Alan Kline is the former editor-in-chief of American Banker. Previously he oversaw its consumer finance and national/regional banking coverage. He also helped direct coverage of the annual Most Powerful Women in Banking rankings.

-

Synovus Financial struggled along with its customers during the financial crisis. Now that it's healthy again, it credits the strong ties it built with those customers, and the involvement of its executives in the communities they serve, with helping restore its status as one of banking's most reputable brands.

By Alan KlineJune 27 -

Embattled prepaid card issuer Green Dot has officially split the roles of chairman and chief executive by naming a longtime payments industry executive as its new chairman.

By Alan KlineJune 27 -

Lending Club has revised its loan sales data for the last week of May after discovering that the numbers included loans that it actually bought itself.

By Alan KlineJune 10 -

Large enough to meet the needs of most customers yet small enough to escape some of the Dodd-Frank Act's most onerous compliance expenses, banks with assets of $2 billion to $10 billion are more profitable, as a group, than their smaller and larger counterparts, according to an analysis by Capital Performance Group.

By Alan KlineMay 26 -

TD Bank announced Thursday that is doing away with the Penny Arcade coin-counting machines that are stationed in more than 1,000 of its branches along the East Coast.

By Alan KlineMay 20 -

TD Bank announced Thursday that it is doing away with the Penny Arcade coin-counting machines that are stationed in more than 1,000 of its branches along the East Coast.

By Alan KlineMay 19 -

EverBank Financials first-quarter profits more than doubled from the same period last year as strong loan growth more than offset a sharp drop in income from servicing mortgages.

By Alan KlineApril 27 -

Ally Financial reported strong loan and deposit growth in the first quarter, but a shift in the makeup of its automobile loan portfolio forced the Detroit company to nearly double its loan-loss provision from a year earlier.

By Alan KlineApril 26 -

Paragon Commercial Bank, Unity Bancorp and Nicolet Bankshares have found success by radically rethinking their strategies.

By Alan KlineApril 25 -

Opus Bank in Irvine, Calif., reported a profit of $17.1 million in the first quarter, up 56% from a year earlier, as strong loan growth more than offset higher expenses and an uptick in problem loans. Its earnings per share climbed 50%, to 51 cents.

By Alan KlineApril 25 -

Citizens Financial Group in Providence, R.I., said Thursday that its first-quarter earnings increased 7% from the same period last year, to $223 million, as strong commercial loan growth offset a dip in fee income. Earnings per share increased 8%, to 41 cents.

By Alan KlineApril 21 -

Competitive pricing and softening demand at the high end of the apartment- and condo-building market had executives at BankUnited, Signature and New York Community answering tough questions about their growth projections and diversification strategies.

By Alan KlineApril 20 -

Signature Bank in New York reported record profits in the first quarter as strong loan, asset and deposit growth more than offset increased expenses and deterioration in its portfolio of taxi-medallion loans.

