Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

Many of the 15 executives selected for our Most Powerful Women in Banking: Next list are in roles that took on outsize importance in a year punctuated by a global pandemic, economic free fall and widespread protests over police brutality and racial inequality.

May 6 -

Cordray, named this week to lead the Education Department's office of federal student aid, cracked down on banks, student loan servicers and for-profit colleges when he was director of the Consumer Financial Protection Bureau.

By Kate BerryMay 4 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

By Kate BerryApril 30 -

The Consumer Financial Protection Bureau disputes a district court ruling that misconduct claims against the company were already covered by a previous settlement.

By Kate BerryApril 22 -

“You all will not let me breathe” is just one example in the CFPB’s complaint database where a consumer likened alleged mistreatment by a financial institution to social injustice. An artificial intelligence firm uses technology to help companies flag such language.

By Kate BerryApril 19 -

The company agreed to pay a $750,000 to address claims it steered consumers into high-cost loans from affiliated lenders. It will also reimburse consumers $646,000 in fees.

By Kate BerryApril 13 -

The Consumer Financial Protection Bureau's revocation of a Trump-era policy on abusive practices could mean higher fines and penalties for violators. But it still isn't clear what makes a practice abusive.

By Kate BerryApril 13 -

A recent statement by acting Director Dave Uejio is the clearest signal that the agency plans to revive strong underwriting standards that the Trump administration eliminated.

By Kate BerryMarch 29 -

The FHFA’s forbearance extension to September is forcing nonbank servicers to buy out more delinquent loans. It's also upended loss estimates for investors and made racial and income disparities in the mortgage market worse.

By Kate BerryMarch 25 -

Former Obama-era regulators Kara Stein and Sarah Bloom Raskin, as well as Atlanta Fed President Raphael Bostic, have joined the field of potential nominees to lead the Office of the Comptroller of the Currency, according to sources familiar with the process.

March 25 -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

By Kate BerryMarch 24 -

Top officials at the U.S. central bank and Treasury Secretary Janet Yellen reaffirmed their commitment to understand how extreme weather events affect financial institutions and the economy as a whole. Many Republicans, however, worry the Federal Reserve’s new climate focus strays too far from its traditional function.

By Hannah LangMarch 23 -

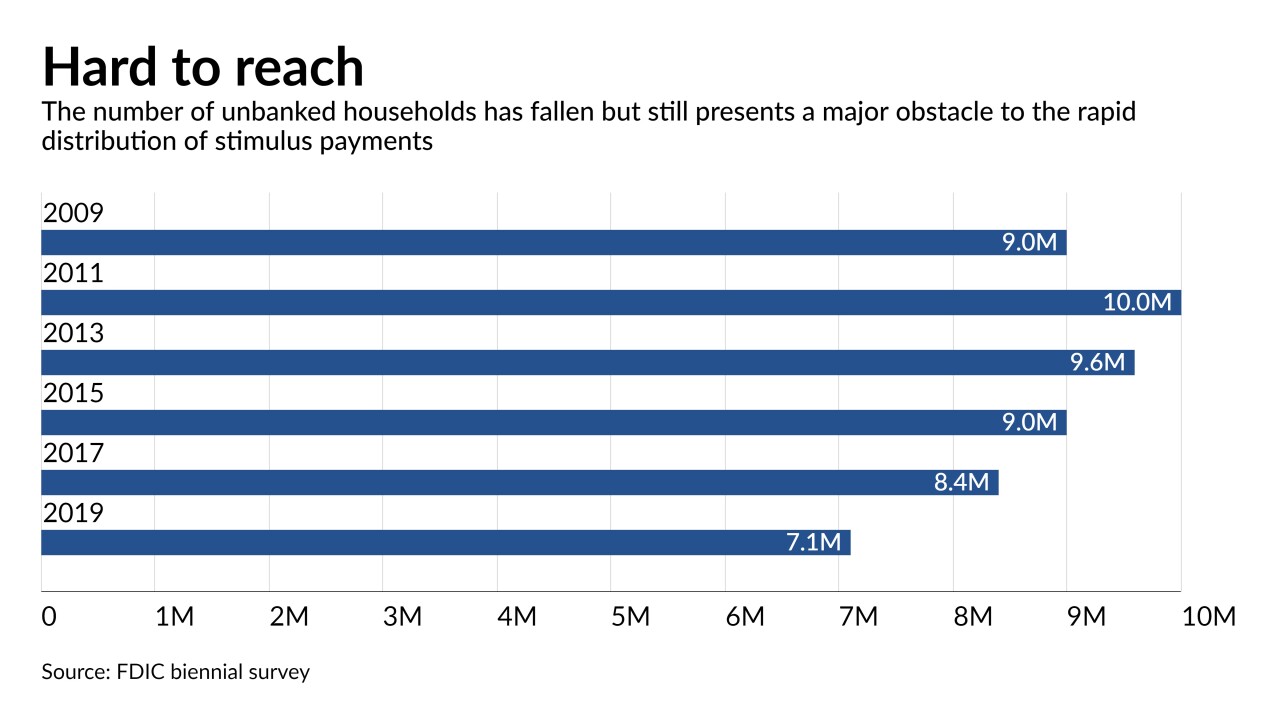

The IRS, FDIC and more than 70 banks and credit unions are urging consumers to open affordable accounts so they can receive their Economic Impact Payments quickly and safely. Many people have signed up, but millions lack accounts and will be harder to serve.

By Kate BerryMarch 17 -

The agency's new leadership, which has already unwound numerous actions from the prior administration, said the January 2020 guidance implementing criteria for punishing firms that mistreat customers was “inconsistent with the bureau’s duty to enforce Congress’s standard.”

By Kate BerryMarch 11 -

Many in Washington have been in suspense about whether the Biden administration would favor a former Obama official or a financial inclusion advocate for comptroller of the currency. Mehrsa Baradaran, the candidate preferred by community activist groups, appears to have the edge.

March 10 -

In "Democracy Declined," Duke public policy professor Mallory SoRelle argues that policymakers should be more aggressive in combating unfair lending practices.

By Kate BerryMarch 8 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

By Kate BerryMarch 7 -

The agency issued a proposal moving the compliance date for the Qualified Mortgage rule revamp to October 2022.

By Kate BerryMarch 3 -

Rohit Chopra, President Biden's pick to lead the Consumer Financial Protection Bureau, told a Senate panel he would do more to protect veterans from foreclosure, empower consumers to dispute data on their credit records and crack down on student loan servicers that aren't helping troubled borrowers.

By Kate BerryMarch 2 -

In an analysis of the pandemic's impact on the housing market, the agency said nearly 10% of households could be at risk of eviction or foreclosure despite government programs to enable homeowners to delay their payments.

By Kate BerryMarch 1