John Adams is executive editor of payments for American Banker. John interviews top executives in the payments, cryptocurrency and fintech industries, hosts podcasts, moderates conference panels and curates the new Payments Intelligence portal.

His work includes profiles of

John has been with American Banker and related products for 30 years, covering bank technology, advertising, mortgages and capital markets.

-

Libra is distancing itself from Facebook not only through a name change, but also by attempting to draw attention toward its digital payment rail instead of the creation of alternative money.

By John AdamsDecember 1 -

Digital workforce collaboration apps like Slack are hot acquisition targets, particularly for a company like Salesforce, which needs to compete with enterprise technology companies while making it easy for its clients to execute an "invisible payment" that's embedded in cross-selling and marketing.

By John AdamsNovember 30 -

High profile companies like Facebook, Square and PayPal have brought attention to using cryptocurrency for payments — but speed is more important than buzz in getting stores to view crypto as tender, according to a group of developers who are building connections to merchants.

By John AdamsNovember 30 -

Companies like Affirm and Klarna have been a beacon for investors, leading to at least one multibillion-dollar planned IPO in support of a point-of-purchase lending model that could set the stage for use cases well beyond credit.

By John AdamsNovember 19 -

Within the payments industry, Wirecard as a brand has become almost like Enron — but an exec at Railsbank says the German processor's fall from grace masks talent and innovation that can thrive elsewhere and help forge new paths to financial services.

By John AdamsNovember 19 -

Italian technology firm Nexi has dedicated about $15 billion over the past two months to shore up its position in the European payment processing market, a local burst of consolidation that exists inside a larger wave of similar mergers globally.

By John AdamsNovember 17 -

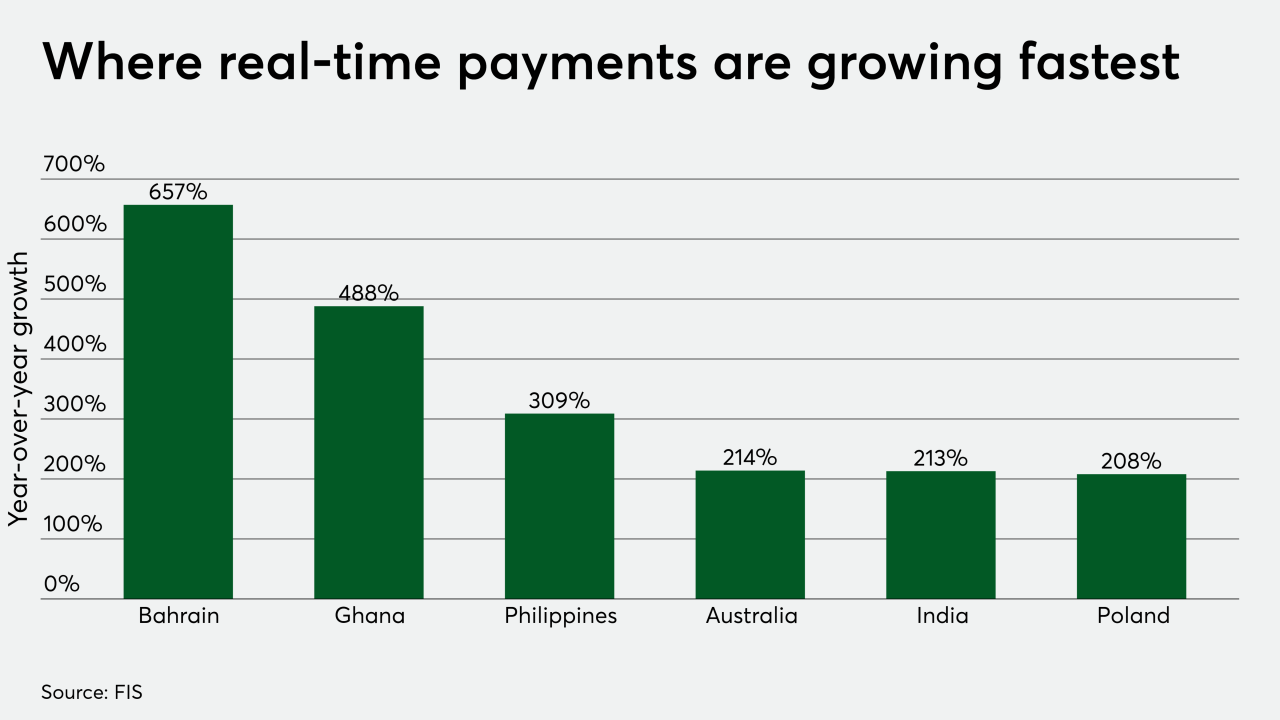

As futuristic as real-time digital payments can be, the concept is almost like a blast from the past for FIS’ Raja Gopalakrishnan.

By John AdamsNovember 16 -

President-elect Joe Biden’s victory has cleared uncertainty over White House policies that impact fintechs and payment firms, revealing clues as to how the regulatory environment will be different in 2021.

By John AdamsNovember 13 -

Real-time payments carry a trove of valuable data for supply chains, and a way for card networks to grow beyond card-dependent revenue. The collaboration between Payments Canada and Mastercard’s Vocalink will go a long way toward both ends.

By John AdamsNovember 13 -

Even given the huge jump in digital transactions from e-commerce, card brands are holding out for COVID-19 vaccines as a path out of the payment declines that have accompanied 2020’s health and economic crises.

By John AdamsNovember 11 -

Ahead of a holiday shopping season that should focus heavily on e-commerce, Amazon is updating its rewards program to keep delivery drivers interested in handling its packages.

By John AdamsNovember 10 -

President-elect Joe Biden's victory over incumbent Donald Trump will end four years of Trump-led isolationist policies, but the balance in Congress is still uncertain and could stall the President-elect's agenda.

By John AdamsNovember 7 -

One area of certainty in the 2020 election is the momentum for legalizing cannabis, as a string of ballot box victories makes it harder for banks to avoid working with dispensaries and other legal marijuana businesses.

By John AdamsNovember 4 -

As the presidential voting count waged deep into the night on Tuesday, the fate of fintech, financial services and payments regulation hung in the balance.

By John AdamsNovember 4 -

Control of Congress was still in play late Tuesday, as the Democrats retained control of the House of Representatives while neither party gained the necessary seats to control the Senate.

By John AdamsNovember 4 -

As the pandemic and economic downturn take their toll on consumer spending, the card companies are relying on scale, partnerships and subsidiaries to turn consulting, security and fast technology deployment into new and sustainable revenue streams.

By John AdamsNovember 2 -

The concept marries digital ID to the trend toward making the car’s internet connectivity an e-commerce lane.

By John AdamsOctober 30 -

Visa has seen tepid returns of payments volume as economies reopen, but the renewed virus cases and government responses have created an extra layer of uncertainty — particularly for cross-border transactions and travel.

By John AdamsOctober 28 -

Even as consumers shift more spending away from cash and the market for personal travel picks up, the coronavirus pandemic is still exerting a heavy toll on Mastercard's consumer and corporate spending.

By John AdamsOctober 28 -

Amy Coney Barrett will assume a lifetime appointment on the Supreme Court, just as it prepares to hear a case on the Affordable Care Act that could toss years of advancement in health care payments into disarray.

By John AdamsOctober 27