-

White House National Economic Council Director Kevin Hassett said Friday that the administration expects banks to voluntarily issue "Trump cards" with 10% rate caps, a move that could quell Congress' moves to impose a cap through legislation — but that's no guarantee.

January 16 -

"We're coming into your market," PNC Chief Executive Bill Demchack said Friday. "If you're not coming into our market to come fight us, we're coming to your market to come fight you, and we're going to get some percentage of your market."

January 16 -

During the fourth quarter, the Buffalo, New York-based bank reported its lowest ratio of nonperforming loans to total loans since 2007.

January 16 -

Merchant groups are not taking a position on President Donald Trump's threats to cap interest rates, but they are bullish on the president's endorsement of the Credit Card Competition Act.

January 16 -

Federal Reserve Vice Chair for Supervision Michelle Bowman warned that labor market conditions could weaken further and said the central bank should avoid signaling a pause in monetary policy.

January 16 -

Data collected by the Conference of State Bank Supervisors demonstrates a huge disparity in compliance costs between large and small banks. Policymakers in Washington who claim to support community banks must act to reduce regulatory burden.

January 16

-

Community Financial in Syracuse has agreed to purchase a small bank that's built its business model around end-of-life planning.

January 16 -

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

January 16 -

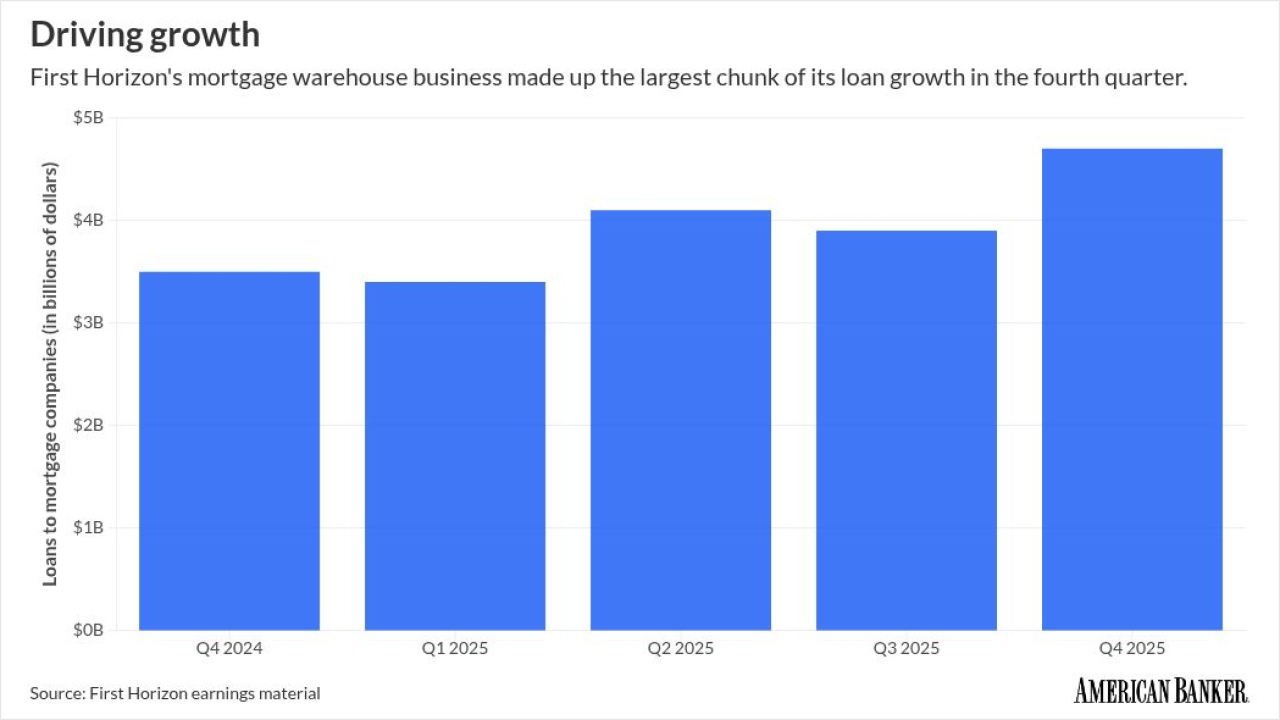

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

January 15 -

The fintech investment firm Portage is now managing a $280 million portfolio acquired from the venture arm of Mets owner Steven Cohen's firm Point72.

January 15