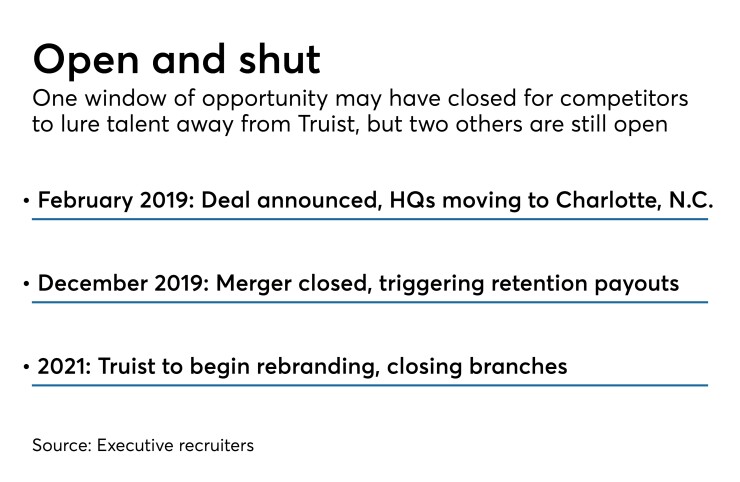

Timing is critical when it comes to snagging clients from merged banks.

Atlantic Union Bankshares in Richmond, Va., and F.N.B. Corp. in Pittsburgh are eager to recruit customers from Truist Financial, which was

For now, they are sharpening their pitches to use when the $464 billion-asset Truist starts rebranding and closing branches in 2021.

"We're still in a period of uncertainty," Vince Delie Jr., chairman, president and CEO of F.N.B., said during the $35 billion-asset company's earnings call. F.N.B.

"I don't think we're at a point yet where the customers are feeling pain because they haven't really finalized assignments," Delie added. "They haven't integrated systems."

The BB&T-SunTrust merger "will be a multiyear disruption with one of our largest competitors,” John Asbury, Atlantic Union's president and CEO, said during the $18 billion-asset company's quarterly call.

Maria Tedesco, president of Atlantic Union's bank, added that the recruitment process would be "a marathon event" spanning several years.

Atlantic Union even has a code name for its effort: Project Sundown.

“I hope you all see the humor” in the name, Asbury said.

Some bankers have already left BB&T and SunTrust.

Atlantic Union had some early success, bringing on 39 former BB&T and SunTrust employees last year. Expectations are more subdued for 2020, with Shawn O'Brien, who leads Atlantic Union's consumer banking group, estimating that fewer than 10 Truist employees are expected to make the switch.

The $1.1 billion-asset Bay Bank of Virginia in Richmond announced earlier this month that it had

While BB&T is an experienced acquirer, having bought dozens of banks in the past 20 years, Jason O’Donnell, chief investment officer at the Community Financial Institutions Fund, noted that SunTrust is “far larger than anything they’ve done before" so some lender and client displacement is inevitable. He said a number of the fund's contacts in the Southeast are confident that they can benefit from the merger.

BB&T and SunTrust offered $1,500 bonuses to two-thirds of their 60,000 employees if they stayed until the deal closed. The offer did not include high-level executives and employees with commission-based compensation.

It will be another 12 to 18 months before Truist, of Charlotte, N.C., starts to integrate its legacy banks, with states such as North Carolina and Virginia expected to be among the last to see changes.

When the process begins, executives in charge will tap the people with whom he or she is familiar to fill key slots, said Rod Taylor, CEO of the executive recruiting firm Taylor & Co. That could bring another wave of defections, along with an opportunity to bring on more clients.

“I don’t think it can ever be a purely objective decision, based on talent, skills and expertise alone,” Taylor said. “It always involves the cultural preference of the executive making the decisions.”

A Truist spokesman declined to comment.

Delie and Asbury are ready to make the most of that opportunity.

"We're getting opportunities to have meetings" with customers, Delie said.

"In the past some of the prime borrowers would not open themselves up" to change, he added. "But I think the uncertainty has created opportunities to at least interface, which is positive. ... If the opportunity came up to hire a higher-performing banker, we would certainly move on that.”

"We're at ground zero for this event and we have a sense of what will happen," Tedesco said. "Every business [manager] has their plan in which to be offensive and be opportunistic."