HSBC Holdings' U.K. unit is planning to stop collecting data on the gender of its customers across some products as the bank pursues more inclusive services for nonbinary and trans people.

The bank has begun removing references to gender in some products including HSBC Kinetic, its mobile-first banking business account, and its new tool for mortgages in principle, according to a company spokeswoman. It is part of a wider review into the inclusivity of its offerings and further changes are being explored.

“The concept of gender is evolving at a societal level, and we’re looking at how it’s relevant for our sector,” Jimmy Higgins, co-chair of HSBC’s U.K. Pride Employee Network, said in emailed comments. “There is no reason we should be capturing information for a bank account or a loan if it’s not relevant.”

Banks are taking steps to better accommodate trans identities in their products amid an increasingly heated debate over gender in the U.S. and U.K. Bank of Montreal in recent months began offering bank cards aimed at nonbinary people, following a similar move by Citigroup.

Such moves have stoked tensions. The British lender Halifax last month tweeted, “Pronouns matter. #ItsAPeopleThing.” After a row on social media, the firm

Firms that take a bold stance on gender identity will need to stand firm when challenges arise, said Matt Cameron, founder and global managing director of LGBT Great, an organization that works with firms including Citigroup and BlackRock. But he added that increasing numbers of young people are identifying as LGBT+. “Organizations that are bold on LGBT+ inclusion will be those that build more trust, attract broader talent and appeal to a broader customer base.”

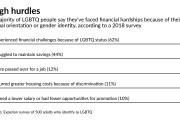

Gender discrimination

The move to cease collecting gender data raises the question of how best to track other forms of discrimination. There have long been complaints that women find it harder to access credit than men, and Credit Karma

Many couples take out loans and mortgages in the male partner’s name, meaning women have less credit history, even when they work full time and contribute to the bills, said Akansha Nath, Credit Karma’s head of partnerships for U.K. and Canada. “At the point when a person is going to a bank and saying they need to borrow X amount, all these biases have already impacted.”

HSBC has research programs in place to track the inclusiveness of its products without necessarily capturing that information from every customer. It is monitoring the situation and may adjust its approach in relevant cases.

Legacy systems

The British lender has already simplified its procedures for changing names to make things simpler for trans customers, and has removed the labels “husband” and “wife” and replaced them with “spouse.”

That’s no small feat in banking, where legacy systems can make accommodating changes more difficult, according to Bobbi Pickard, chief executive of Trans in the City, whose members include Citigroup and JPMorgan Chase. When Pickard changed her name four years ago, some banks made the process easy, while others insisted on notarized deed polls.

That’s slowly changing. Citigroup announced a collaboration in 2020 with MasterCard that enables non-binary people to use their chosen name on credit cards, which have since been used by more than 26,800 people. Bank of Montreal became the first financial institution in Canada to offer the service and is now considering extending it to debit cards in Canada and credit cards in the U.S.

Research found that 90% of transgender Canadians have had to use an ID with a name or gender that did not match their presentation, and 43% have been verbally harassed.

Customers apply for the card with their legal name, which is used for identification verification. Once approved, they can contact BMO and ask for a new card with their preferred name.

“One customer was brought to tears that BMO would have this feature,” Jennifer Douglas, BMO’s head of North American retail and small-business payments, said in an interview.