A judge said he would approve Deutsche Bank's $26.3 million settlement of a lawsuit that accused the bank of misleading investors about how thoroughly it vetted clients, including Jeffrey Epstein and Russian tycoons.

U.S. District Judge Jed Rakoff on Tuesday said he would allow the settlement to go forward, finding it "fair, adequate and reasonable." The judge said he would issue an order finalizing his approval in the next day or two as he considers whether to grant a fee request of one-third of the settlement to lawyers for the shareholders.

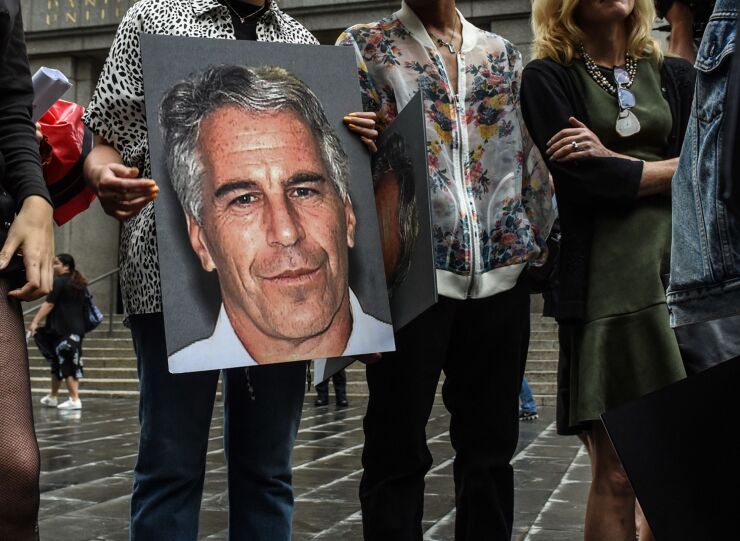

Rakoff's approval resolves a class action filed in 2020 over the bank's anti-money-laundering and "know your customer" systems. In the suit, the plaintiffs cited Deutsche Bank's business relationship with Epstein, Russians including the billionaire Roman Abramovich and what they called "other unsavory high-net-worth individuals and their affiliated companies." They used Epstein's name more than 100 times and called him "a particularly egregious example."

In the settlement, the bank denied wrongdoing.

Epstein was charged by U.S. prosecutors in July 2019 with sex trafficking and was found dead in his jail cell a month later while awaiting trial, in what authorities ruled a suicide.

The shareholders claimed the bank's executives and management board "routinely overruled compliance staff so that the bank's wealth management business could commence or continue relationships with high-risk, ultra-rich clients" such as Epstein, "founders of terrorist organizations, people associated with Mexican drug cartels, and people suspected of financing terrorist organizations," Rakoff wrote in June, in rejecting the bank's request to dismiss the suit.

Investors who acquired Deutsche Bank shares between March 14, 2017, and Sept. 18, 2020, alleged they lost money after the bank's false statements about its vetting processes artificially inflated its stock price. The shares then plunged when information about the bank's client list went public.

In 2020, Deutsche Bank agreed to pay New York's banking regulator $150 million for a string of compliance lapses including a half-decade of lax oversight of Epstein's financial dealings.

The case is Karimi v. Deutsche Bank AG, 22-cv-02854, US District Court, Southern District of New York (Manhattan).