-

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

Financial institutions want to protect customers and employees from the coronavirus but are caught in the middle of a politically charged public health debate. The stance taken by the industry’s largest trade group gives them cover.

July 23 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

In a letter to Director Mark Calabria, 17 organizations requested an additional 60 days to weigh in on the proposal meant to strengthen Fannie Mae and Freddie Mac's balance sheets post-conservatorship.

July 1 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

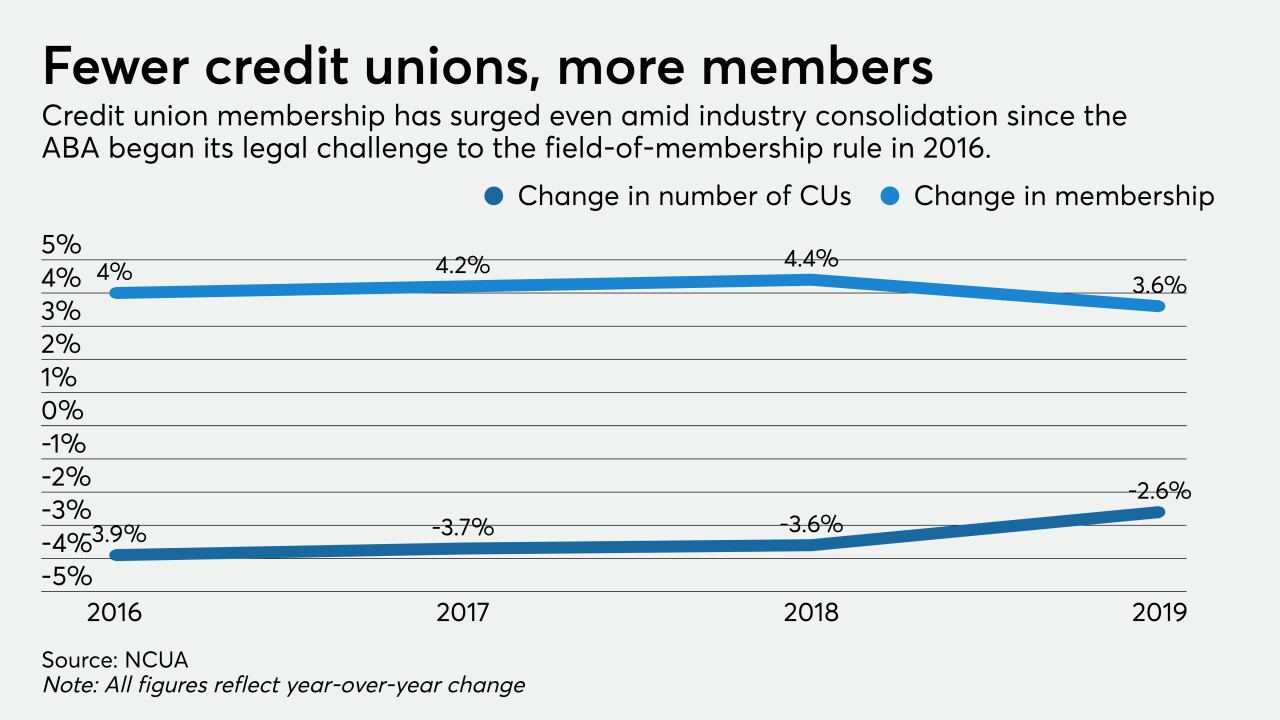

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The Supreme Court ruled the Consumer Financial Protection Bureau's leadership structure is unconstitutional and refused to hear a lawsuit over the NCUA's field of membership rule. Credit unions are watching to see what happens now.

June 29 -

The court's decision not to consider an appeal from the American Bankers Association is likely to be the last step in a legal saga dating back to 2016.

June 29 -

Three banking trade associations told the FDIC that Rakuten Bank America, even after revisions to its earlier application to the agency, would still violate the separation of banking and commerce as well as present consumer privacy concerns.

June 23