John Adams is executive editor of payments for American Banker.

-

N26 and Monzo halted or delayed expansion plans here largely because competition for customers was already intense and obtaining a banking license proved difficult.

By John AdamsNovember 19 -

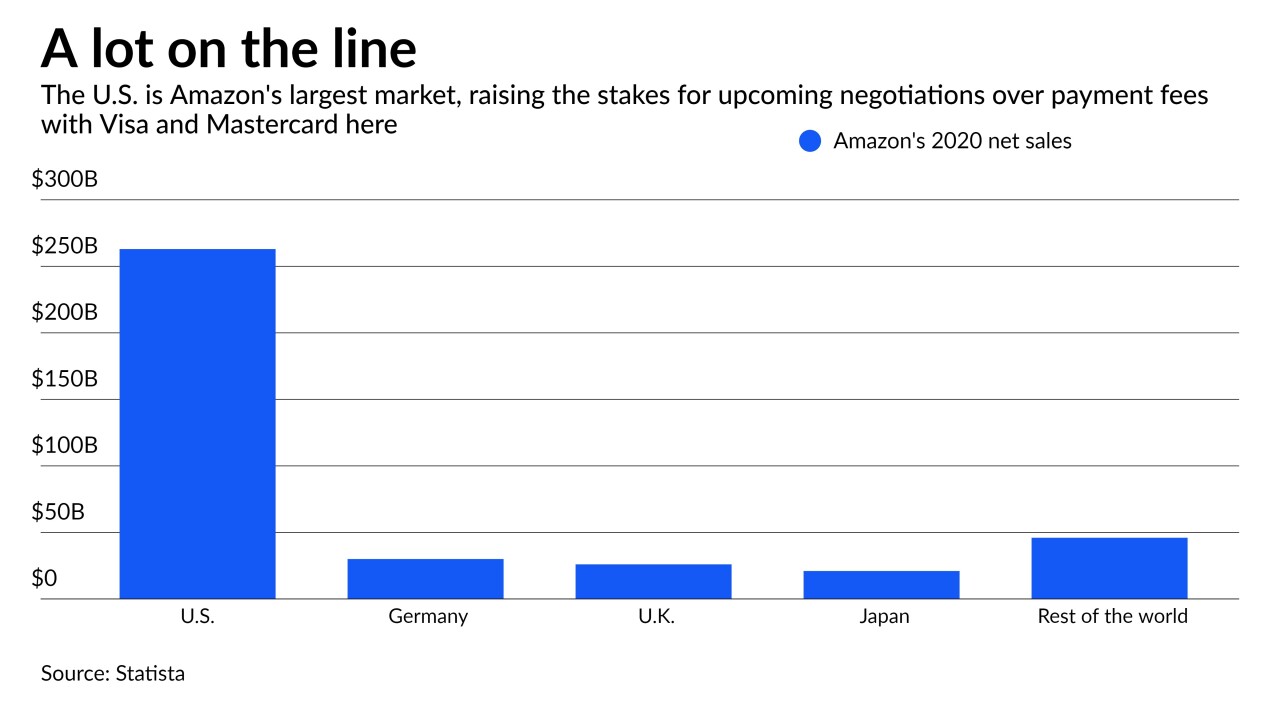

The online retailer’s plan to block certain credit card payments in Britain is seen as an opening move in likely negotiations with Mastercard and Visa ahead of the card networks' planned fee hikes in 2022.

