David Heun is an associate editor for technology at American Banker.

-

More e-commerce companies see recurring billing as a key revenue model, a trend that convinced Stripe to try to lower the bar to entry.

By David HeunApril 5 -

In deploying the Social Pay money transfer service, ICICI Bank says it is the first bank in India to allow nonresidents to send money to family and friends in the country for special occasions like festivals and birthdays.

By David HeunApril 5 -

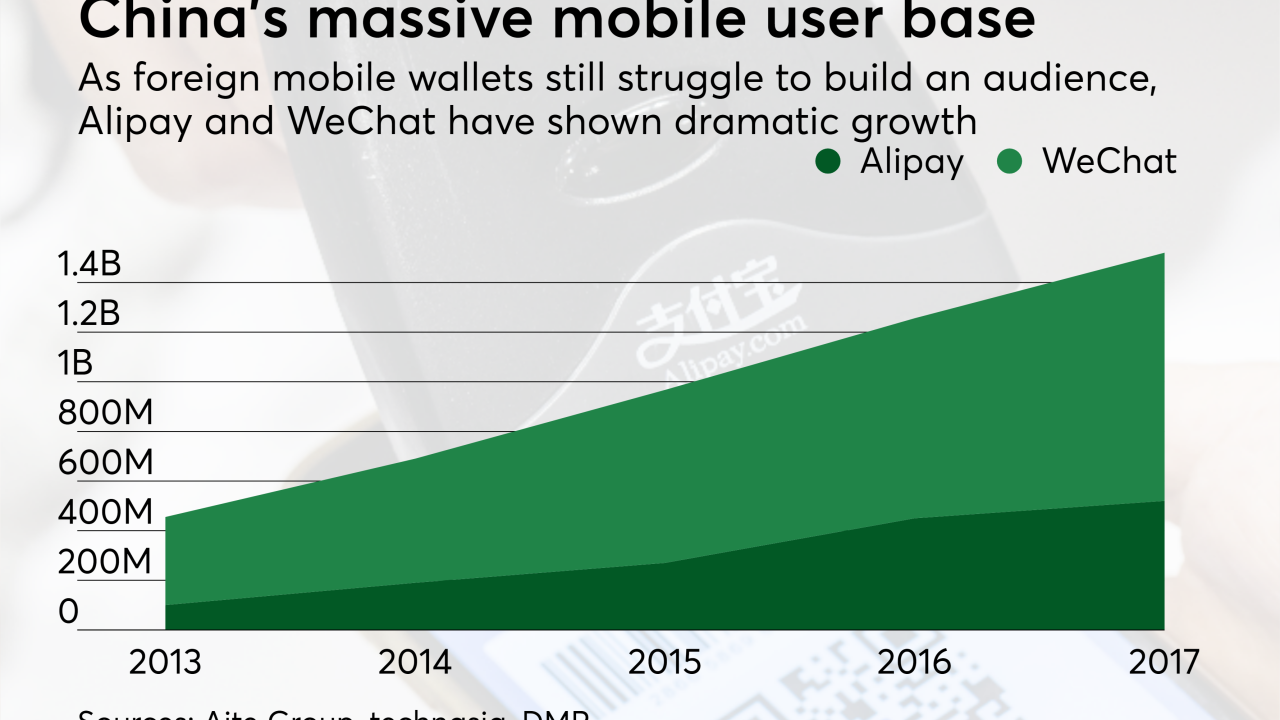

Some of the biggest digital wallets in the world — including Alipay and WeChat Pay — succeed because they have very little in common with other big-brand wallets like Apple Pay, Google Pay and Samsung Pay.

By David HeunApril 5 -

This year could be a pivot point for blockchain to move past proofs of concept to adoption, propelled by strong investor interest. But many still see the tech as being three to four years away from going mainstream.

By David HeunApril 4 -

Europe's banks stand to benefit a lot from the SEPA Instant Credit Transfer scheme — but "instant" is a high bar that many banks may not be able to reach.

By David HeunApril 4 -

KFC is finally converting its point of sale terminals to accept EMV chip cards, opting for a semi-integrated system to accept all payment types.

By David HeunApril 3 -

Considering Walmart spent the better part of a decade trying to establish its own bank, it comes as no surprise that the retail giant is aiming big with its latest financial service.

By David HeunApril 3 -

The threat that mobile would displace plastic never came to be. But the new technology — often developed by retailers and other nonbanks — nevertheless forced issuers to take stock of their own offerings.

By David HeunApril 3 -

The funding round comes on the heels of what BitPay cited as a record year in 2017 in processing more than $1 billion in bitcoin payments.

By David HeunApril 2 -

Braintree's newest offering is designed to make e-commerce partnerships easier — at least, from a technology perspective.

By David HeunMarch 27