-

The additions come as the Georgia regional looks to maintain momentum in commercial lending.

By Jon PriorFebruary 10 -

The new features use automatic transfers to encourage account holders to build savings faster and with less effort.

By Jon PriorFebruary 5 -

The timing couldn’t be worse for ag and energy lenders as well as global banks, which were all counting on the Chinese market to help bolster commercial lending and fee income.

By Jon PriorFebruary 4 -

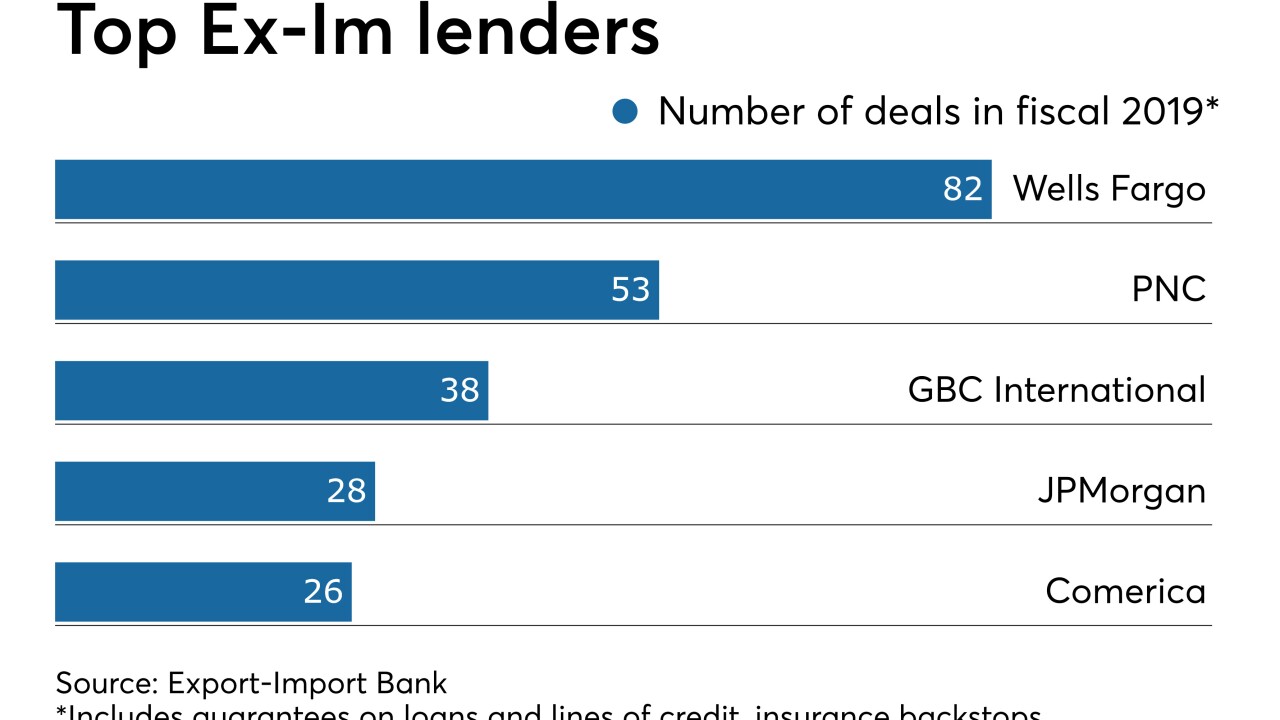

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

By Jon PriorJanuary 30 -

No Republicans voted for the package of bills intended to overhaul the credit reporting system, casting doubt on its chances in the GOP-controlled Senate.

By Jon PriorJanuary 30 -

Cassandra McKinney's promotion to executive vice president of the retail bank is the latest executive move by Curt Farmer, who became the Dallas company's CEO in April.

By Jon PriorJanuary 29 -

The largest bank in Puerto Rico said hundreds of millions of dollars of its mortgages and consumer loans are tied to the parts of the island hit by the recent quake or still recovering from two hurricanes.

By Jon PriorJanuary 28 -

The promotion of Melinda Chausse was one of several leadership changes the Dallas company announced this month.

By Jon PriorJanuary 23 -

Commercial lending was sluggish in 2019, but leaders at Huntington, KeyCorp and M&T are encouraged that rates are stabilizing and business sentiment is improving.

By Jim DobbsJanuary 23 -

Fourth-quarter fees earned from managing the assets of family offices rose 12% and were a powerful counterbalance to tighter margins.

By Jon PriorJanuary 22 -

Eric Smith and Michael Morton have been brought on as vice chairs to help build out the Chicago bank's commercial lending arm.

By Jon PriorJanuary 22 -

The Dallas bank’s troubled energy loans reached a nearly two-year high as crude prices plummeted.

By Jon PriorJanuary 21 -

Total loans at Regions Financial fell slightly last year, but executives say a shift in consumer lending priorities and more aggressive C&I lending will start to pay off this year.

By Jon PriorJanuary 17 -

The fintech Sezzle has finally received its point-of-sale lending license in California after agreeing to refund consumers in the state and pay a penalty for previously making illegal loans there, the California Department of Business Oversight said Thursday.

By Jon PriorJanuary 17 -

The fintech Sezzle received its license after agreeing to refund customers and pay a fine for previously making loans that state regulators had deemed illegal.

By Jon PriorJanuary 17 -

CEO William Demchak said the bank has witnessed "a lot of mischief" among customers who open checking accounts to collect bonuses and then never use the accounts again.

By Jon PriorJanuary 15 -

The country's biggest bank is leaning more on fee income to offset rate pressures, expanding in selected U.S. cities and laying the groundwork for operations in China that CEO Jamie Dimon hopes will endure “for 100 years.”

By Jon PriorJanuary 14 -

Can Charlie Scharf fix what ails Wells Fargo? How will Kelly King and Bill Rogers manage the integration of the biggest bank merger since the early 2000s? And will New Jersey Gov. Phil Murphy be able to beat back opposition from the banking industry and make good on his promise to create a state-owned bank? Here are 11 leaders to keep an eye on in 2020.

By Alan KlineJanuary 12 -

Native American leaders are cheering the proposal, which would give banks Community Reinvestment Act credit for making loans on reservations, even if the lands sit far outside their assessment areas.

By Jon PriorJanuary 7 -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

By Jon PriorJanuary 2