-

At first the deal seemed an unlikely marriage of two mortgage-heavy companies. But acquiring the Michigan company would help New York Community accomplish its two chief goals — reducing deposit costs and its concentration of multifamily loans — while giving it the scale to pursue more deals.

By Jim DobbsApril 26 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

By Jim DobbsApril 22 -

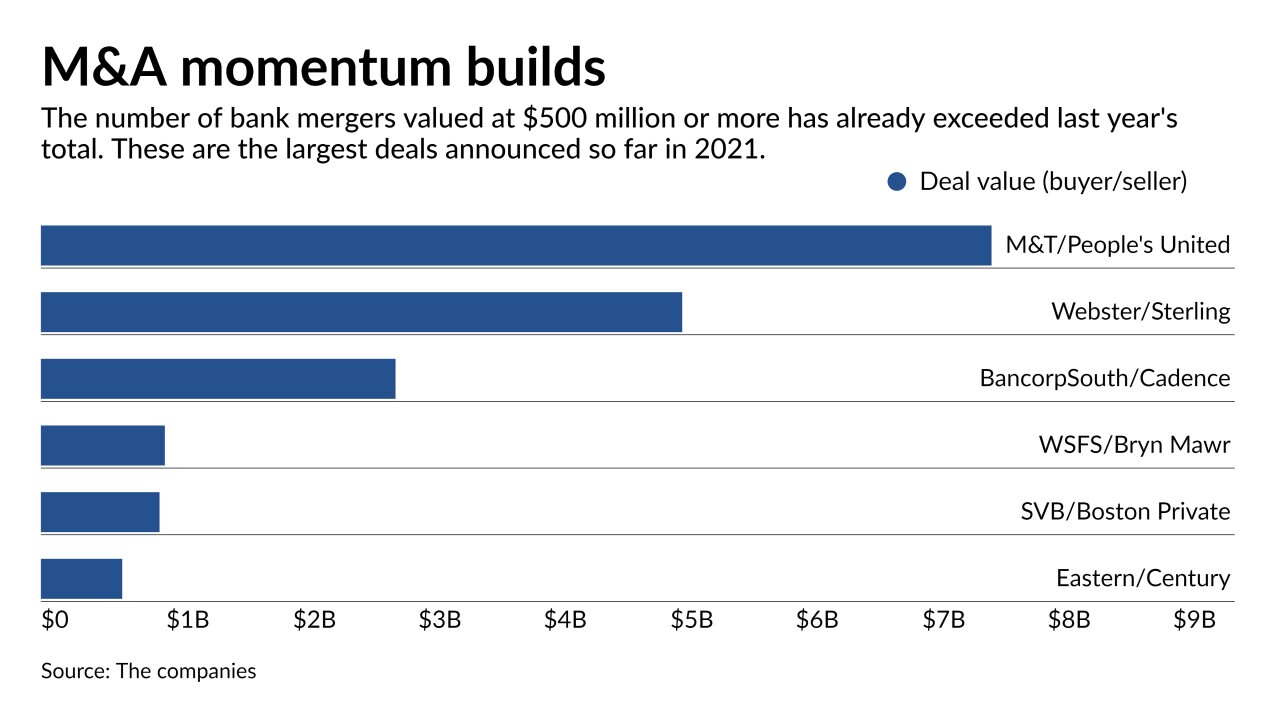

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

By Jim DobbsApril 21 -

BofA is awash in liquidity, but an uptick in credit card applications and heightened interest from commercial borrowers have executives hopeful that loan demand will soon rebound.

By Jim DobbsApril 15 -

The Iowa company, which operates a dozen individually branded banks, now has a name that matches its stock symbol.

By Jim DobbsApril 14 -

Brian Mauntel, who previously served as president of Heartland Bank in Ohio, will join Citizens Business Bank in late April.

By Jim DobbsApril 13 -

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

By Jim DobbsApril 12 -

The California company has not established a time or pricing for the IPO.

By Jim DobbsApril 9 -

With its deal for Century Bancorp, Eastern will significantly boost its deposit share in greater Boston while gaining an entrée into several new business lines, including cannabis banking.

By Jim DobbsApril 8 -

HoldCo Asset Management is trying to convince shareholders ahead of an April 27 vote that the deal's $900 million price is too low, while Boston Private's board characterized its negotiations as "carefully designed and calibrated."

By Jim DobbsApril 7 -

Bankers are already working on marketing materials and new products for commercial borrowers that might secure government contracts under President Biden's $2 trillion American Jobs Plan.

By Jim DobbsApril 5 -

The Oklahoma regional bank said Steven Bradshaw plans to retire in March 2022.

By Jim DobbsApril 5 -

The Michigan company recently paid $70 million to close the books on a matter dating to the last financial crisis.

By Jim DobbsMarch 31 -

Over the past year, bankers have been able to sit back and field calls from borrowers eager to take advantage of low rates. Now, with rates rising, many in the industry will likely adopt a more aggressive approach.

By Jim DobbsMarch 29 -

Four months into the job, Charles Shaffer has struck a deal for Legacy Bank of Florida and is eyeing more acquisitions. His predecessor, Dennis Hudson III, built Seacoast with more than a dozen buyouts across the Sunshine State.

By Jim DobbsMarch 24 -

Fees from forgiven Paycheck Protection Program loans are providing a short-term lift, but balance sheets are shrinking and it isn't clear what will drive future growth.

By Jim DobbsMarch 21 -

M&F Bancorp in North Carolina plans to use some of the $18 million it received from big banks to make overdue improvements to its commercial lending platform.

By Jim DobbsMarch 16 -

Acquisition-hungry Stearns Bank has been fielding so many calls from would-be sellers that it has brought in a merger specialist to sort through them.

By Jim DobbsMarch 12 -

The Delaware company would remove a rival, gain scale in affluent Philadelphia suburbs and accelerate its transformation from a branch-heavy lender to a digital-first bank with the $976 million acquisition.

By Jim DobbsMarch 10 -

“We were already shifting to recruiting more problem solvers than people handling transactions,” said Robert Fisher, CEO of Tioga State Bank in New York and incoming chairman of the Independent Community Bankers of America. “That pace of change has accelerated.”

By Jim DobbsMarch 8