John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

Turnaround times on loans in the 504 program are stretching out for weeks as the Small Business Administration grapples with a spike in applications and responsibilities tied to the Paycheck Protection Program.

By John ReostiMarch 1 -

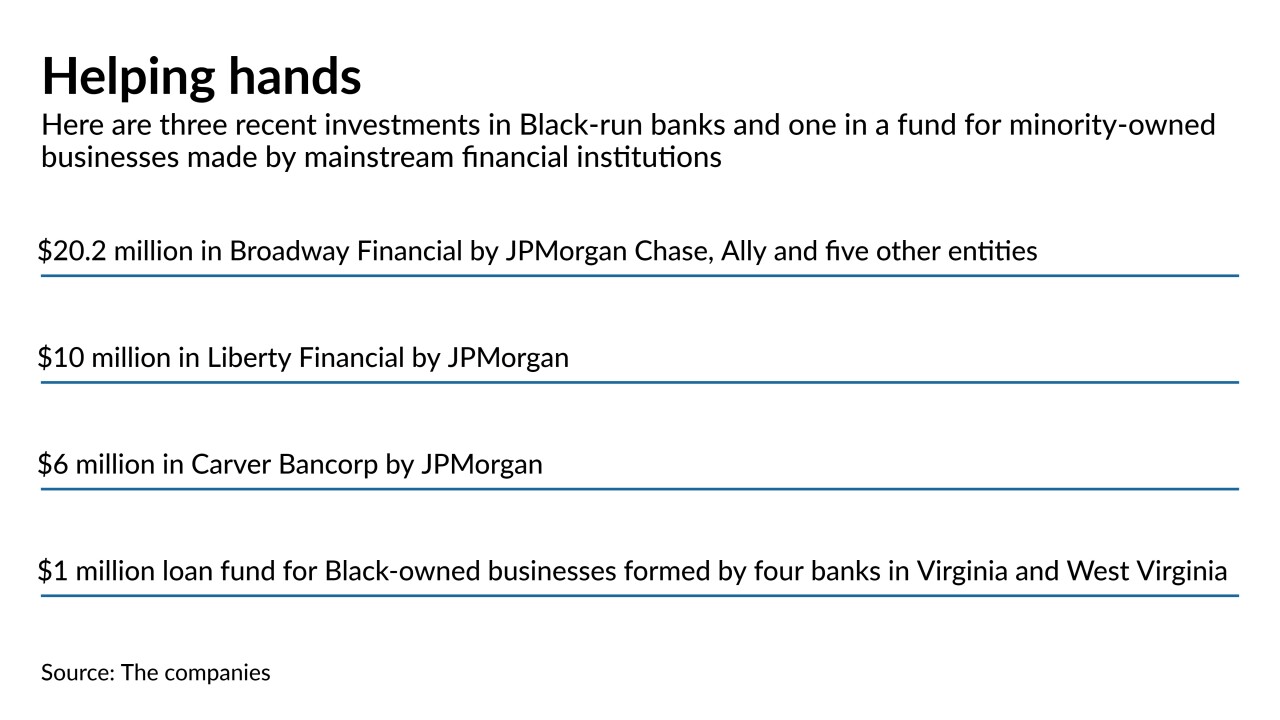

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

By John ReostiFebruary 24 -

It would ignore technical glitches plaguing the entire Paycheck Protection Program and could end up delaying loans to larger borrowers who also need relief, bank executives and their trade groups say.

By John ReostiFebruary 22 -

The Small Business Administration wants to vet Paycheck Protection Program loans of $2 million or more, but lenders have grown tired of waiting for months with no updates.

By John ReostiFebruary 19 -

Todd Harper, chairman of the National Credit Union Administration, said new assessments are likely needed because of an influx of deposits, but industry groups and other board members say the agency should wait to see if the reserve ratio recovers on its own.

By John ReostiFebruary 18 -

A survey commissioned by Bank of America found that Black entrepreneurs are more hopeful about revenue opportunities than other small-business owners, though many are still struggling to bring in the capital needed to expand.

By John ReostiFebruary 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

By John ReostiFebruary 17 -

Banks have diverted resources from traditional Small Business Administration lending to make Paycheck Protection Program loans, but many are taking steps to rev up 7(a) and 504 lending once the PPP winds down.

By John ReostiFebruary 12 -

The majority of Paycheck Protection Program loans are being approved for borrowers in industries that have yet to regain their footing.

By John ReostiFebruary 10 -

Bankers have claimed that the Small Business Administration's procedures to counter fraud and improper lending have ensnared legitimate Paycheck Protection Program applications.

By John ReostiFebruary 10