll be selective, we would welcome [a deal] under the right circumstances. There aren’t that many left with any size.

First Bank is going to grow. We live in the ninth-largest state that it going to [become] the seventh-largest state, and South Carolina is also growing at that kind of clip. To be the bank we want to be we have to grow with the communities that we serve. There are only two ways to grow, and I believe we will have a mix of that.

Are you seeing opportunities from recently announced deals?

Opportunity is everywhere. We think we saw some of that in our first-quarter numbers. Our loan and deposit growth were higher than what we were expecting. Our phones are ringing off the hook from people who work in some of those other organizations who are extremely nervous. All things equal, wouldn’t you like to work for the local folks instead of reporting to someone 300 or 600 miles away? There’s anxiety out there and we have been the beneficiary, and I don’t think that is going to change.

What would it take to make First Bank become a seller?

Our goal is to serve our customers. We think we do that by always having the best associates we can and maximizing shareholder value. We’re running this place with the belief that we can be more profitable on our own by giving great customer service and staying with the businesses that are seeing loan points move higher and higher every time someone is swallowed up. So there’s a need there.

We think we can do that and be more profitable over a three- or four-year period than if someone came in and offered us a market premium. Somebody could come in here with a crazy offer, but I don’t think that’s going to happen right now as long as we perform. We’ve proven to the market the last three years that we can and do perform.

First Bank evolved from a mostly rural bank to one with offices in most major North Carolina markets. Where do you go from here?

We’re a Carolinas-centric bank. We like our South Carolina locations, and we’re looking for both de novo opportunities and acquisitions. We understand those markets culturally. I don’t think there are many people my age who have crisscrossed the state for as long as I have. I will be 57, and I have been traveling this state with one hat or another since 1989 and have had an opportunity to work with business and community leaders over that time. These are markets we feel very comfortable with.

We’re going to take our bank to places where people in North Carolina are choosing to move to. We’re not going to leave rural North Carolina behind, but we are going to grow in places where the pie is expanding. I am really proud of how quickly we have repositioned ourselves in urban markets. We were smart. We were disciplined. And we were lucky. That’s a nice combination.

You're a former elected official. What would you say is the likelihood of regulatory and tax reform?

As Americans, we hope we live within a governmental system that recognizes how we can make society better for the vast majority of its citizens. That’s easy to say but difficult to do. We have to make sure that rural and urban American has as much liquidity and financial opportunity in the neighborhood that you live in as possible. We live in a capitalistic society, and you can’t have that without an extremely efficient and fair financial industry embedded in it.

There is no doubt that small banks did not cause the recession. There was a natural overreaction to paint the entire financial services industry with too big a brush. I think there are Democrats and Republicans who all agree on that point. So I hope there is some rational public policy change that recognizes that it doesn’t make common sense to require a bank, even one the size of mine, to have the same standards and oversight as a big Wall Street bank. I am reasonably optimistic that that might change — some.

The banking industry also has to face the fact that we’re nobody’s favorite industry. People need us, but they don’t want to be nice to us. We have to understand that.

How much relief do you think we’ll see? And how long will it take?

I think the run in the market was based primarily on tax relief. Secondly, I think there was a feeling that this crowd might actually be able to do the things needed to get GDP back over 2%. Then the last piece is regulatory reform. I am cautiously optimistic that we’ll see some relief, but I wouldn’t bake it into a bottom-line model.