-

The National Association of Federally-Insured Credit Unions' new campaign highlights $243 billion in fines slapped on Wall Street banks. The group says it's responding to political attacks, but the banking industry says NAFCU is trying to distract from criticism of its tax exemption.

By Ken McCarthyDecember 13 -

The Atlanta bank said the deal will accelerate its small-business and commercial and industrial lending while expanding its presence in point-of-sale financing.

By Jim DobbsDecember 13 -

The $85 million acquisition of Metro Phoenix Bank would more than double Alerus Financial’s loans and deposits in the nation’s fifth-largest city.

By Jim DobbsDecember 9 -

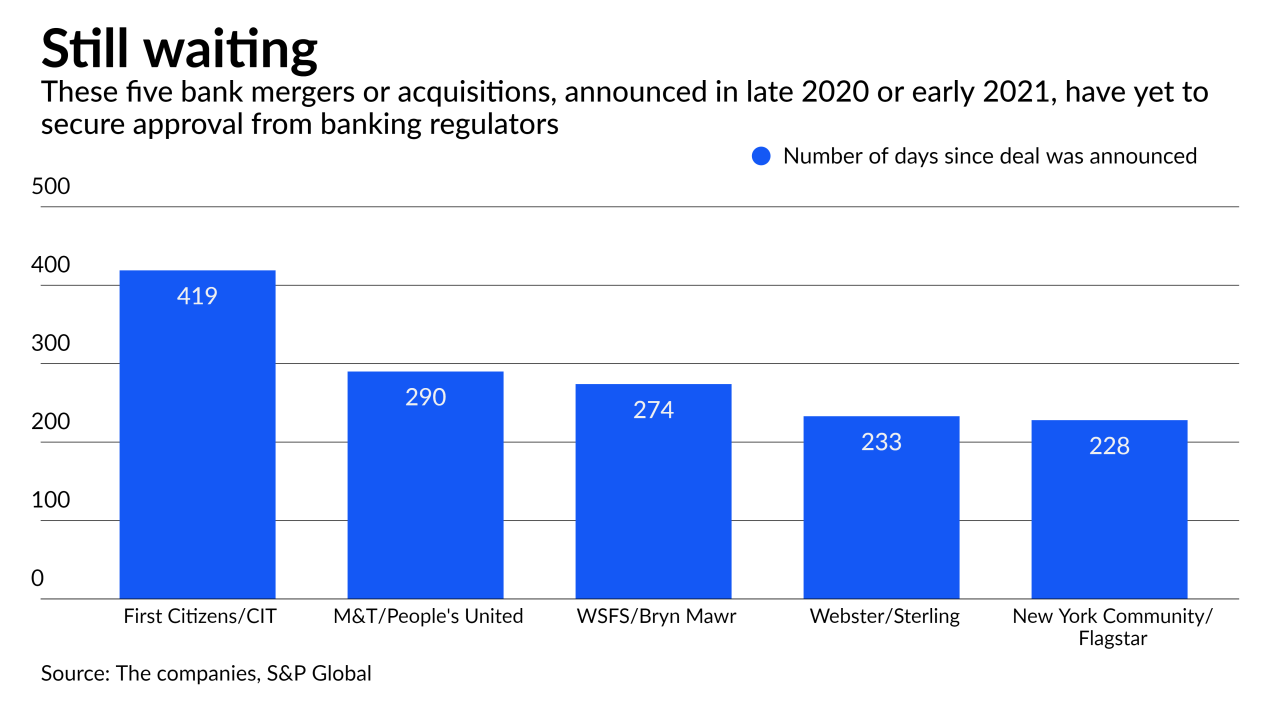

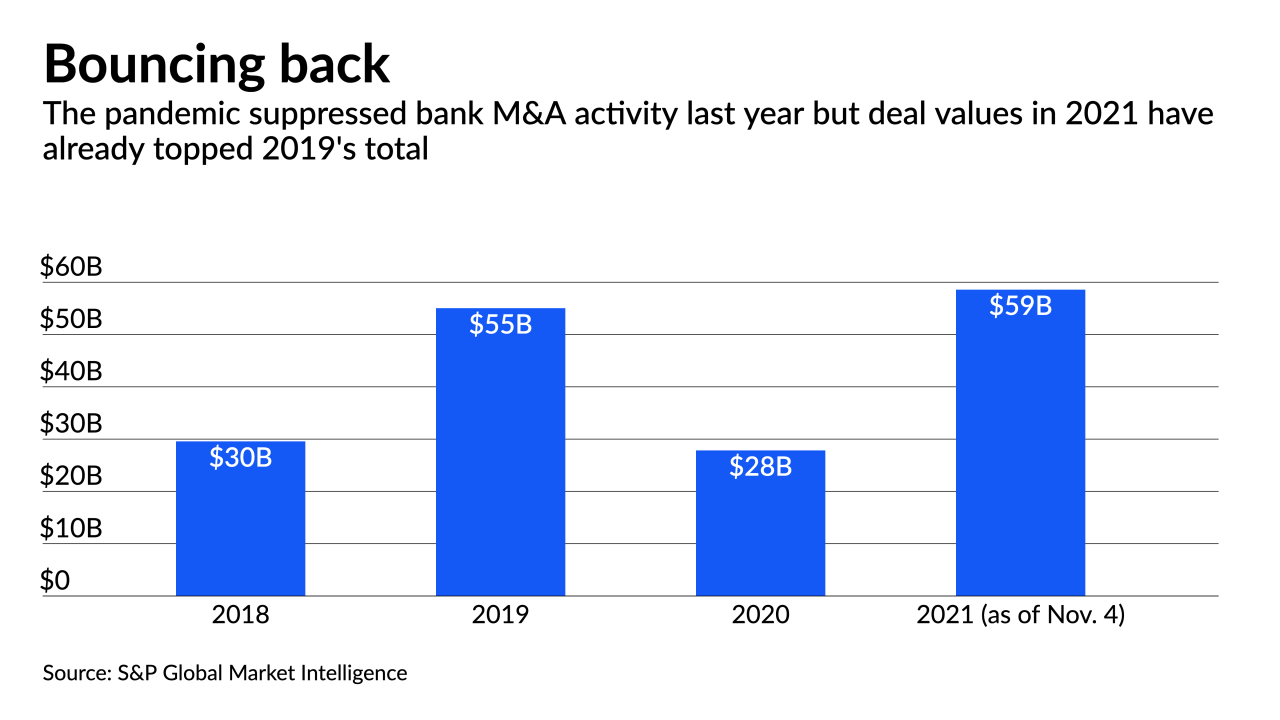

Bankers say the Biden administration’s call for regulatory greater scrutiny of mergers and acquisitions is causing holdups and could slow dealmaking activity in 2022.

By Jim DobbsDecember 7 -

The new omicron strain is prompting more financial institutions to extend mask mandates in the workplace and remote work schedules.

By Jim DobbsDecember 2 -

The Denver company said it would pay $56 million for Legacy Bank in Colorado and pick up nearly $500 million of assets.

By Jim DobbsDecember 1 -

Borrowers expect the Federal Reserve to raise interest rates next year to contain soaring prices and are locking in favorable terms now, bankers say.

By Jim DobbsNovember 24 -

The buyer said it would enter two of Wyoming’s largest markets and expand in Nebraska and Colorado with the purchase.

By Jim DobbsNovember 22 -

Buying Spirit of Texas would give the Arkansas company access to the Austin, San Antonio and Houston markets and make it a bigger player in the fast-growing south-central U.S.

By Jim DobbsNovember 19 -

