-

The Federal Reserve said its decision to accept input for several more weeks reflects the logistical challenges presented by the coronavirus pandemic.

By Jim DobbsJanuary 29 -

Stock Yards Bancorp in Louisville says it would pay $190 million in cash and stock for Kentucky Bancshares.

By Jim DobbsJanuary 27 -

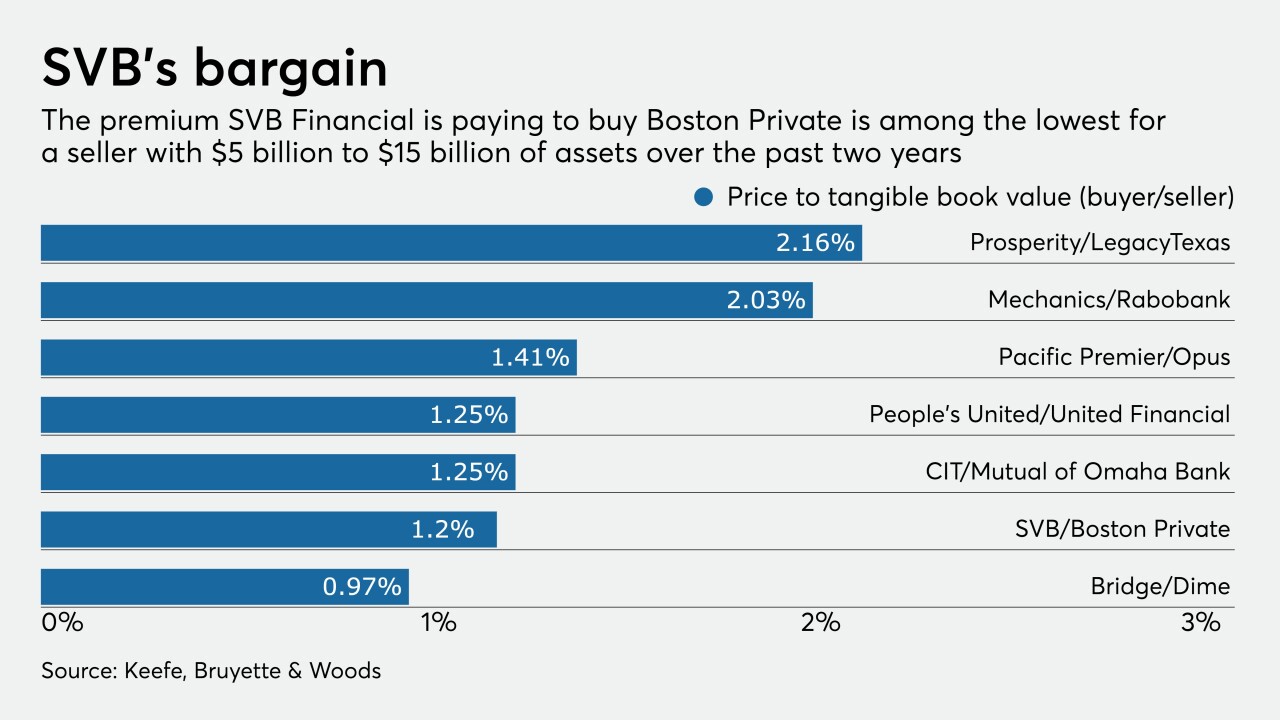

The investment fund HoldCo Asset Management said the $900 million price tag of the agreement with SVB Financial Group “substantially undervalues” Boston Private Financial Holdings.

By Jim DobbsJanuary 27 -

Mergers and acquisitions were largely on ice in 2020, but banks' mounting need to control expenses and invest heavily in technology could spur a comeback this year.

By Jim DobbsJanuary 24 -

Pandemic-induced shifts in how people work and bank will allow the Tennessee company to shed more branches and office space. It now projects it will slash expenses by an additional $30 million a year.

By Jim DobbsJanuary 22 -

Payments activity “snapped back” in the fourth quarter and should lift revenue the next few quarters, CEO Brian Moynihan said.

By Jim DobbsJanuary 19 -

Robert Kafafian says he's hearing more MOE chatter now than at any time in his decades-long career as a consultant. He cited smaller banks' need to cut costs, improve tech offerings and compete with bigger lenders.

By Jim DobbsJanuary 13 -

Bank stocks have climbed because of expectations that the change of power in Washington will hasten vaccine distribution and speed the economic recovery. The boost could give executives more flexibility to pursue acquisitions or make other strategic moves.

By Jim DobbsJanuary 11 -

HoldCo Asset Management wants more details about the banking company’s pending merger with SVB Financial. The shareholder's concerns center on payouts to the seller's management team and questions about the sale process.

