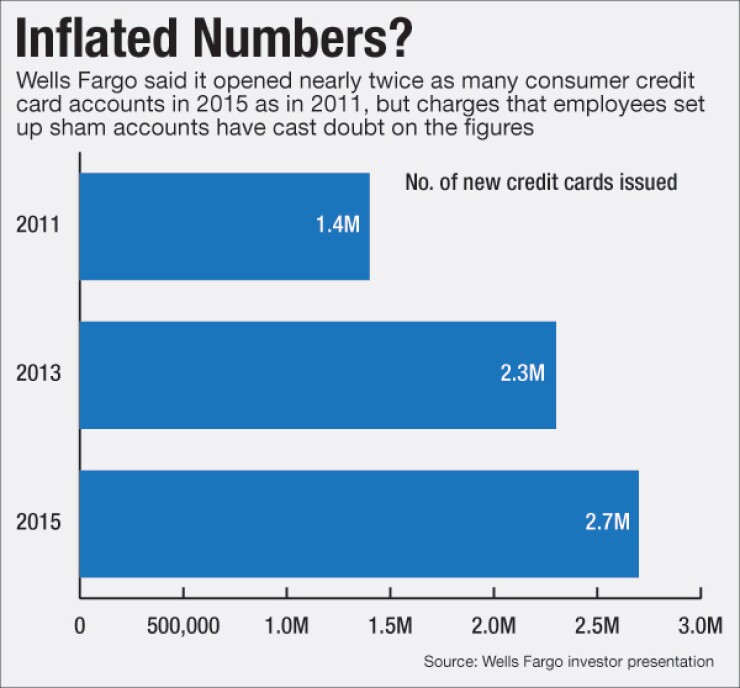

Quarter after quarter after quarter, Wells Fargo boasted about strong growth in its credit card business.

During the first three months of 2013, 577,000 new credit card accounts were opened, according to a company presentation filed with the Securities and Exchange Commission. The following quarter, Wells reported 594,000 new accounts.

By May 2015, 42.6% of Wells Fargo's retail banking households had a credit card with the company, according to the firm's most recent earnings report. That penetration rate was up from 31% just three years earlier.

But the revelation Thursday that Wells employees were enrolling customers in products without their consent is sparking doubt about the accuracy of some of the company's disclosures.

The scandal also casts in a harsh new light on Wells Fargo's strategy of building a large credit card business branch by branch, customer by customer, and employee by employee, rather than through the use of mass advertising, as most other big banks have done. This approach, in which branch employees were awarded bonuses for signing customers up for credit cards and other products, created circumstances that were ripe for fraud.

Wells agreed to pay $190 million to settle charges that employees opened bank and credit card accounts for customers without their knowledge. That total included a record $100 million penalty to the Consumer Financial Protection Bureau, $50 million to the city and county of Los Angeles and $35 million to the Office of the Comptroller of the Currency.

An analysis conducted for the San Francisco-based bank found that between May 2011 and July 2015, Wells Fargo employees applied for approximately 565,000 credit card accounts that may not have been authorized by consumers.

A Wells Fargo spokeswoman said Friday that the bank stands by the numbers it previously reported regarding new credit card accounts and the penetration rates for those accounts. Then she cut the interview short, referring American Banker to another spokeswoman who did not provide answers to questions by deadline.

Wells is the third-largest U.S. bank by assets, but in the credit card business it lags behind six other banks. The big six credit card issuers are JPMorgan Chase, Bank of America, American Express, Citigroup, Capital One Financial and Discover Financial Services.

Credit cards are a lucrative business, and Wells has been striving in recent years to become a bigger player. Though it had once been rumored to be in the market to buy a credit card lender, it chose to build the business organically and it has had some success. Consumer card balances at Wells Fargo grew from $21.0 billion in the second quarter of 2011 to $33.4 billion five years later.

But the firm's growth in credit cards has been limited by its strategy of distributing plastic primarily through branches and digital channels to existing Wells Fargo customers.

Unlike Chase, Citi and others, Wells Fargo has not relied on the heavy solicitation of new customers. "The card portfolio at Wells is pretty unique because of the way it's grown," said Brian Riley, an analyst at Mercator Advisory Group.

Nick Clements, a former credit card executive at Citi and Barclays, said that Wells Fargo has taken a completely different approach to credit cards than other big banks.

Rather than competing for new customers by making highly enticing offers, Wells relied on its branch staff to sell credit cards, he said.

The branch-centric approach is even reflected in the company's organizational chart, where credit cards are embedded within the consumer lending group, rather than standing on their own. The firm's credit card business is part of a group headed by Shelley Freeman, who reports to Avid Modtjabai, the bank's head of consumer lending.

Wells Fargo's strategy has recently started to evolve, Clements said, as the company has put more emphasis on competing for customers who do not have existing relationships with the bank. To cite one example, Wells recently inked a promotional deal with MagnifyMoney, a comparison-shopping website that Clements co-founded.

Clements sees Thursday's enforcement action, which brought the announcement that more than 5,000 employees have been fired, as a sign that Wells Fargo's traditional strategy in credit cards has hit its limits.

"When you've got over 5,000 people who exit, there's something systemic about that. And incentives play systemic roles," he said, referring to the bonuses Wells Fargo paid to employees. "My guess is the incentives are going to have to change. And when the incentives change, you're going to see different outcomes."