The retired Laurence Bensignor is prohibited from working for “any insured depository institution or any holding company of an insured depository institution” because of his failure to disclose key information about an alleged insider-loan scheme, the Federal Reserve says.

By Jim DobbsNovember 16 -

The acquisition of First Sound Bank would give the fintech a lending platform to go along with its deposit-gathering capabilities. It would be BM's first buyout since being spun off from Customers Bancorp last year.

By Jim DobbsNovember 15 -

The purchase of Peoples Banktrust would create the fifth-largest bank based in Georgia’s most populous metropolitan area.

By Jim DobbsNovember 11 -

Without the ability to build cutting-edge technology or recruit top talent, the best outcome for many small lenders is to merge with a bank seeking to enter a new market.

By Jim DobbsNovember 10 -

The Houston companies emphasized the need for added size to compete with megabanks such as JPMorgan Chase and Wells Fargo.

By Jim DobbsNovember 8 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

By Jim DobbsNovember 5 -

Amid a spate of deals in 2021, community banks are actively recruiting from merging rivals that are focused on closing and integrating acquisitions.

By Jim DobbsNovember 3 -

The Illinois bank is acquiring about 1,800 loans to insurance agents. As part of the deal, a team of Allstate specialists will join the bank's insurance agency finance business.

By Jim DobbsNovember 1 -

The community lender, which emphasizes an environmental, social and governance mission, plans to beat the Paris Climate Agreement's timeline by five years.

By Jim DobbsOctober 28 -

Lending momentum is building and tourists have come back, but the coronavirus is a lingering concern for a state that relies heavily on vacationers.

By Jim DobbsOctober 27 -

Businesses trying to meet a surge in demand for consumer goods are knocking on community banks' doors to finance expansions.

By Jim DobbsOctober 25