By Jim DobbsJanuary 6 -

Acquiring Boston Private could put the parent company of Silicon Valley Bank years ahead of schedule in catering to the investment needs of high-tech and biomedical clients, whose industries have thrived during the pandemic.

By Jim DobbsJanuary 5 -

Chris Maher recently unloaded loans hurt by the coronavirus shock, convinced he was freeing the New Jersey company of baggage that could impede a large M&A deal. This assertive move makes him one of our community bankers to watch in 2021.

By Jim DobbsDecember 29 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

By Jim DobbsDecember 28 -

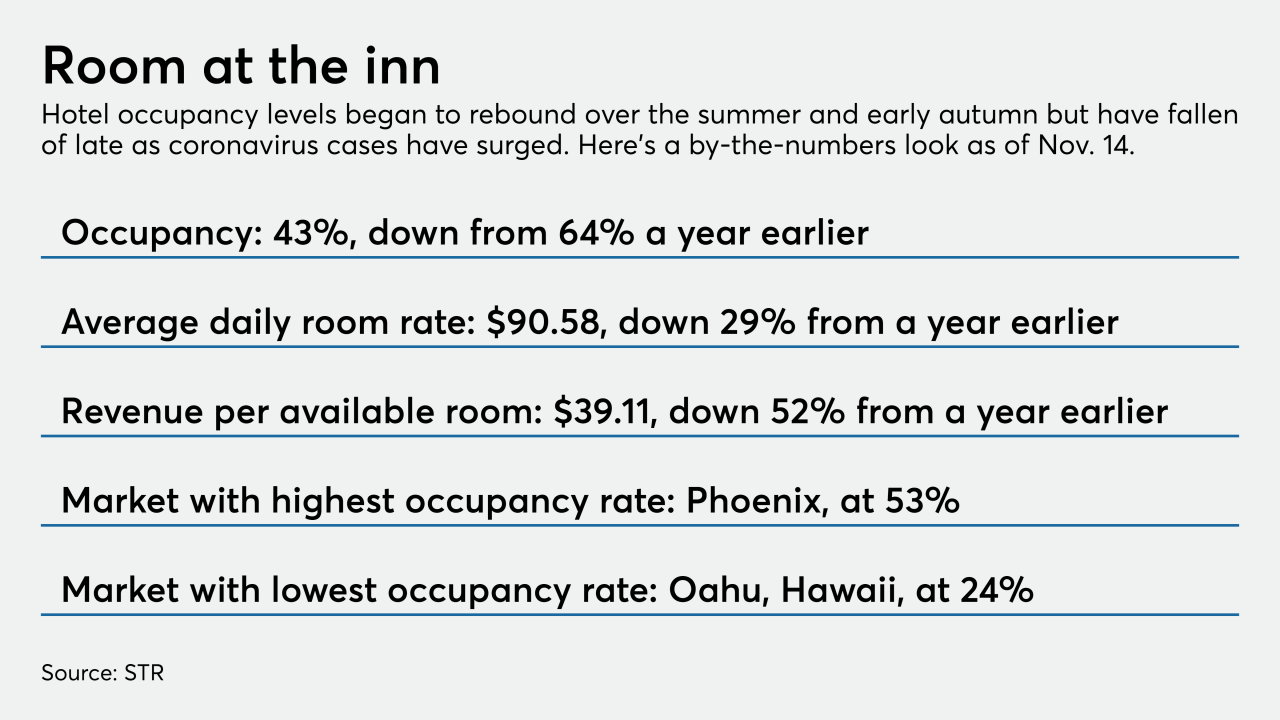

While banks are reporting steady declines in deferrals, hard-hit borrowers such as airlines, commercial real estate developers and hotel operators will almost certainly struggle to regain their footing.

By Jim DobbsDecember 17 -

The Pittsburgh company also sold a portfolio of indirect auto loans and repaid a large amount of Federal Home Loan Bank borrowings.

By Jim DobbsDecember 10 -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

By Jim DobbsDecember 10 -

The company hired two Atlantic Union bankers to run its bank and begin recruiting customers in and around Washington.

By Jim DobbsDecember 7 -

The company agreed to acquire a Colorado plan provider that operates as RPS Plan Administration and 24HourFlex.

By Jim DobbsDecember 2 -

First Horizon, TCF and Webster are among the banks eyeing efficiency initiatives that could include more branch closings, layoffs and reduction of office space. Expect others to follow suit as low rates and tepid loan demand tied to the pandemic pressure revenue.

By Jim DobbsDecember 1 -

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

By Jim DobbsNovember 23 -

The Virginia company, which shuttered 14 locations in September, will close another five branches early next year.

By Jim DobbsNovember 17