John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

Broadway Financial prefers a small balance sheet and loans to real estate investors that offer affordable housing. Capital Corps and its founder, Steven Sugarman, want the bank to expand by making more loans directly to low- and moderate-income borrowers.

By John ReostiFebruary 13 -

Ed Skyler, the bank's global head of public affairs, says a newly established $150 million fund will make equity investments in firms seen as having a positive impact on society.

By John ReostiFebruary 10 -

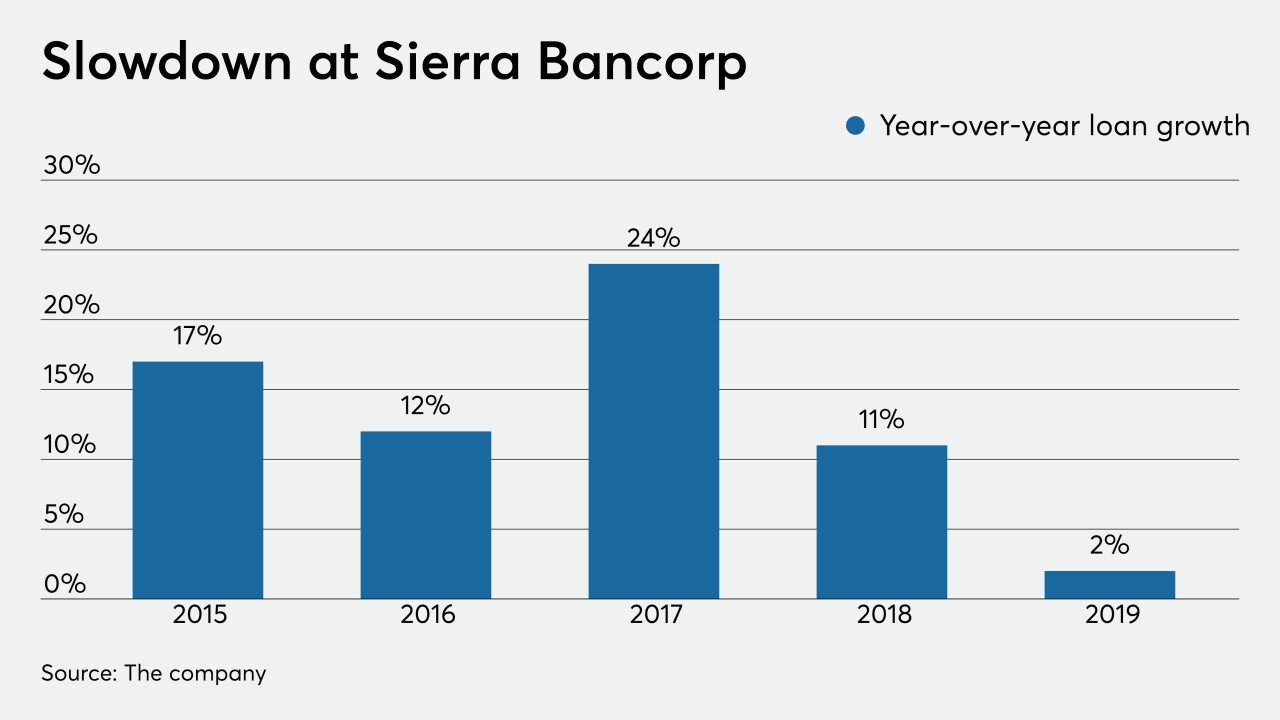

Sierra Bancorp in Porterville has formed dedicated lending teams in Sacramento and Greater Los Angeles in its bid to accelerate loan growth following a sluggish 2019.

By John ReostiFebruary 7 -

Reduced dine-in traffic is eating away at bottom lines, forcing eateries to rethink how they borrow money.

By John ReostiFebruary 4 -

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

By John ReostiJanuary 29 -

Two major banking organizations objected to a proposal by the agency that would expand the pool of investors in subordinated debt issued by credit unions. They fear it could provide credit unions more financing to buy banks.

By John ReostiJanuary 23 -

There are no provisions in a new NCUA plan that outright bar credit unions from leveraging subordinated debt to acquire a bank. The long-awaited rule on bank purchases, also released Thursday, merely clarifies existing regulations rather than adding new components.

By John ReostiJanuary 23 -

The National Credit Union Administration plans to unveil new capital proposals on Thursday. It's a given that bankers won't like them, but credit unions could also find themselves disappointed.

By John ReostiJanuary 22 -

The National Credit Union Administration plans to unveil new capital proposals on Thursday. It's a given that bankers won't like them, but credit unions could also find themselves disappointed.

By John ReostiJanuary 22 -

For small regionals like Atlantic Union and F.N.B., the biggest opportunity to snag customers will come when the rebranding of BB&T and SunTrust branches begins next year.

By John ReostiJanuary 21 -

The Arkansas bank is bracing for a rough 2020 amid record prepayments and a big substandard loan in its commercial real estate book, but CEO George Gleason insists shareholders will see "a nice payoff" in the long run.

By John ReostiJanuary 17 -

Lenders grew more optimistic that Congress will undo or narrow the loan-loss accounting standard after members of a House subcommittee assailed Russell Golden for approving the rule without studying its impact on credit availability.

By John ReostiJanuary 16 -

The San Francisco bank is also bulking up in Florida and Wyoming, no-tax states where many of its affluent clients have retired or have second homes.

By John ReostiJanuary 14 -

A North Carolina group is trying to take regulators' cue to work together. A successful effort could encourage others to follow its lead.

By John ReostiJanuary 12 -

The agency's new leader began her career as a part-time night-shift package handler for UPS in Chicago.

By John ReostiJanuary 7 -

Here's one way community banks are trying to win over commercial clients and wealthy households: by sharing internal research with them and positioning themselves as experts on everything from business sentiment to demographics.

By John ReostiJanuary 6 -

Franklin Financial CEO J. Myers Jones is trying to reduce his company's exposure to shared national credits and health care loans, which have enjoyed solid yields but come with a downside.

By John ReostiJanuary 1 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

By John ReostiDecember 30 -

Spirit of Texas Bancshares is acquiring four branches and a loan production office from Simmons First National as part of an aggressive expansion in its home state.

By John ReostiDecember 26 -

Industrial Bank CEO Doyle Mitchell has spent countless hours in New York since his bank bought the failed City National in November, meeting with existing customers and plotting his growth plans.

By John ReostiDecember 20