Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

John Stumpf may have hoped that Tuesday's hearing on Capitol Hill would mark a key turning point in Wells Fargo's blossoming scandal, but his harsh questioning by lawmakers and his struggle to answer many of their questions suggests that the embattled megabank's problems are just beginning.

By Kevin WackSeptember 20 -

Wells Fargo's board of directors will decide whether to claw back any executive compensation that may have been tied to inflated sales metrics, the company said Monday in a letter to five U.S. senators.

By Kevin WackSeptember 19 -

The embattled bank is under pressure to claw back bonus pay from executives. Its decision figures to have ripple effects throughout the industry.

By Kevin WackSeptember 16 -

Fifth Third Bancorp said Tuesday that it plans to close 44 branches, a cost-cutting move that follows its recent shutdown of more than 100 branches.

By Kevin WackSeptember 13 -

A fintech startup called Point is allowing consumers sell a piece of their home equity to investors, rather than borrowing against the value of their houses.

By Kevin WackSeptember 13 -

Lending Club, which has been rebuilding its executive ranks in the wake of a recent scandal, is hiring Thomas Casey as its chief financial officer.

By Kevin WackSeptember 12 -

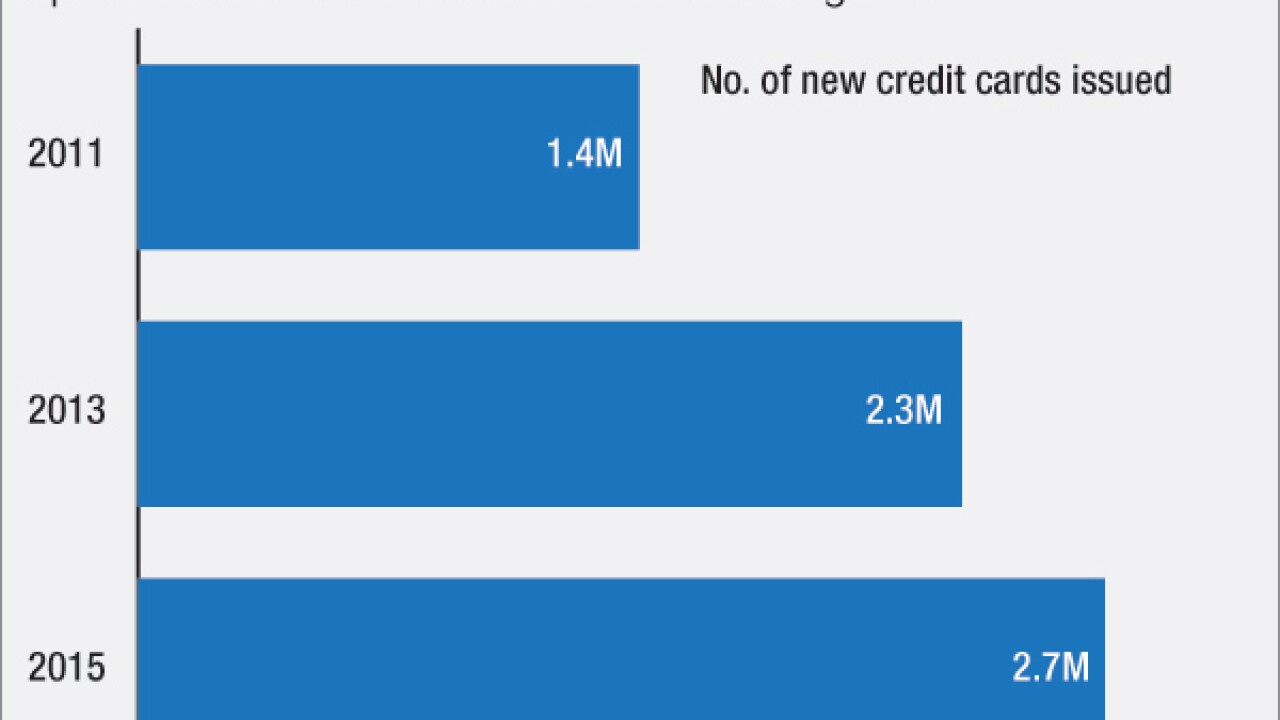

The revelation Thursday that Wells Fargo employees were opening accounts for customers without their consent is sparking doubt about the accuracy of the reported growth in the credit card business. The scandal also casts in a harsh new light on Wells strategy of building a large credit card operation through its branch network.

By Kevin WackSeptember 9 -

The revelation that Wells Fargo employees were opening accounts for customers without their consent is sparking doubt about the accuracy of the reported growth in the credit card business. The scandal also casts in a harsh new light Wells strategy of building a large credit-card operation through its branch network.

By Kevin WackSeptember 9 -

Alliance Data Systems in Plano, Texas, has reached an agreement to provide credit card programs for Williams-Sonoma, the high-end kitchenware retailer.

By Kevin WackSeptember 9 -

Alliance Data Systems in Plano, Texas, has reached an agreement to provide credit card programs for Williams-Sonoma, the high-end kitchenware retailer.

By Kevin WackSeptember 8