-

State and federal regulators finally approved the Mississippi bank’s acquisitions of Ouachita Bancshares and Central Community after anti-laundering and CRA matters were resolved. BancorpSouth’s CEO says he may pursue more deals.

By Hilary BurnsDecember 28 -

The veteran banker wants to turn his Pennsylvania bank into a major business lender. But first he has to spin off the buzzy digital-only bank he helped build.

By Hilary BurnsDecember 27 -

The company has registered shares that three private equity firms have held since early 2010.

By Hilary BurnsDecember 21 -

The wealth management firm Boston Private has agreed to sell Anchor Capital Advisors to Anchor’s management team.

By Hilary BurnsDecember 21 -

The Fed approved an application giving Natcom Bancshares indirect control over Republic Bank, declining to take into account claims the transaction imperils the target's S corporation status.

By Hilary BurnsDecember 19 -

Amalgamated in New York wants to enter several left-leaning cities across the country, but it might be tough to find more like-minded banks to buy.

By Hilary BurnsDecember 19 -

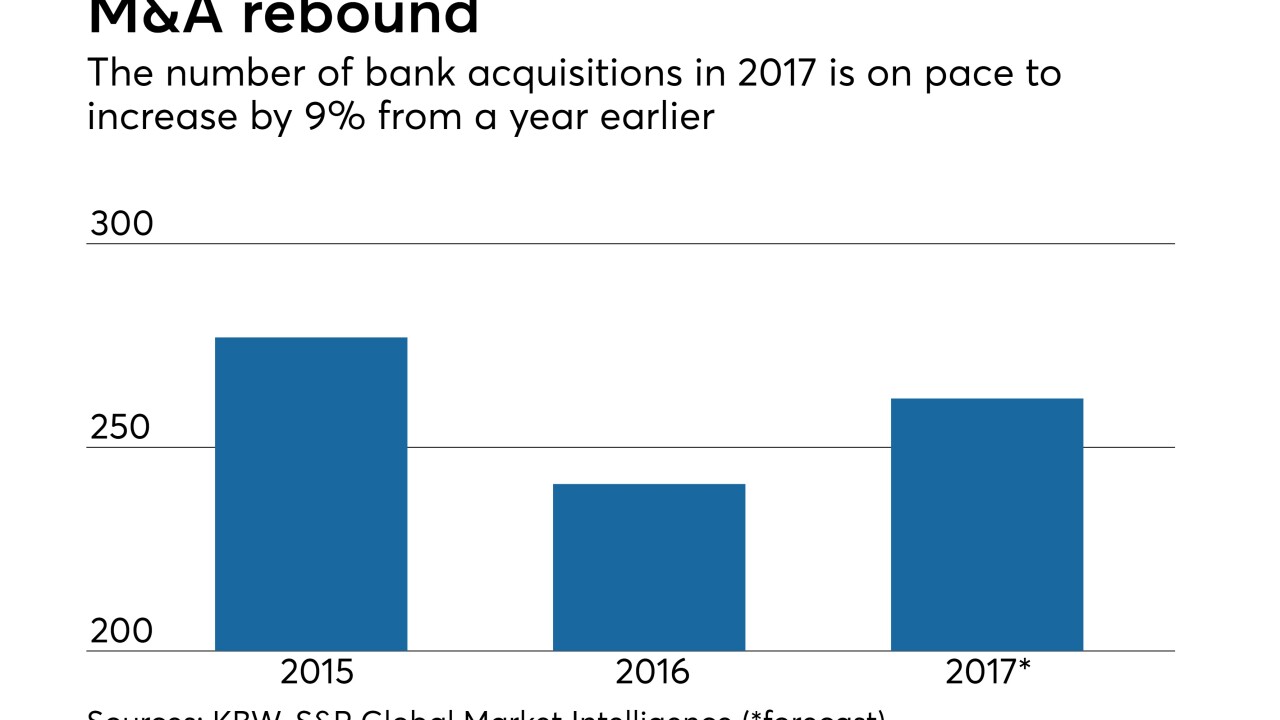

The number of deals, overall dollar volume and premiums are on pace to top those from a year earlier, giving hope that even more consolidation will take place in 2018.

By Hilary BurnsDecember 15 -

Ken Veccione, who rejoined the Arizona company earlier this year, is set to succeed Sarver.

By Hilary BurnsDecember 14 -

A group has filed an application for form a bank in Birmingham, a city with a large pool of bankers and a steadily growing economy.

By Hilary BurnsDecember 12 -

As some lenders exit indirect auto lending, those that stick around have an opportunity to control pricing and reach more customers.

By Hilary BurnsDecember 7 -

The Delaware bank will process payments and provide debit card sponsorship services for SoFi Money, which is set to debut next year.

By Hilary BurnsDecember 7 -

Dennis Zember, Ameris' chief operating officer, was named CEO of the company's bank. Edwin Hortman Jr. will continue to run Ameris.

By Hilary BurnsDecember 7 -

The expected refund is tied to loans that investors bought when they acquired the failed BankUnited in 2009.

By Hilary BurnsDecember 4