-

The House Financial Services Committee is preparing to vote on legislation to modernize anti-money-laundering rules, but the latest version of the bill excludes a key provision involving the collection of beneficial ownership information.

June 13 Transparency International U.S.

Transparency International U.S. -

Republican congressmen Blaine Luetkemeyer and Steve Pearce say their new legislation would update anti-money-laundering and counterterrorism requirements for small financial institutions.

June 13

-

Legislation with bipartisan support would raise the threshold for reporting suspicious activity, a goal banks have long sought.

June 12 -

Financial institutions can improve monitoring of suspicious activity and potentially risky customers using algorithms, but they need to treat this new technology with caution.

June 8 IBM Global Business Services

IBM Global Business Services -

Financial institutions can improve monitoring of suspicious activity and potentially risky customers using algorithms, but they need to treat this new technology with caution.

June 5 IBM Global Business Services

IBM Global Business Services -

No surprises expected from the annual Fed reviews; Elad Roisman is seen as the pick to replace Michael Piwowar on the panel.

June 4 -

California lawmakers have voted to authorize the establishment of state-chartered banks for the limited purpose of serving the marijuana industry.

June 1 -

Speaking at an industry conference Thursday, Wells Fargo CEO Tim Sloan left open the possibility that employees intentionally falsified important regulatory documents.

May 31 -

The Senate bill is a huge win for the financial services industry, but there are still plenty of unresolved legislative issues of interest to banks and credit unions.

May 23 -

The Senate bill is a huge win for the banking industry, but there are still plenty of unresolved legislative issues of interest to financial institutions.

May 22 -

Deadlines imposed by U.S. and EU regulators are giving banks intercontinental whiplash.

May 18 -

For cryptocurrency entrepreneurs in particular, many of whom are just developing the anti-money laundering programs they are required to have under other FinCEN rules, the CDD rule is worth taking note of, writes Laurel Loomis Rimon, senior counsel at O'Melveny & Myers LLP.

May 17 O'Melveny & Myers LLP

O'Melveny & Myers LLP -

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 16 Promontory Financial Group

Promontory Financial Group -

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 11 Promontory Financial Group

Promontory Financial Group -

Trump-appointed regulators are making headway on easing regulations. But there's one critical voice missing.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

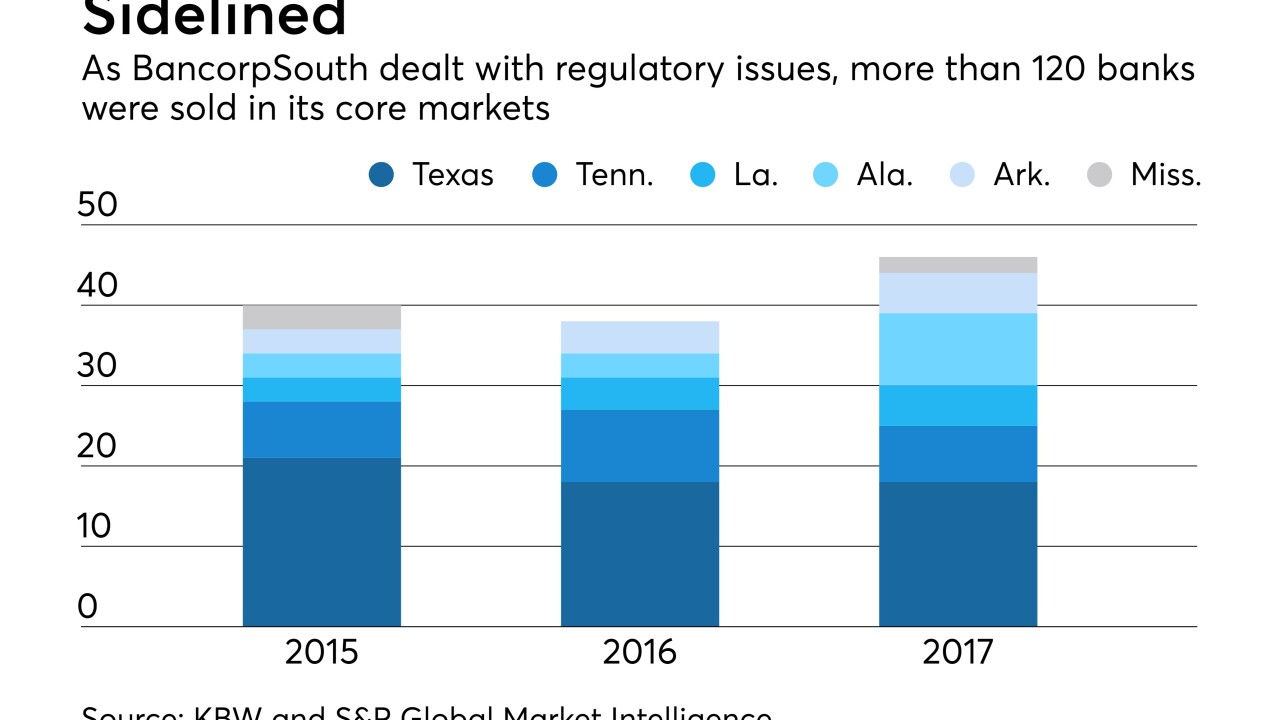

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant