-

In the news this week: A consumer group filed a complaint against Starbucks over its mobile app and reloadable gift cards, Apple Pay added a new payment tech firm, The Clearing House hired Amanda Stewart as its new marketing chief, and more.

January 5 -

Reading Cooperative Bank and Queensborough National Bank and Trust are among those that see value in being close to fintech startups.

January 5 -

Jonathan McKernan, a member of the Federal Deposit Insurance Corp. board, voiced concerns about the growing influence of Vanguard, BlackRock, and State Street on publicly-traded banks, suggesting regulators should more actively review their interactions.

January 5 -

Southern Bancorp in Little Rock, Arkansas, plans to put $250 million in equity capital it received from the Treasury Department to good use making mortgages and acquiring banks.

January 5 -

These executives have taken charge at firms like PayPal, Discover and Early Warning Servcies during a volatile time for the entire industry.

January 5 -

The use of digital wallets to finance the Hamas attack on Israel highlights the need for tighter controls on the transfer of cryptocurrencies.

January 5 Silent Eight

Silent Eight -

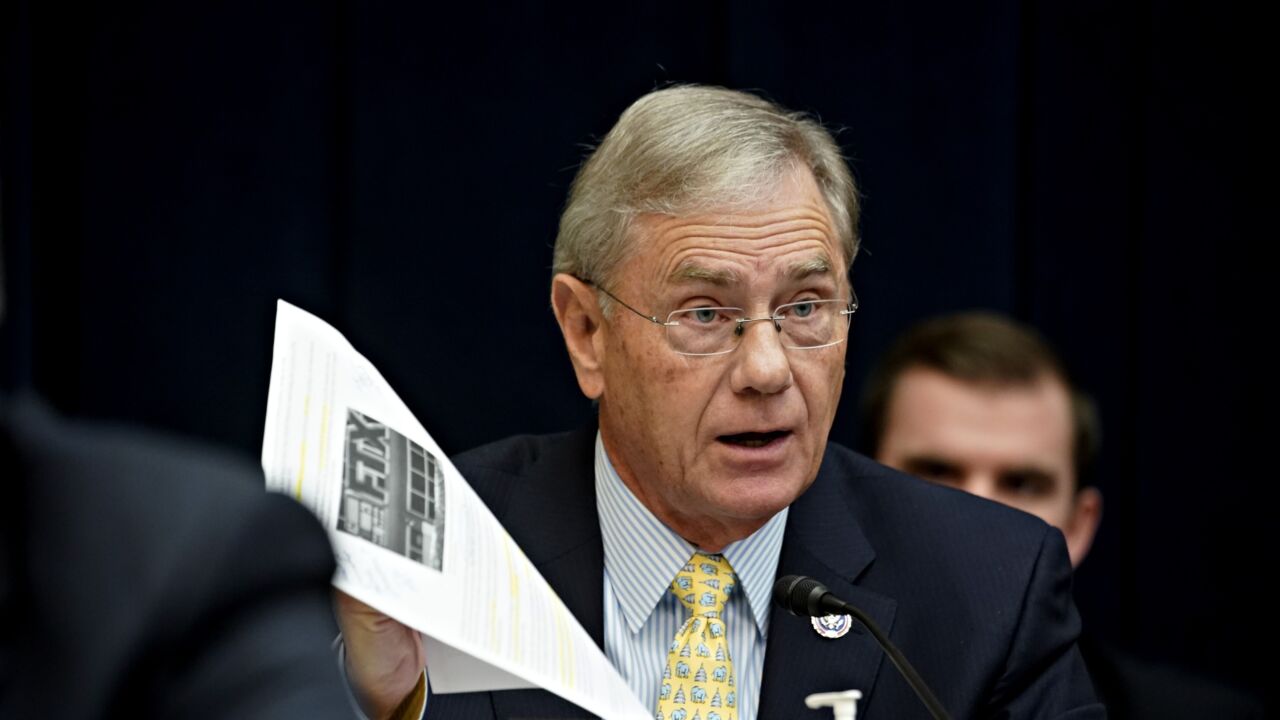

Rep. Blaine Luetkemeyer, R-Mo., was seen as a frontrunner to replace outgoing Rep. Patrick McHenry as the top Republican on the House Financial Services Committee before his announced retirement from Congress Thursday afternoon.

January 4 -

In comment letters to the Consumer Financial Protection Bureau concerning its proposed rule to allow consumers to share their banking data with third-party providers, banks worry about implementation costs while fintechs fear the rule will stymie innovation.

January 4 -

One of the smallest banks in the country hasn't consistently made a profit since 2007 and has been the subject of enforcement actions. The FDIC's public rebuke against it indicates a last-ditch effort to figure out a less messy solution than receivership.

January 4 -

Alberto Musalem, a finance professor with experience in both the public and private sectors, will take over the reins at the regional reserve bank in April.

January 4