By John AdamsNovember 17 -

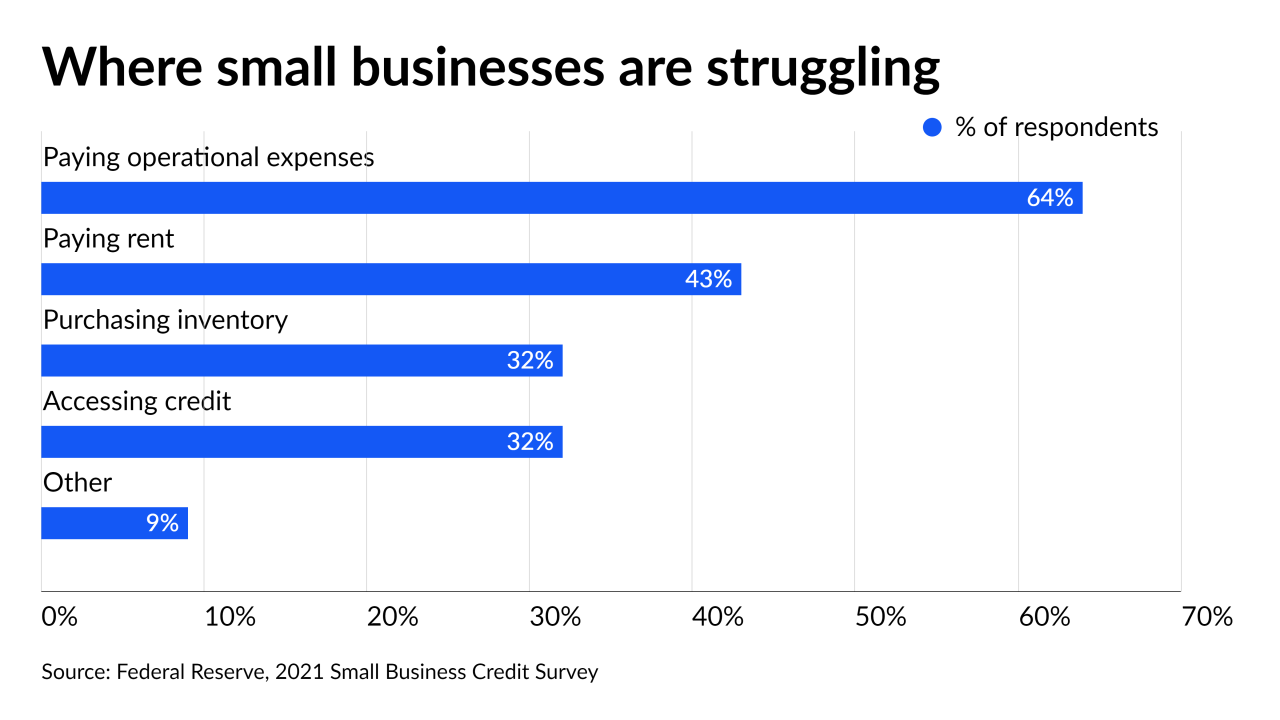

Backups at ports have created inventory and cash-flow challenges for many businesses. Bank of the West, Swift, SAP and others are offering customers faster payments services, short-term loans and virtual cards to ease liquidity pressures.

By John AdamsNovember 16 -

The data aggregator is recruiting partners such as Railsbank, Silicon Valley Bank and Marqeta for a project designed to make certain digital transactions easier to complete.

By John AdamsNovember 10 -

The bank is partnering with Anthemis to match investors with female entrepreneurs, who according to Findexable research attract just 1.5% of investment in the sector.

By John AdamsNovember 8 -

The institution joins a small but growing list of large banks that allow businesses like utilities and mobile carriers to instantly accept consumer transactions.

By John AdamsNovember 8 -

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

By John AdamsNovember 5 -

Jack Dorsey's payments company wants to reach a younger demographic while also giving adults more reasons to use its peer-to-peer service.

By John AdamsNovember 4 -

As installment lending becomes more popular, regulators in the U.S., Europe and Australia are considering new restrictions or taking action against lenders.

By John AdamsNovember 4 -

Digital upstarts like Square, Stripe and PayPal are invading community banks' turf by appealing to local merchants with a mix of electronic payments and lending. Small banks are fighting back by leaning into digital services while maintaining their personal touch.

By John AdamsNovember 3