Ebrima Santos Sanneh covers the Treasury, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency for American Banker. He is a native of Providence, R.I. and a 2020 graduate of UCLA. Before joining American Banker he worked as a staffer for Sen. Jack Reed, D-R.I.

-

Appointed by Janet Yellen in 2021, Michael Hsu has served as acting Comptroller of the Currency longer than any predecessor. That arrangement is lawful and born out of political pragmatism, but some observers say it's a shortcut around Senate confirmation.

August 28 -

Cohen, a partner with law firm Morrison Foerster and seasoned expert in workplace monitorships and diversity initiatives, will audit and report on the agency's efforts to overhaul a culture characterized by patriarchy and insularity.

August 22 -

A coalition of financial industry groups is calling on the Federal Deposit Insurance Corp. to provide more data and extend the comment period on proposed brokered deposit restrictions, warning the changes could disrupt banking practices and harm consumers.

August 21 -

New standards forwarded by the Public Company Accounting Oversight Board and approved by the Securities and Exchange Commission bolster auditor responsibilities and introduce enhanced technology use, impacting over 350 publicly traded banks.

August 21 -

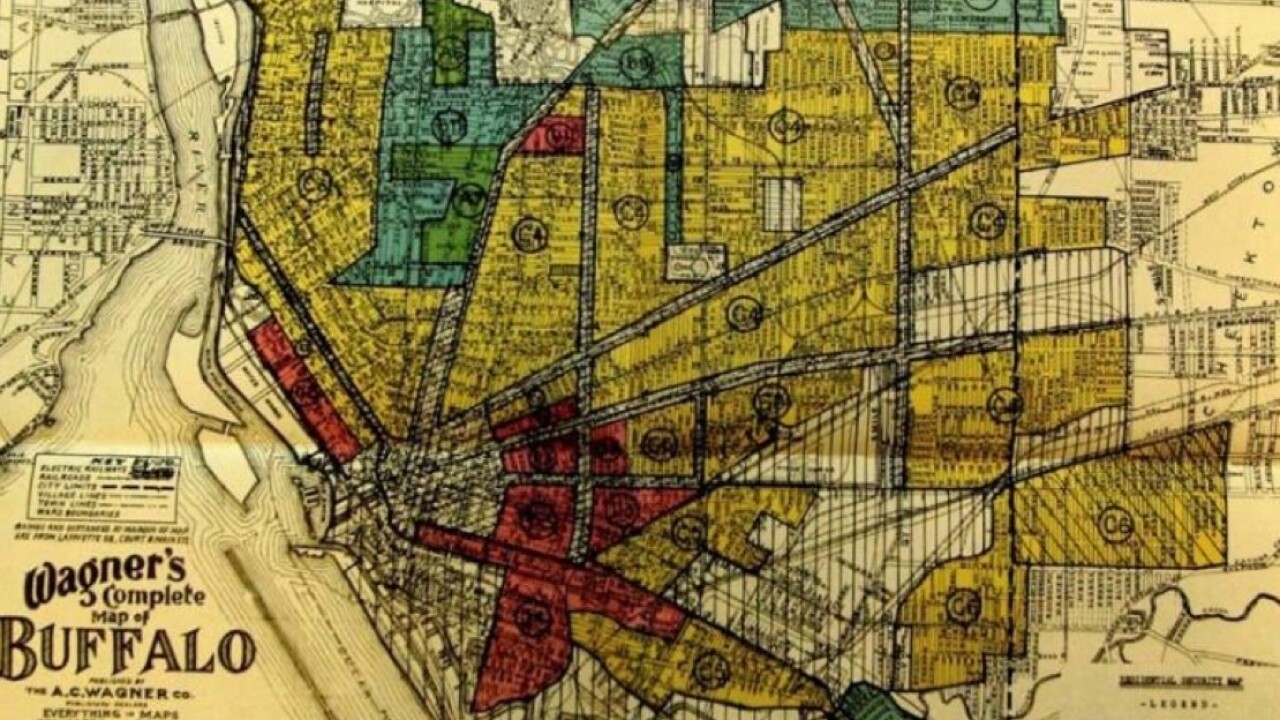

The industry-led legal challenge to new anti-redlining rules is opposed by some banks and consumer protection groups, who say the changes are necessary.

August 20 -

An amicus brief filed in a lawsuit challenging newly finalized implementing regulations for the Community Reinvestment Act argues that the court was chosen because plaintiffs believe the court is more likely to rule in their favor.

August 16 -

A bipartisan group of ex-inspectors general is pushing Senate leaders to quickly confirm Christy Goldsmith Romero to chair the Federal Deposit Insurance Corp. despite scheduling delays and the upcoming election.

August 13 -

Beneficial State Bank — which was joined by various civil rights groups — said in an amicus brief that the regulatory reforms are much-needed and that banking groups' legal challenge to the Community Reinvestment Act rules should be dismissed.

August 9 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

Industry experts argue that the Federal Deposit Insurance Corp.'s recent brokered deposit proposal, which would expand the classification of brokered deposits and reverse key elements of a 2020 rule, reflects outdated thinking and may discourage banks from holding such deposits.

August 7 -

Governor Tim Walz, whom Vice President Kamala Harris selected as her running mate Tuesday, has a slight but progressive record on financial policy, suggesting a potential leftward shift in banking policy in a prospective Harris administration.

August 6 -

Judge Martin Glenn of the Federal Bankruptcy Court of the Southern District of New York greenlighted SVB Financial's bankruptcy plan Monday, but $1.93 billion in FDIC-held deposits remain contested pending further litigation.

August 5 -

A report by the FDIC Office of the Inspector General found the agency failed to sustain corrective actions, leading to a persistent environment of sexual harassment, distrust of management and fear of retaliation.

August 1 -

In addition to a new rule enabling more active review of large asset managers acquiring shares in FDIC-supervised banks, the FDIC board finalized living will guidance and requested public input on deposits.

July 31 -

The Federal Deposit Insurance Corp. issued proposals Tuesday that would reverse Trump-era rules on brokered deposits and tighten the agency's guidelines for approving applications to incorporate new industrial loan companies.

July 30 -

While the federal banking agencies are not changing any current rules, they issued a joint statement Thursday cautioning banks about risks in third-party deposit partnerships. They are also seeking public input on bank-fintech partnerships more generally.

July 25 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

The Biden Administration firmly rejects proposed cuts to key financial oversight and consumer protection agencies in the Republican-backed financial services appropriations bill for fiscal year 2025.

July 22 -

Federal banking agencies asked the Fifth Circuit to lift an injunction on new community lending regulations, arguing that the court misinterpreted the scope of the Community Reinvestment Act's reach.

July 22 -

Two recent Supreme Court rulings, Loper Bright and Cantero, are likely to upend the Office of the Comptroller of the Currency's long-standing approach to federal preemption of state banking laws, experts say.

July 18