New York Community Bancorp

But New York Community's overall deposit base is now stable and positioned to grow, and work continues to bring back some of the Signature deposits that fled during the industry turmoil this spring, New York Community President and CEO Thomas Cangemi told analysts Thursday.

The company currently has 127 private banking teams — 92 in the Northeast and 35 on the West Coast — focused on reeling in former Signature Bank customers and their deposits. That number includes six private banking teams that have joined New York Community from First Republic Bank, the San Francisco-based company that suffered through weeks of deposit runs, stock price volatility and general duress until it was

"The teams are excited to be building back the liabilities that have shredded off the balance sheet because of the fear in March," Cangemi said during New York Community's quarterly earnings call. "And not only are we seeing positive momentum there [but] the teams are excited, it's stable, and we believe that over time as things start to normalize we'll get more deposits back."

The teams are reporting some success, according to Eric Howell, a former president and longtime chief operating officer at Signature who is now a senior executive at New York Community.

"The teams are really starting to have success and attract those clients back," Howell said on the call. "Our clients simply just don't want to be at the mega institutions that they ran to."

Deposits at the Hicksville, New York, company totaled $88.5 billion as of June 30, up 4.4% from the first quarter and more than double what was on the balance sheet as of June 30 last year.

It is one of several companies that reported an uptick of deposits for the second quarter, joining the likes of

Still, about $1.4 billion of legacy Signature deposits — mostly higher-cost brokered deposits — fled during the quarter, the company said. That's on top of $2 billion of Signature deposits that flowed out of New York Community between March 20, the day after New York Community

The deal, which came one week after regulators closed New York City-based Signature following a run on deposits, included $33.5 billion of new deposits. In April, executives at New York Community said they thought about 20% of the $33.5 billion — or about $6.7 billion — would leave the balance sheet over time.

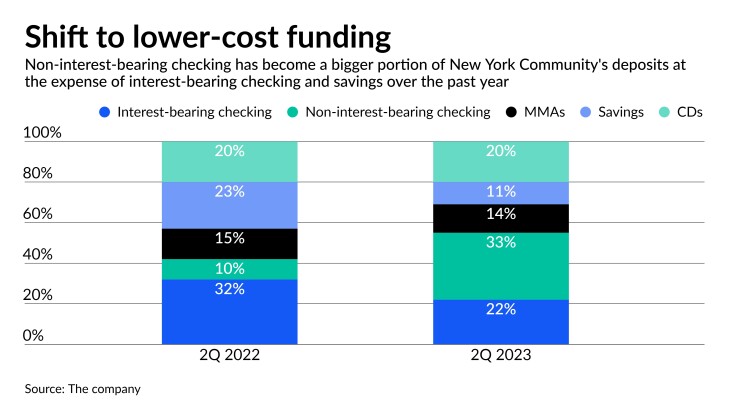

The second-quarter outflow, however, was offset by an uptick in non-interest-bearing deposits, the company said. Such deposits made up 33% of New York Community's total deposit base at June 30, a sharp difference from mid-2022 when they made up about 10% of the deposit base.

The increase in non-interest-bearing deposits during the quarter includes about $5.9 billion of custodial deposits, which are from paydowns of certain Signature loans held by the Federal Deposit Insurance Corp. but serviced by New York Community as part of the failed-bank deal between the two entities, Chief Financial Officer John Pinto said on the call. Excluding those custodial deposits, non-interest-bearing deposits were still 29% of total deposits at the end of the second quarter, according to New York Community.

As the loan portfolio shrinks and eventually is sold, there will be fewer custodial deposits on New York Community's balance sheet, Pinto noted.

New York Community has been tweaking its deposit composition for two and a half years to reduce funding costs by shifting away from higher-cost deposits such as certificates of deposit. It's part of a broader strategy to

One major component of the strategy was the December 2022 acquisition of Flagstar Bancorp in Troy, Michigan. The

About $2.9 billion of the deposits the company obtained from the failed Signature Bank had fled as of last week, and executives are forecasting that number to double. However, they say they're "cautiously optimistic" they can lure some deposits back.

The focus on deposits and deposit-gathering cuts across both acquisitions, Cangemi said.

"Culturally, the focus here is relationship deposit-gathering in all of our lines of businesses," Cangemi said Thursday. "That's the culture here going forward. I've said it many quarters: deposits, deposits, deposits. Culture, culture, culture. And on the culture build we are really meshing well. We're putting three companies together to build a new Flagstar."

Flagstar is the name of New York Community's banking subsidiary following the acquisition.

For the quarter, New York Community reported net income of $353 million, excluding a purchase bargain gain of $141 million related to the Signature deal and certain merger-related items tied to both acquisitions, the company said. Adjusted earnings per share totaled 47 cents, handily beating the average estimate of 29 cents from analysts surveyed by FactSet Research Systems.

Net interest income was $900 million, up 151% from $359 million in the same quarter a year ago.

Fee income was $161 million, excluding the $141 million bargain purchase gain. The total includes a gain on loan sales of $25 million and loan administration income of $39 million, which is related to loan subservicing income tied to the Signature acquisition, the company said.

Expenses totaled $661 million, up from $138 million year over year. For the full year, executives are projecting expenses of $2 billion to $2.1 billion as the company builds out business lines, prepares for new capital rules and integrates both Flagstar and Signature Bank, they said.

The company is also investing in the private banking strategy, Cangemi said. He hinted there may be more private banking teams that will be joining the company in the future.

"Stay tuned. There's a lot of activity out there," he said. "And, you know, hopefully we continue to be successful in convincing these team members to become part of the new Flagstar."