Allissa Kline is a Buffalo, New York-based reporter who writes about national and regional banks and commercial and retail banking trends. She joined American Banker in 2020 and previously worked for more than a decade at Buffalo Business First, where she covered banking and finance, insurance and accounting. Kline started her journalism career at the Observer-Dispatch in Utica, New York. She graduated from Colgate University and the S.I. Newhouse School of Public Communications at Syracuse University.

-

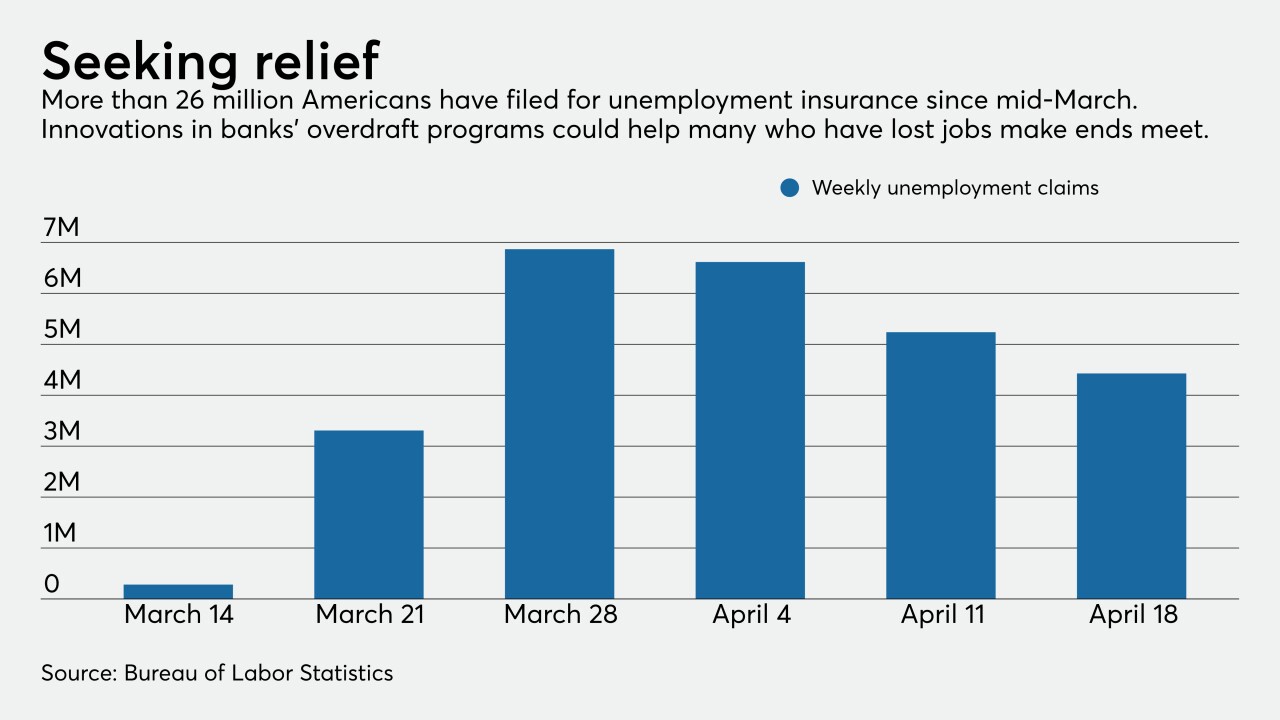

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

The Georgia bank could rely more on drive-through-only branches, trim office space and reassess staffing levels after the coronavirus crisis, according to Kessel Stelling.

April 24 -

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

April 22 -

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

April 16 -

Quick forbearance actions averted an immediate hit to asset quality, but executives warned that a spike in unemployment and a looming recession will cause long-term problems.

April 15 -

Reluctant to cancel what have become pipelines for developing talent, banks are delaying start dates or moving programs entirely online.

April 13 -

Bankers say they’re still trying to figure out if the Fed’s complex loan-buying vehicles will help them cater to the needs of midsize commercial customers hammered by the economic shock from the coronavirus outbreak.

By Jon PriorApril 9 -

Soaring demand for loans from firms hard hit by the coronavirus pandemic has led to predictions that the program could soon run out of funds.

April 7 -

The Cincinnati company will hire about 950 workers to meet heightened demand for loan deferrals and other forms of relief clients are seeking to weather the economic fallout of the coronavirus outbreak.

April 7 -

Banks, under pressure to act hastily, began taking applications for government aid to small businesses hit hard by the coronavirus outbreak. But narrow eligibility rules at some banks angered business owners and lawmakers.

By Kevin WackApril 3