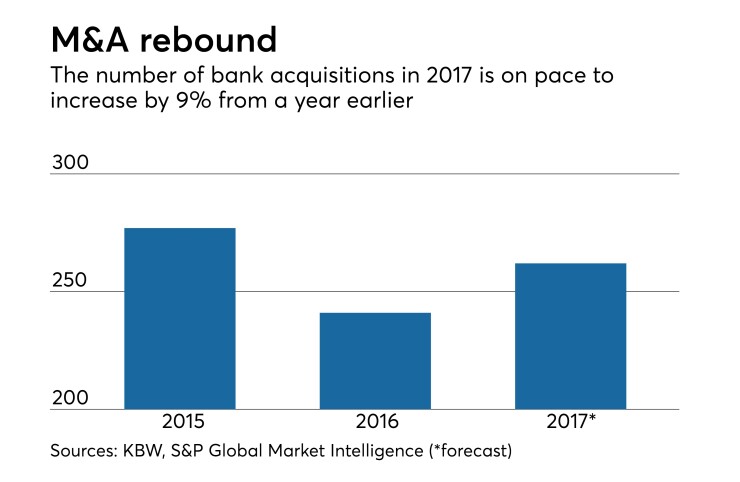

Bank consolidation finally started to accelerate this year.

The industry is on pace to announce 9% more deals in 2017 than it did a year earlier, according to data from Keefe, Bruyette & Woods and S&P Global Market Intelligence.

The overall value of this year’s deals and the premiums paid to sellers, in terms of average price to tangible book value, are also expected to increase from the prior two years, raising expectations that more consolidation lies ahead.

“The environment right now trends towards [more] banks getting together,” said Jonathan Hightower, a lawyer at Bryan Cave in Atlanta. “We have a lot of different complimentary strengths across the banking landscape right now.”

A number of bankers are also bullish about pursuing acquisitions in coming months.

Great Western Bancorp in Sioux Falls, S.D., has an increased interest in acquisitions, Ken Karels, the $11.7 billion-asset company’s chairman, president and CEO, said during an Oct. 26 conference call to discuss quarterly results.

“We continue to look at acquisitions, probably more strongly than we have in the past,” Karels said. “There are some great opportunities out there.”

At the same time, some bankers said they are seeing increased opportunity, which is allowing them to be selective about their targets.

“There's a lot of activity out in the market,” Kevin Riley, president and CEO of First Interstate BancSystem in Billings, Mont., said during his company’s quarterly call. “We see a number of deals and I think we're being picky as to what … we're going to enter into.”

Total deal volume this year is up 1% from 2016, to $25.6 billion, according to KBW. Pricing premiums have increased by 21%, averaging of 165% of a seller’s tangible book value.

A closer look reveals that the nature of deal making took a turn at midyear.

While 2017 started off slow, deals announced in the first half of the year were, on average, bigger and pricier than those from 2016. In recent months, however, the pace of M&A activity has ticked up, while the average deal size decreased.

Uncertainty immediately after last year’s presidential election caused some acquirers to take a wait-and-see approach to regulatory and tax reform, Hightower said.

Regional banks eventually took advantage of a post-election surge in their stock prices by announcing deals in early 2017.

“You did have emerging regional champions lead the M&A wave,” Hightower said. “Those guys continue to drive M&A. That class of banks continues to get larger.”

Eight of the year’s 10-biggest bank deals were announced in the first five months. They included Sterling Bancorp’s $2.2 billion purchase of Astoria Financial, First Horizon’s $2.2 billion acquisition of Capital Bank Financial, and Pinnacle Financial Partners’ $1.7 billion deal for BNC Bancorp.

Bigger buyers were generally in search of larger targets.

“You really have to be of a certain size to get on their radar,” Hightower said.

Smaller banks came off of the sidelines later in the year as aspiring acquirers grew more comfortable with the regulatory approval process. Many were also on the hunt for new markets, higher-yielding loans and lower-cost deposits.

Those trends will likely continue in the months ahead.

“In terms of 2018, it seems like we have the right recipe in place that is going to lead to some really good banks getting together,” Hightower said.

Still, sellers with strong loan portfolios or low-cost deposits typically command higher prices, bankers and industry experts said.

Recent rate increases, a steeper yield curve and expectations of a lower tax rate have also increased bank valuations and premiums, said David Brooks, chairman, president and CEO of Independent Bank Group in McKinney, Texas.

“You have to have willing partners,” Brooks said during an Oct. 24 conference call. “In that vein, the pricing expectations are still very full … on the part of sellers today.”

Independent

Don’t be surprised to see a short-term lull in activity as bankers wait for Congress to pass tax reform legislation, said Bob Wray, a managing director at Capital Corporation in Prairie Village, Kan. Acquisitions could pick up if a bill passes.

While North Carolina was a torrid consolidation market this year, largely driven by private-equity investment, Wray said states such as Kansas, Missouri, Minnesota and Iowa, which have scores of banks, could lead M&A in 2018.

“Just by the number of banks, it’s going to continue to be hot in the Midwest,” Wray said.