-

Old National relocates Louisville office following mass shooting in April, American Express brings back $1 million in grants for historic eateries, Adyen speeds payouts for gig workers and more in this week's banking news roundup.

June 2 -

The U.S. arm of Mitsubishi UFJ Financial Group has hired nine bankers away from Wells Fargo in an effort to expand its restaurant finance group. The lender focused on the fast-casual and quick-serve segments during the pandemic and anticipates growth in that sector.

May 17 -

Many eateries that relied on outdoor dining to survive the pandemic could see revenues plummet as the weather turns cold.

October 30 -

Banks' restaurant and hotel clients in many oceanside communities are seeing an uptick in business as travelers opt for short hops over long hauls during the coronavirus crisis. But activity could slow as colder weather approaches.

September 25 -

A survey of companies that received funding from the Paycheck Protection Program also showed that respondents on average have cut their payroll costs by more than half.

August 6 -

The owner of The Shuckery in Petaluma, Calif., says she was unable to get a Paycheck Protection Program loan until she responded to an email from the delivery service and BlueVine.

August 5 -

U.S. retail sales jumped in May by the most on record and double forecasts, regaining more ground than expected after unprecedented drops the prior two months as states allowed more merchants to reopen.

June 16 -

The lenders are bracing for spikes in delinquencies or defaults on loans to a sector heavily punished by social distancing measures.

April 29 -

No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

March 12 -

The deal for Trinity Capital in Los Angeles would further strengthen the company's capital markets capabilities.

February 13 -

Reduced dine-in traffic is eating away at bottom lines, forcing eateries to rethink how they borrow money.

February 4 -

As more consumers order in using such services as Uber Eats and Grubhub, restaurants are selling fewer desserts, drinks and other high-margin items, said CEO Rajinder Singh.

January 24 -

If the no-premium agreement announced by First Horizon and Iberiabank this week is a sign that sellers’ asking prices will come down, then Regions might reconsider its anti-M&A stance, a company executive said.

November 7 -

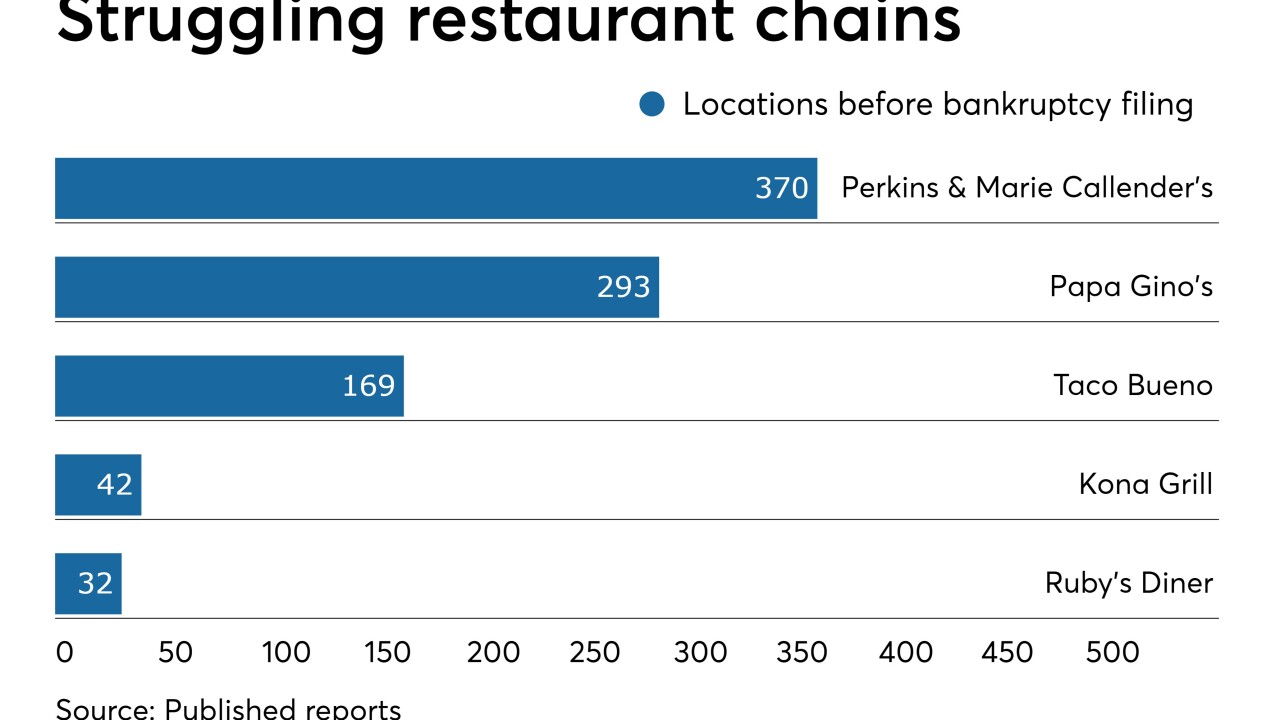

As a growing number of chains go bankrupt, loan charge-offs are rising.

August 21 -

While apps are still a popular way for customers to order and pay, other options are emerging because they're a natural fit for restaurant patrons, many of whom are already heavy users of text, social media and voice technology.

November 27 -

The company has tested Harbortouch Bar & Restaurant software at 50 locations and has informed independent sales organizations the service is ready to deploy for restaurant clients.

August 7 -

As new customers visit a restaurant for the first time, Punchh Acquire delivers information about the customer and assigns them with digital identities and profiles.

March 23 -

Consumers aren't leaving without paying, but are paying through an app that avoids the point of sale.

February 27 -

Many restaurateurs expect more from their merchant services than a paper bill at the end of the month listing the basic credit card transactions, writes Andrew Szala, a content specialist at Upserve.

December 29 Upserve

Upserve