Bankers are making plans to finance any projects that could come from infrastructure improvements.

The Biden administration's $2 trillion proposal would improve the nation’s aging roads and bridges and invest in a number of projects that include schools and affordable housing.

While any final legislation hinges on Congress, and Republicans have already voiced concerns about the plan’s substantial corporate tax increase, banks have begun drafting marketing materials and exploring new products to give commercial borrowers with financial flexibility should government contracts become available.

Infrastructure upgrades could give the economy a

“It could provide that one extra jolt we may need to climb out of this pandemic quickly,” said Laurie Stewart, president and CEO of the $861 million-asset Sound Financial in Seattle.

Stewart said she is interested in the plan’s potential to bolster the

“Anything we can do to address housing affordability would be big,” Stewart said. “That’s a huge issue. First-time buyers are essentially priced out of a lot of markets.”

MVB Financial in Fairmont, W.Va., will track the proposed legislation closely and prepare financing options for clients who expect a surge in construction if a bill passes, said Larry Mazza, the $2.3 billion-asset company’s president and CEO.

“When you throw that kind of money out there, there’s no question construction would boom,” Mazza said. “We definitely need infrastructure improvement all over the U.S. It’s critical.”

The proposal certainly faces an uphill battle of being passed in its entirety because the program would be supported by raising the corporate tax rate from 21% to 28%, industry observers said.

While Republicans are unlikely to support anything with a tax hike, Brian Gardner, chief Washington policy analyst at Stifel Financial, said Democratic control of Congress means that “some form of this bill is likely to pass.”

Democrats

“There will be a lag,” said Claude Hanley, a partner at Capital Performance Group. “I think this is a 2022 story” for banks.

Several lenders expressed concern about the tax hike, along with the sheer size of the spending proposal.

Raising taxes during a pandemic is "not a good idea," even if the hike is delayed until 2022, said Matt Selke, CEO of the $82 million-asset Pinnacle Credit Union in Atlanta. Selke expressed concerns that higher taxes could dampen corporate investment and hiring.

But investment in infrastructure is “long overdue,” Selke said, adding that he would be on the lookout for

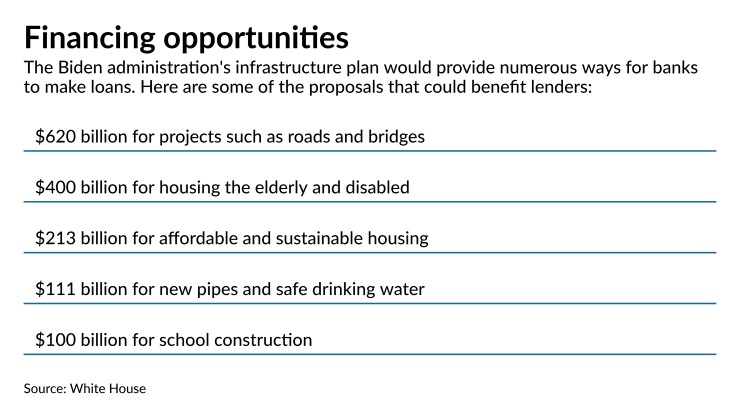

Key elements of the plan include about $620 billion for transportation infrastructure such as roads and bridges, $400 billion for housing the elderly and disabled, $213 billion for affordable and sustainable housing, $111 billion for new pipes and safe drinking water and $100 billion for school construction.

UMB Financial in Kansas City, Mo., has many clients that are involved with civil engineering and the construction of bridges and roads, said Tom Terry, the $33 billion-asset company’s chief credit officer. Those clients have been waiting for federal infrastructure spending for several years.

Terry said he is optimistic a deal will be reached, though he was unsure about the final amount.

“I think something will get done,” Terry said.

Legislation will likely pass, though it could evolve and potentially shrink modestly as negotiations take place, said Cal Evans, who leads market intelligence for the $54 billion-asset Synovus Financial in Columbus, Ga.

“It’s an investment with a return,” Evans said. “It’s not just a handout.”

Funding for medical equipment manufacturers or businesses involved in the health care supply chain could be prioritized because of the pandemic, and money that would go to repairing the power grid would be in high demand after recent winter freezes in Texas, Evans said.

On the housing front, Evans pointed to a specific need for workforce housing — projects that are notoriously difficult to pull off without government subsidies or tax credits.

“A lot of the commercial construction opportunities that were shelved in 2020 by the pandemic can be recreated by some of these initiatives,” Evans said.

South State in Winter Haven, Fla., is already working on marketing materials for its commercial bankers to use with clients, said Chris Nichols, the $38 billion-asset company’s director of capital markets.

South State is exploring “infrastructure support loans” that can be extended to commercial clients to leverage federal contracts, Nichols said. Banks can also offer credit lines to give businesses the flexibility to react quickly when they get a contract.

The proposed legislation would give lenders the ability to make educated guesses around which customers may be eligible for contracts, Nichols said.

The package “is nothing to sneeze at and can help drive both the economy and relationship growth at banks,” Nichols said. “Banks that are proactive will find that they will receive a larger share of the pie and play a bigger role in supporting the U.S. economy.”