-

Chris Maher recently unloaded loans hurt by the coronavirus shock, convinced he was freeing the New Jersey company of baggage that could impede a large M&A deal. This assertive move makes him one of our community bankers to watch in 2021.

By Jim DobbsDecember 29 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

By Jim DobbsDecember 28 -

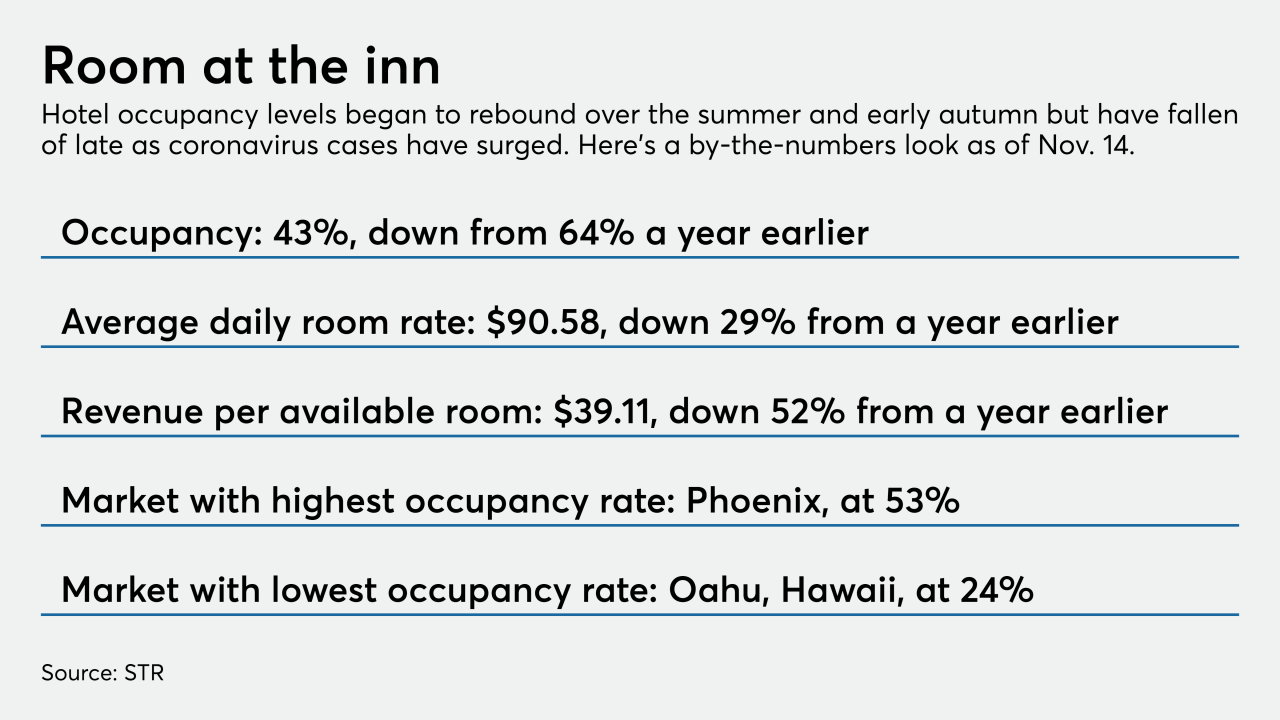

While banks are reporting steady declines in deferrals, hard-hit borrowers such as airlines, commercial real estate developers and hotel operators will almost certainly struggle to regain their footing.

By Jim DobbsDecember 17 -

The Pittsburgh company also sold a portfolio of indirect auto loans and repaid a large amount of Federal Home Loan Bank borrowings.

By Jim DobbsDecember 10 -

The emergence of vaccines has boosted travel forecasts — and crude prices. The expected bump at the pump could help oil and gas companies get back on track with loan payments.

By Jim DobbsDecember 10 -

The company hired two Atlantic Union bankers to run its bank and begin recruiting customers in and around Washington.

By Jim DobbsDecember 7 -

The company agreed to acquire a Colorado plan provider that operates as RPS Plan Administration and 24HourFlex.

By Jim DobbsDecember 2 -

First Horizon, TCF and Webster are among the banks eyeing efficiency initiatives that could include more branch closings, layoffs and reduction of office space. Expect others to follow suit as low rates and tepid loan demand tied to the pandemic pressure revenue.

By Jim DobbsDecember 1 -

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

By Jim DobbsNovember 23 -

The Virginia company, which shuttered 14 locations in September, will close another five branches early next year.

By Jim DobbsNovember 17 -

The Pittsburgh company is using its BlackRock windfall to execute a familiar script: buy an underperforming bank, cut costs and strengthen ties with commercial clients.

By Jim DobbsNovember 16 -

Lending opportunities have become scarce, especially with commercial borrowers, and banks are resisting the temptation to relax standards to boost volume.

By Jim DobbsNovember 12 -

Many small banks are reactivating repurchase programs, signaling that capital levels remain strong and credit issues are under control.

By Jim DobbsNovember 10 -

The region now leads the nation in virus cases, and with winter lurking the fear is that the outbreak will only get worse.

By Jim DobbsNovember 5 -

A prosperous decade leading up to the pandemic had left lenders in good shape, but they're worried the economic shock to the state's most vital industry could linger into 2022.

By Jim DobbsNovember 2 -

The New Jersey company reported a quarterly loss after becoming one of the first lenders to liquidate loans harmed by the coronavirus pandemic.

By Jim DobbsOctober 30 -

The Mississippi company said Duane Dewey, the president of its bank, will succeed Gerard Host as CEO in January.

By Jim DobbsOctober 28 -

Rob Holmes, who will join the Dallas company in January, has been the global head of corporate client banking and specialized industries at JPMorgan Chase.

By Jim DobbsOctober 27 -

The Paycheck Protection Program and encouraging digital innovation are top priorities for James Edwards, CEO of United Bank in Georgia. He also expects the American Bankers Association to promote diversity and regulatory reform in the next year.

By Jim DobbsOctober 26 -

The Memphis company is looking to take out more costs than initially planned due to the economic uncertainty brought on by the coronavirus pandemic.

By Jim DobbsOctober 23