Allissa Kline is a Buffalo, New York-based reporter who writes about national and regional banks and commercial and retail banking trends. She joined American Banker in 2020 and previously worked for more than a decade at Buffalo Business First, where she covered banking and finance, insurance and accounting. Kline started her journalism career at the Observer-Dispatch in Utica, New York. She graduated from Colgate University and the S.I. Newhouse School of Public Communications at Syracuse University.

-

A new academic paper dives into the key factors that have caused bank failures over the past 160 years.

September 20 -

Donald Felix, who has previously worked at JPMorgan Chase and Citi, will become Carver's president and CEO on Nov. 1. He succeeds interim CEO Craig MacKay, who's been running the unprofitable bank for the past year.

September 17 -

Tim Ryan, who joined the megabank in June, will work with COO Anand Selva to oversee enhancements to Citigroup's data integrity systems, according to a memo.

September 16 -

Executives at the super-regional bank told investors that years of investments are poised to start paying off in rising profits, but the market seemed skeptical about the company's plan forward.

September 12 -

The North Carolina bank lowered its medium-term target for return on tangible common equity target, reflecting the fact that the financial projections for the merger of BB&T and SunTrust Banks have not come to fruition.

September 10 -

The Dallas company, which has been in transformation mode for three years, recently took a series of actions to try to meet the profitability targets it set for itself.

September 6 -

The third-largest Canadian bank's proposed minority stake in KeyCorp is an unconventional way to generate more U.S. revenue. Analysts say it's a less risky approach than buying an American bank outright.

August 23 -

Fortuna Bank in Columbus would be the third U.S. bank specifically formed to be women-owned, according to its organizers. Supporters say it's another win toward obtaining gender-equitable capital access.

August 12 -

The parent company of Fulton Bank announced the creation of three new management roles and promoted existing employees into those jobs. The changes follow the recent hiring of an outsider to be CFO.

August 6 -

The Kansas City, Missouri-based regional bank said it is making progress on its pending purchase of Heartland Financial USA in Denver. The deal is expected to close during the first quarter of 2025.

July 31 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

As a managing director within Citi Investment Management, a division that sits within wealth, White is playing an integral part in reshaping that line of business.

July 29 -

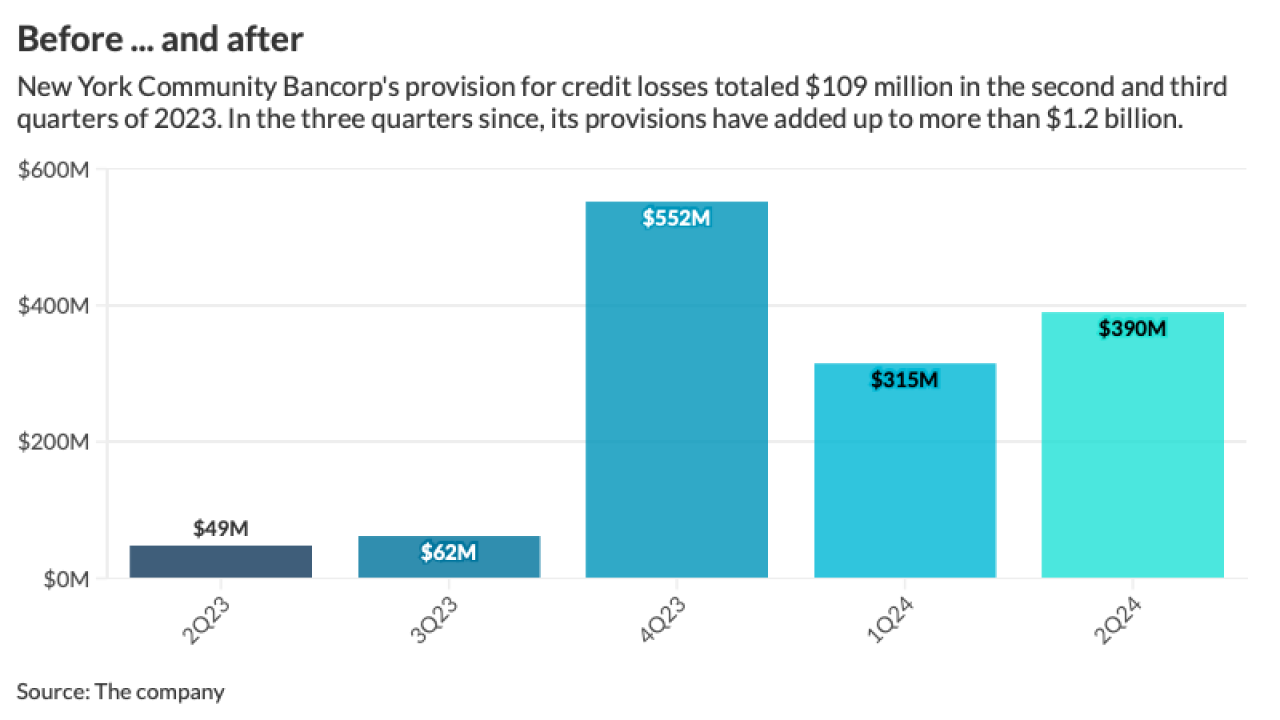

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

The Northeast regional bank missed expectations on net interest income and negatively revised much of its 2024 guidance.

July 23 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

Two Northeast banks will get new CFOs next month. Webster Financial hired Neal Holland, the former CFO of the failed First Republic Bank, and Eastern Bankshares hired David Rosato, who left Berkshire Hills Bancorp last month.

July 16 -

The investment banking giant said that it will "moderate" its pace of share repurchases as it continues to talk to the Federal Reserve, which recently increased its stress capital buffer from 5.5% to 6.4%.

July 15