-

Trump-appointed regulators are making headway on easing regulations. But there's one critical voice missing.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

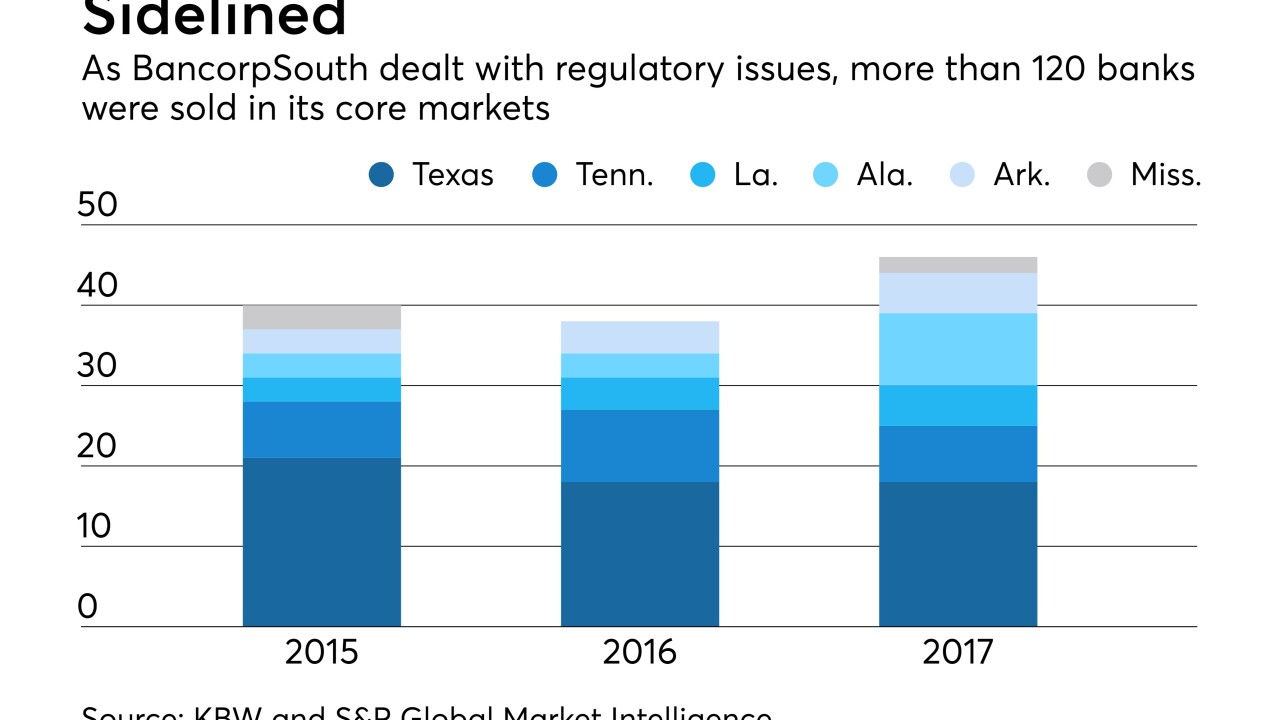

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant -

Comptroller of the Currency Joseph Otting took office only late last year, but he is wasting little time in tackling a series of hot-button topics, including easing anti-money laundering regulations and lowering national bank fees.

April 15 -

The Seattle bank's improved loan yields offset higher expenses tied to Bank Secrecy Act remediation. Washington Federal had to delay a pending acquisition after issues emerged with its anti-money-laundering compliance.

April 11 -

The comptroller said he is looking to capitalize on the industry's strong profits and high capital reserves to reduce costs and lower exam fees next year.

April 10 -

Comptroller of the Currency Joseph Otting laid out an ambitious regulatory reform agenda Monday, telling a group of community bankers that he is committed to CRA upgrades, new flexibility in BSA compliance and other measures.

April 9