-

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

Bankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

By Jim DobbsMarch 25 -

The surge in online and mobile use is a high-profile test for the industry — and could foreshadow a permanent consumer shift.

By Jim DobbsMarch 19 -

The Federal Reserve's support for the commercial paper market made clear that it was willing to go beyond cutting interest rates, but the central bank may feel pressure to do even more as the crisis worsens.

By Hannah LangMarch 17 -

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

By Jim DobbsMarch 16 -

Coronavirus concerns, along with the Fed's emergency rate cut and an erratic stock market, have forced most bankers to take pause and reassess potential deals.

By Ken McCarthyMarch 13 -

Noah Wilcox, a fourth-generation banker, says community banks are well positioned to provide stability and capital in underserved markets during uncertain times.

By Jim DobbsMarch 10 -

The outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

By Jim DobbsMarch 9 -

The company said it expects to enter into the order with the FDIC and its state regulator later this month.

By Jim DobbsMarch 5 -

The South Florida company said Alberto Peraza, who played a key role in its 2018 initial public offering, is leaving for personal reasons.

By Jim DobbsMarch 5 -

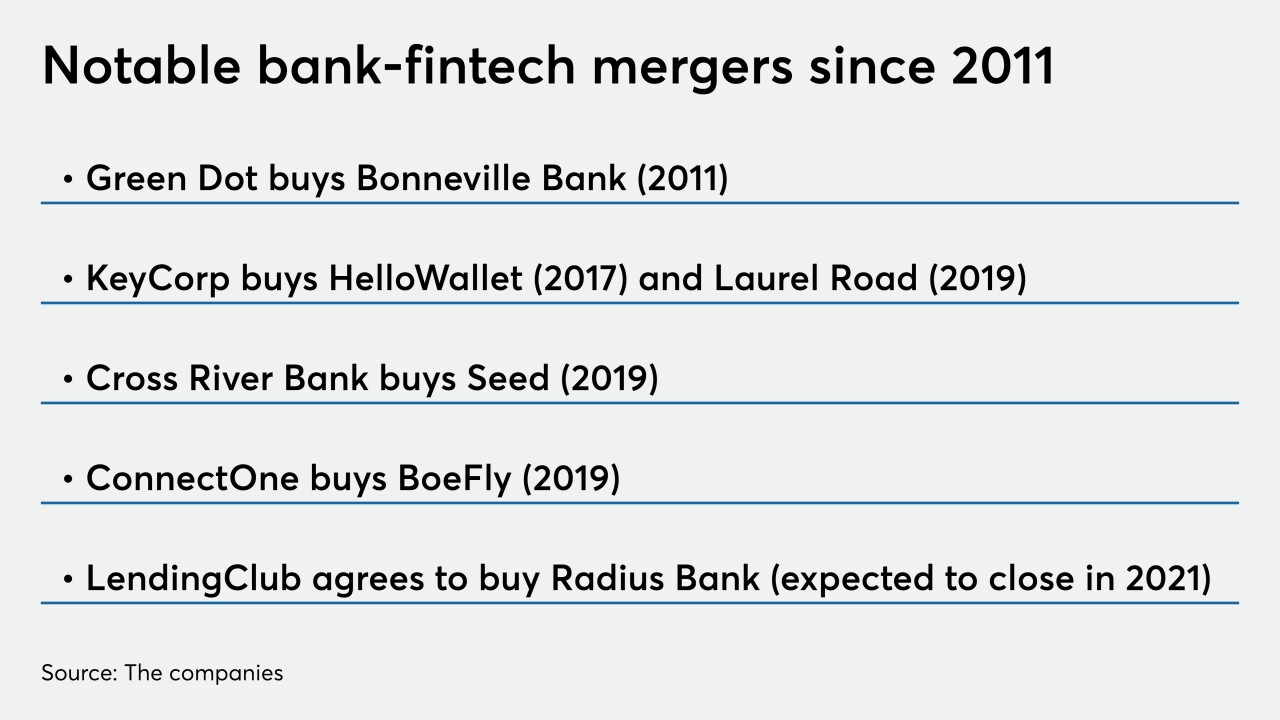

Compliance, risk management and staffing will likely come under added scrutiny as regulators lay out a framework for future fintech-bank mergers.

