John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

The Cleveland company will launch the service in March to broaden relationships its Laurel Road student loan refinancing unit has built with health care professionals.

By John ReostiJanuary 21 -

Members of the Gunther family who own nearly a third of the company's stock are urging the board to consider strategic alternatives.

By John ReostiJanuary 19 -

In a party-line vote, the agency issued a proposal that would redefine a "complex" credit union.

By John ReostiJanuary 14 -

The pace of forgiveness for Paycheck Protection Program loans is expected to accelerate when the Small Business Administration issues guidance on additional steps meant to streamline the process.

By John ReostiJanuary 13 -

Several community banks said they didn't have enough time to review the Paycheck Protection Program's application forms, forcing them to sit out Monday's reopening. The SBA is not saying when more lenders will be allowed to access its portal.

By John ReostiJanuary 12 -

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

By Hannah LangJanuary 8 -

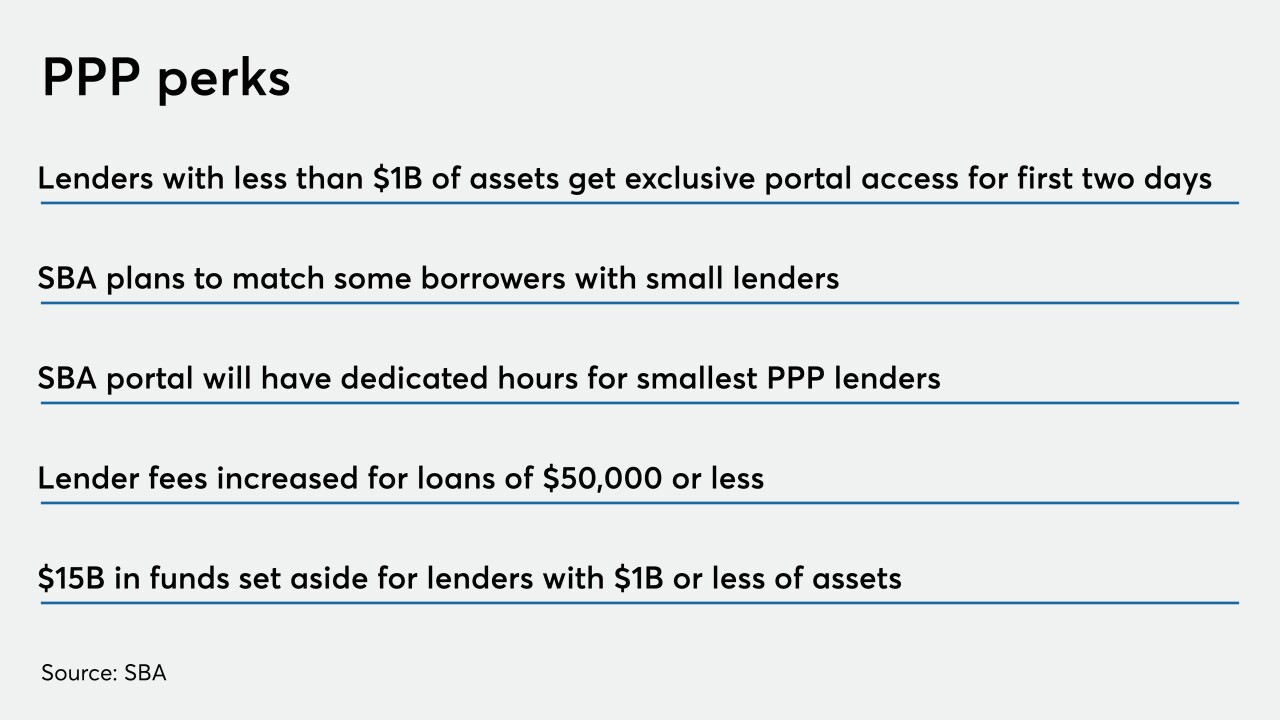

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

By John ReostiJanuary 7 -

Brian Argrett, whose City First Bank is being sold to Los Angeles-based Broadway Financial, would take the helm of the combined company at a time of increased national interest in reinvigorating minority-owned financial institutions.

By John ReostiJanuary 4 -

Speculation is swirling that the Boston company will go on a buying spree after raising $1.8 billion, though some investors are advising caution. This tension makes CEO Bob Rivers one of our community bankers to watch in 2021.

By John ReostiDecember 31 -

The new legislation includes a provision sparing lenders from having to pay such fees on Paycheck Protection Program loans, except in cases where they agree in advance with borrower representatives to do so.

By John ReostiDecember 29 -

The company is also looking to hire more senior lenders as it expands in markets around Los Angeles and San Diego.

By John ReostiDecember 24 -

The legislation allows the Small Business Administration to waive fees and raise the guarantee for 7(a) and 504 loans, which could encourage more small businesses to apply for loans as the economy recovers.

By John ReostiDecember 22 -

At least two items on the industry's Paycheck Protection Program wish list were delivered: provisions allowing many existing borrowers to obtain new funding and streamlined forgiveness for loans of $150,000 or less.

December 21 -

Starting in 2022, hundreds of newly eligible institutions will be able to raise funds from investors. Bankers argued that the change will further blur the line between the two industries.

By John ReostiDecember 17 -

First Technology FCU, led by a former banker, stands ready to raise fresh capital by issuing subordinated debt. But first it must wait for a rule change from the National Credit Union Administration that's drawing fierce opposition from the banking industry.

By John ReostiDecember 16 -

The Columbus, Ohio, company says it has delivered on M&A promises before, and many observers say its deal for rival TCF Financial is an opportunistic move in its bid to build a Midwestern powerhouse. But others questioned whether Huntington's cost-cutting and profit expectations are too optimistic.

By John ReostiDecember 14 -

The $62.7 million merger of Linkbancorp and Gratz Bank would create a company with over $800 million of assets and nine branches stretching from Harrisburg to the Philadelphia suburbs.

By John ReostiDecember 14 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

By John ReostiDecember 13 -

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

By John ReostiDecember 9 -

The end date for the Paycheck Protection Program Loan Facility was moved from Dec. 31 to March 31, giving lenders more time to line up the liquidity needed to buy and sell portfolios.

By John ReostiDecember 4