-

The Consumer Financial Protection Bureau said Monday it has ordered Bridgepoint Education to refund $23.5 million for deceiving students into taking out private student loans that cost more than advertised.

September 12 -

Many lenders are still reluctant to give mortgages to borrowers with less-than-pristine credit, yet such loans are far more likely than prime jumbo loans to be bundled into collateral bonds. Sreeni Prabhu of Angel Oak Capital credits banks' behavior and higher interest rates for that reality.

August 25 -

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

The Federal Housing Administration is promoting a particular kind of financing for residential energy retrofits that another regulator staunchly opposes. Mortgage lenders and investors have qualms, too, about the impact on their standing in collateral claims.

July 29 -

State student loan authorities sense a business opportunity helping graduates who are gainfully employed lower their payments. Their low-cost funding could put them in competition with banks and marketplace lenders.

June 10 -

The pricing of student loans, and higher-ed degrees themselves, should have more to do with the proven earning power of a university's graduates in the eyes of some innovators. Big data could play a huge role.

May 31 -

The due-diligence firms that vet loans before securitization are erring on the side of caution when assessing the risk to investors of liability from the new consumer mortgage disclosure rules.

May 24 -

Calls to break up big banks could complicate efforts by large institutions to raise sizable cushions of capital that can absorb losses in the event of a failure.

April 29 -

Strong investor demand for two recent securitizations by Navient, the largest servicer of federally guaranteed student loans, suggests that banks may soon have an opportunity to resume unloading such assets.

April 20 -

Moodys Investors Service, which put three of Citigroups securitizations of unsecured consumer loans originated by Prosper Marketplace under review for a downgrade, was not invited to rate the latest offering.

March 17 -

While the $1.9 billion of bonds are not guaranteed by the government, most of the underlying loans could have been sold to Fannie and Freddie, and the transaction accomplishes the same thing as the GSEs' risk-transfer deals.

March 16 -

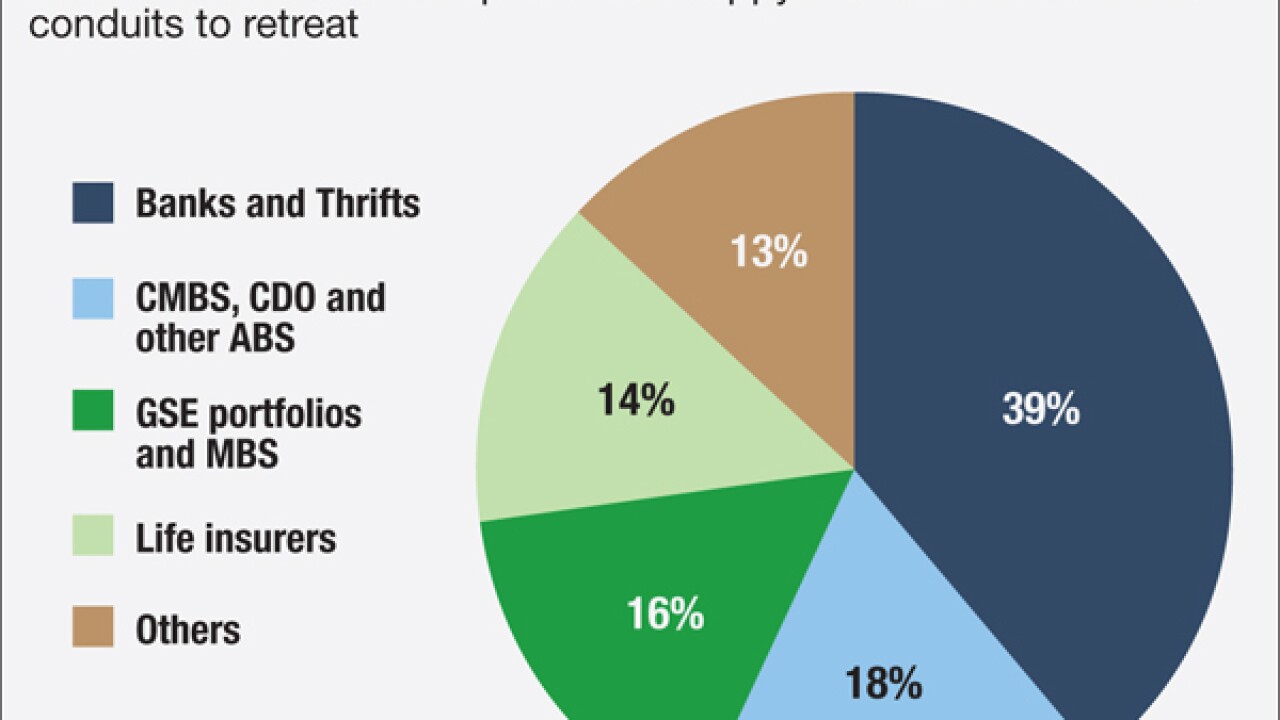

Market volatility and new regulatory burdens are thinning the ranks of commercial mortgage lenders that underwrite loans for securitizations. Activity is slowing down as a result, and it is unclear if banks and insurers will fill the void, especially outside the largest cities.

March 4 -

Competition among lenders for commercial mortgages has driven down interest rates, margins and underwriting standards, and now it's helped drive one lender out of the business.

February 11 -

Lenders argue that the GSEs would be better off buying more loans that are already insured, rather than transferring credit risk after holding them for a time. But Freddie Mac's Kevin Palmer says certainty of reimbursement is more important than the timing of risk transfers.

February 2 -

Forget "bigger is better." Several private-equity-backed lenders are making loans to small landlords, who represent the biggest chunk of the home-rental market and get less help from Fannie Mae and Freddie Mac than they once did.

November 9 -

It could take six months or more before people who deal in collateralized loan obligations receive more explicit regulatory guidance on "skin in the game" rules.

September 21 -

Income-based repayment, a federal government effort to relieve student-loan debt burdens, has roiled a normally tranquil securitization market, as investors can no longer be sure of when they'll be repaid.

September 8 -

CLO managers have long lobbied against proposed rules requiring them to keep "skin in the game" of these deals, arguing that such a requirement would increase the cost of financing for U.S. companies.

December 19 -

The final Volcker Rule is much friendlier to syndicated lenders and collateralized loan obligations than earlier versions. However, some banks will still have to divest some CLO holdings, and leveraged lenders face other regulatory challenges.

December 17 -

A proposal that managers of collateralized loan obligations keep "skin in the game" could force them to shorten no-call periods on CLOs. An alternative would hurt banks that arrange these deals.

September 26