By Jim DobbsMarch 4 -

Recovery from a massive storm that touched down near Nashville is in its early stages, but bankers are looking at fee waivers and increased access to cash for those who were affected.

By Jim DobbsMarch 4 -

The companies spent much of the past decade completing smaller deals that created complementary footprints in the Southeast.

By Jim DobbsFebruary 26 -

Community banks are entering the business as intermediaries to counter the pinch of low loan yields and intense competition on spread income.

By Jim DobbsFebruary 23 -

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

By Jim DobbsFebruary 19 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

By Jim DobbsFebruary 11 -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

By Jim DobbsFebruary 5 -

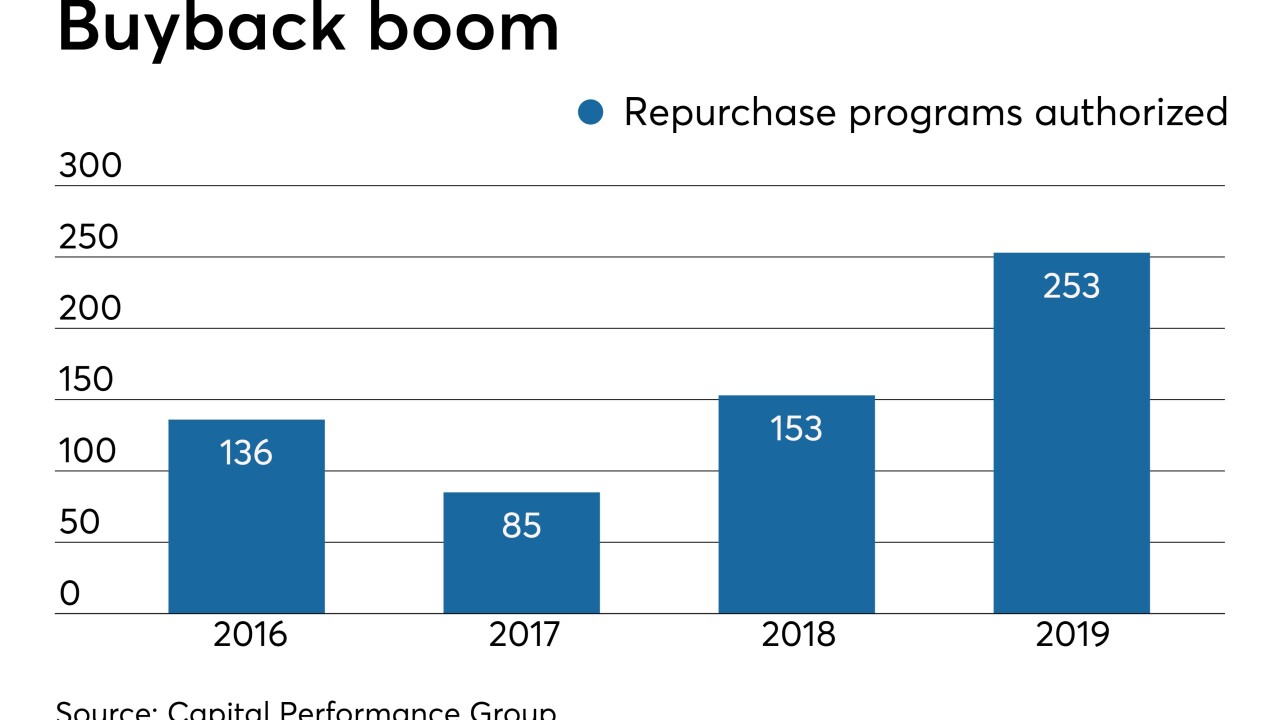

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

By Jim DobbsFebruary 5 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

By Jim DobbsFebruary 3 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

By Jim DobbsJanuary 31