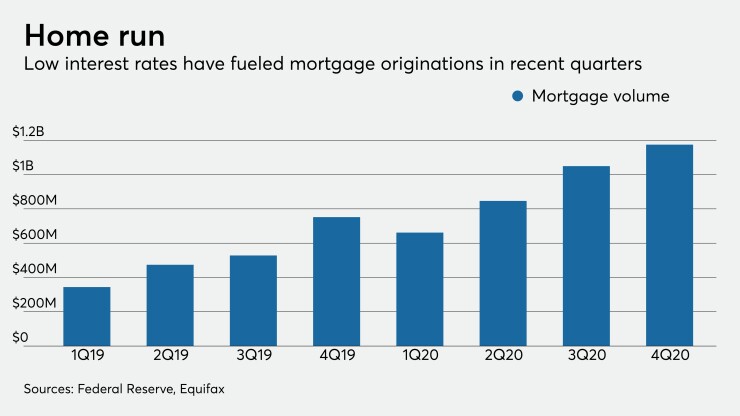

Western Alliance Bancorp’s planned purchase of a big mortgage company fits a narrative

Western Alliance agreed on Tuesday

AmeriHome’s model “diversifies Western Alliance’s current commercially focused spread-based income to deliver a more-balanced business mix,” Ken Vecchione, the Phoenix company’s president and CEO, said during a Tuesday conference call to discuss the deal. “This creates a meaningful increase in noninterest income.”

The acquisition also solves another lingering issue for Western Alliance by providing the means to reinvest $6 billion in liquidity currently parked at the Federal Reserve, Vecchione said in an interview after the conference call.

“After we close, we should be able to … bring on incremental loans that we’ll keep on our books,” he added. “Instead of earning 10 basis points, we’ll earn the note rate on each one of those mortgages.”

AmeriHome, the nation’s third-biggest correspondent mortgage lender, primarily buys home loans from a network of more than 720 originators, then sells the mortgages to investors. It also manages a $99 billion servicing portfolio.

AmeriHome, which would become a unit of Western Alliance Bank, would gain access to low-cost deposits, potentially reducing its funding costs by as much as $53 million in 2022. That it turn would allow it to buy more loans.

The aim AmeriHome all along was to partner with a bank, Jim Furash, the company’s founder and CEO, said in an interview.

“The things they bring us at AmeriHome are going to make me incredibly more competitive in the correspondent space,” Furash said. “The access to liquidity, to the balance sheet for specific products, should we choose to do that, will distinguish me in the market and will deepen my relationships with my sellers.”

Furash had an interim plan that involved going public.

Backed by Apollo Global Management, Aris began planning for an initial public offering last year,

Vacchione said the proposed IPO made it easier for Western Alliance to come up a price for the mortgage company.

“I think having AmeriHome go through the S-1 process and have price discovery helped set a very reasonable price, rather than having two parties come at it with one saying I want higher and the other one saying lower,” Vecchione said. “What we did here is say, ‘We know what the value is, the market has told us.’ We negotiated around the edges of that.”

Vecchione credited Steve Curley, who leads Western Alliance’s mortgage warehouse lending group, with planting the seeds for the deal. AmeriHome has also been a Western Alliance client for more than four years.

“Steve has been calling on Jim for a number of years,” Vecchione said. “He said, `You ought to get to know Jim and his team. They’re a little bit different. They remind [me] of us. I think you’ll get along very well.’ We did that. We got along well.”

“On a deal front, it’s just very rare that you have two CEOs that get along, basically share the same philosophy and business strategy about a combined entity,” Furash said. “You couple that with four years of working experience that prove all the things we believed four years ago. Nothing has changed, it’s only deepened.”

The deal has been well received by those who follow Western Alliance.

Western Alliance “is adding a high-volume producer of mortgages in a plug-and-play transaction,” Timothy Coffey, an analyst at Janney Montgomery Scott, wrote in his client note. “We anticipate immediate EPS growth when the deal closes.”

Still, some industry experts noted that Western Alliance is making a long-term commitment to a cyclical business — mortgages — that several banks

While “compelling from a financial standpoint,” Brad Milsaps, an analyst at Piper Sandler, wrote in a note to clients that he was not “overly excited about adding the volatility” of adding mortgages to Western Alliance’s model.

Still, the proposed merger could lead other banks and mortgage lenders to consider their options when it comes to M&A.

“We believe this transaction could be a catalyst for the market to reconsider” similar deals, Kevin Barker, an analyst at Piper Sandler who covers mortgage lenders, wrote in a note to clients. Western Alliance’s justification for the deal “provides insight into potential synergies for banks.”

AmeriHome should be a “stronger competitor to peers given its cost of financing should drop to [less than 10 basis points] and it will have the capacity to offer more products outside of government or conventional loans,” Barker added.

AmeriHome fits neatly into Western Alliance’s strategy of investing in national lending platforms. Western Alliance has also reached three-year employment agreements with Furash and the rest of AmeriHome’s senior management team.

“I like to say we are a national bank with a regional footprint in Arizona, California and Nevada,” Vecchione said. “We get opportunities to move our capital and liquidity around the country and around different business segments. Jim’s group is another business segment.”

Paul Davis contributed to this report.