By Alan KlineApril 20 -

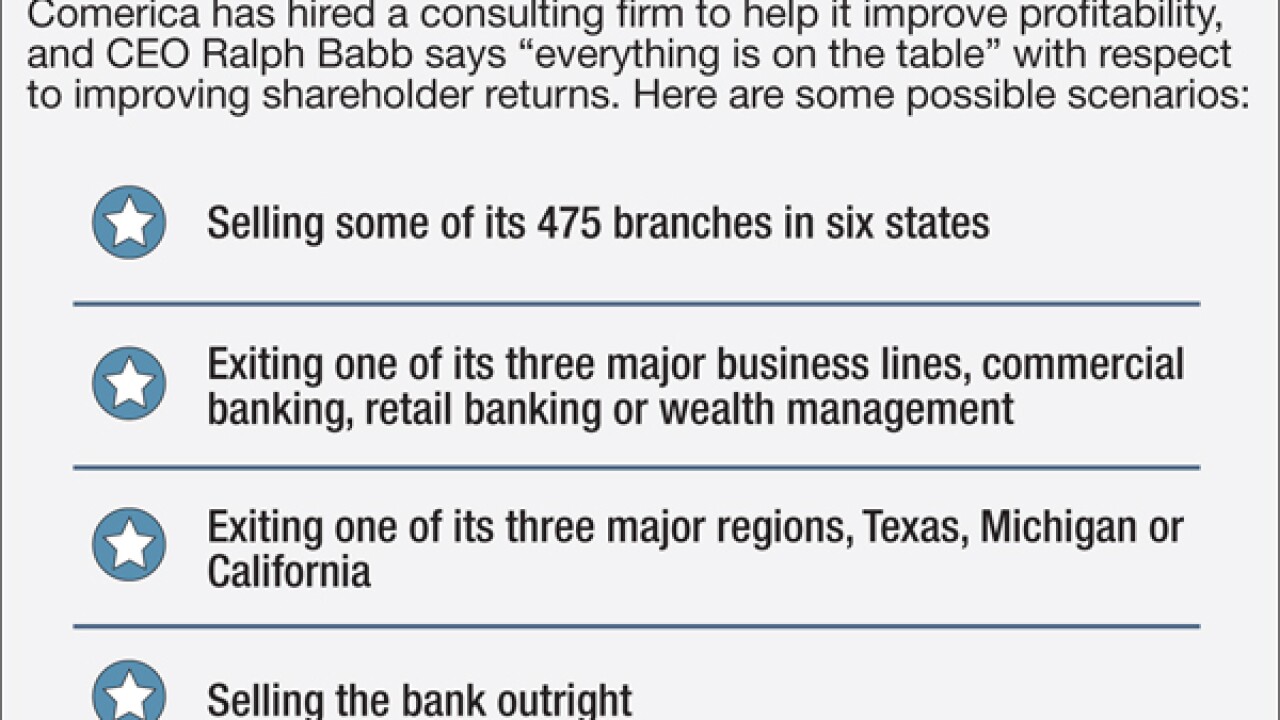

After another disappointing quarter, Comerica is promising big changes in its ongoing quest to improve returns to shareholders. It appears to be considering all options, including selling off business lines and perhaps even merging with another institution.

By Alan KlineApril 19 -

Comerica reported a steep decline in first-quarter profits as weak energy prices forced the Dallas company to sharply boost its reserves for loan losses.

By Alan KlineApril 19 -

A partnership with a firm that makes consumer loans through Home Depot stores is exceeding all expectations at Regions Financial. The company is counting on arrangements with two other alternative lenders to further drive loan growth.

By Alan KlineApril 15 -

Regions Financial in Birmingham, Ala., posted a double-digit gain in its first-quarter profit as strong revenue growth more than offset continued deterioration in its energy-loan portfolio.

By Alan KlineApril 15 -

Bank earnings season is just getting underway, but a consistent theme around energy lending is already emerging credit quality is going to get worse and weigh on profits the rest of the year.

By Alan KlineApril 14 -

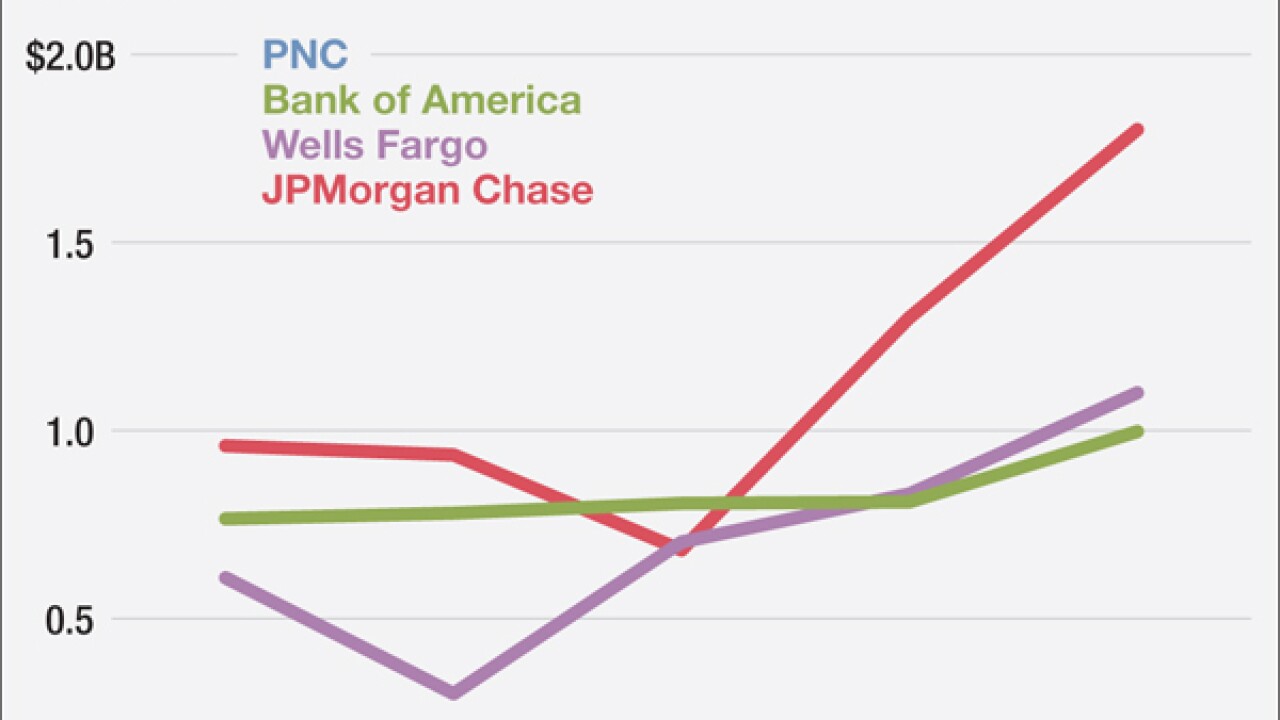

Weakness in the energy sector is weighing on PNC Financial Services Group's profits. The Pittsburgh company said early Thursday that it earned $943 million in the first quarter, a nearly 6% decline from the same period last year.

By Alan KlineApril 14 -

Affirm, a three-year-old online lender that finances consumer purchases at the point of sale, has raised a $100 million in equity funding to help it boost distribution and develop new products and services.

By Alan KlineApril 13