David Heun is an associate editor for technology at American Banker.

-

This week's first transaction over The Clearing House's Real-Time Payments system may be a huge step for speeding up payments in the U.S., but it also highlights the long road still ahead.

By David HeunNovember 14 -

The system went live Monday with a real-time transaction between BNY Mellon and U.S. Bank. Those banks will soon be joined on the network by Citi, JPMorgan, PNC and SunTrust, which together represent the financial industry’s earliest adopters of RTP.

By David HeunNovember 14 -

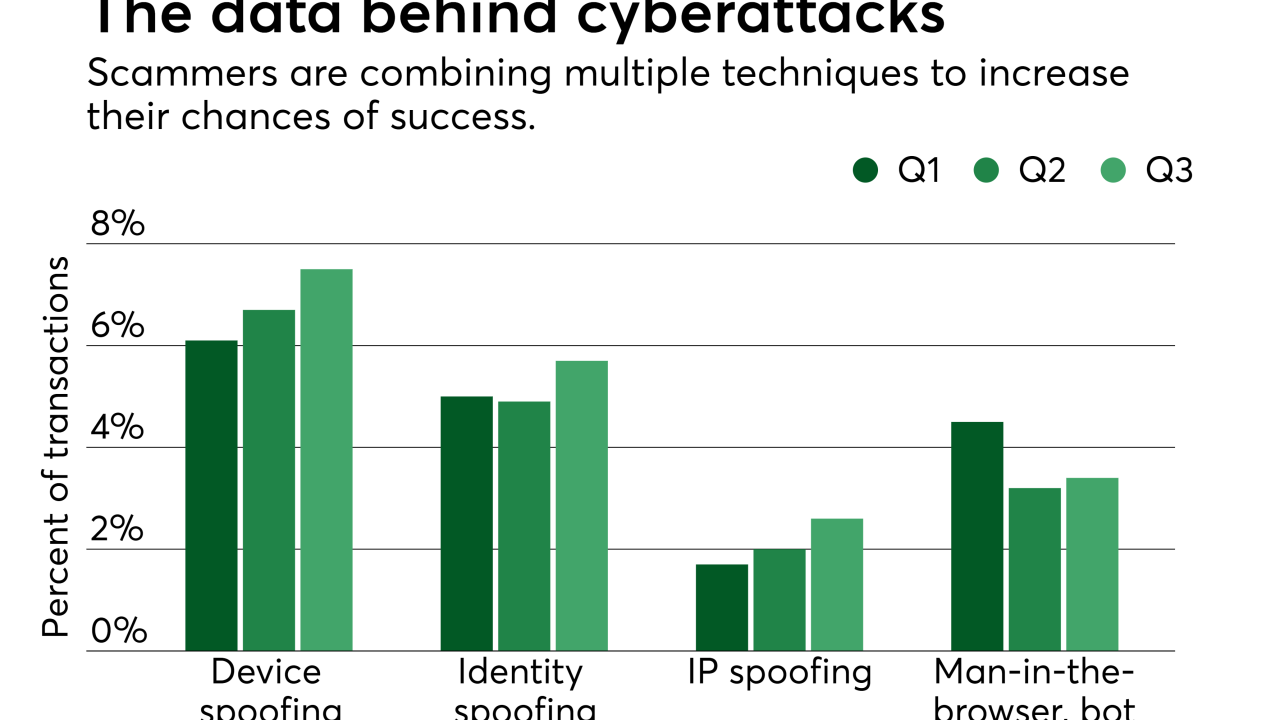

There is a visible shift in attack patterns immediately following a breach, from initial attacks focusing on high-value loan applications at online lenders to low-value identity testing on charities and social media sites to determine if a stolen credential will work.

By David HeunNovember 14 -

For years, American Express has analyzed the more than $1 trillion in annual purchases taking place on its closed-loop network to better advise clients to formulate marketing programs.

By David HeunNovember 13 -

Because wearable payments technology is still considered experimental, it is important to address security before the market for such products gets much bigger.

By David HeunNovember 13 -

The spread of Alexa, Siri, Google Assistant and Samsung's Bixby is changing the way consumers interact with technology. Behind the scenes, artificial intelligence is doing more than ever to handle and protect payments.

By Daniel WolfeNovember 10 -

Over the years, Square has evolved from a supplier of simple card readers to a provider of diverse omnichannel services. But the consumer market has always eluded it.

By David HeunNovember 9 -

Many companies in the payments realm want to be seen as the next Uber, but Uber's Asian counterpart Grab is working to become something else — the next Octopus.

By David HeunNovember 9 -

For much of the last decade, credit card companies and issuers have fine-tuned security to the point where if any suspicious activity occurs on a cardholder account, that cardholder will receive an alert. That same sort of transaction and behavioral analytics is starting to come into other business sectors and walks of life.

By David HeunNovember 8 -

The card is Starbucks' first product with Chase since the companies agreed early in 2016 to make Chase Pay part of the Starbucks app when it became available.

By David HeunNovember 3 -

Apple's digital services group, which includes Apple Pay, generated $8.5 billion in revenue in the quarter for Apple, a jump of 34% from the previous year.

By David HeunNovember 3 -

Neural network systems — which try to emulate the human brain — will become increasingly important as the stolen identities from the recent Equifax breach and others start surfacing in the coming years on fraudulent payment card or loan applications.

By David HeunNovember 3 -

Telcos have long hoped to play a key role in mobile payments, and the mobile-only Orange Bank is a major push toward that goal.

By David HeunNovember 2 -

American Express will launch its next generation of online authentication system, SafeKey 2.0, early next year with support for biometrics technology and mobile commerce.

By David HeunNovember 2 -

Canadian consumers using Samsung Pay can now make Interac debit payments through their mobile devices using a tokenization service from Interac and digital security provider Rambus Inc.

By David HeunNovember 1 -

American Express will become the exclusive issuer of Hilton Honors cobranded credit cards in January, taking over the entire portfolio it previously shared with Citigroup.

By David HeunNovember 1 -

EMVCo has established a new specification for updated 3-D Secure e-commerce fraud prevention that will be the basis by which the EMV standards body will test the new protocol for security compliance.

By David HeunOctober 31 -

Payments technology changes rapidly, and cybercriminal techniques have no trouble keeping pace. Against that backdrop, the Payment Card Industry Security Standards Council must set new rules without hindering development.

By David HeunOctober 30 -

The gig economy is one of the most demanding business sectors in terms of technology, speed and security. All of these factors play into how these companies handle payments.

By Daniel WolfeOctober 27 -

It's been nearly six years in the making, but TableSafe has the EMV certification it has long needed to make its pay-at-the-table Rail platform a future-proof option for restaurants.

By David HeunOctober 25