Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

Consumers voted with their feet in September, as the embattled bank said Friday that new checking accounts were down by 25% from year earlier.

By Kevin WackOctober 14 -

Its reputation tarnished by revelations that employees opened roughly 2 million phony accounts in order to meet sales targets, Wells Fargo last month suffered a steep decline in new retail checking accounts and credit card applications.

By Kevin WackOctober 14 -

Consumers voted with their feet in September, as the embattled bank said Friday that new checking accounts were down by 25% from a year earlier.

By Kevin WackOctober 14 -

Two community banks have put forward plans for a speedier U.S. payment system. They're up against the industry's giants.

By Kevin WackOctober 6 -

A new app aims to modernize the automobile financing process by allowing car shoppers to get credit approval on their phones.

By Kevin WackOctober 5 -

Wells Fargo Chief Executive John Stumpf may get a third grilling by lawmakers over the fake account scandal that continues to embroil the San Francisco bank.

By Kevin WackOctober 4 -

Wells Fargo Chief Executive John Stumpf may get a third grilling by lawmakers over the fake-accounts scandal that continues to embroil the San Francisco bank.

By Kevin WackOctober 4 -

The Federal Reserve said Tuesday that 19 private-sector proposals are now under review by nearly 500 members of two separate task forces, one of which was established to chart a path toward a faster payment system, and the other focused on payment system security.

By Kevin WackOctober 4 -

The number of firms vying to build a faster U.S. payment system has been whittled down slightly.

By Kevin WackOctober 4 -

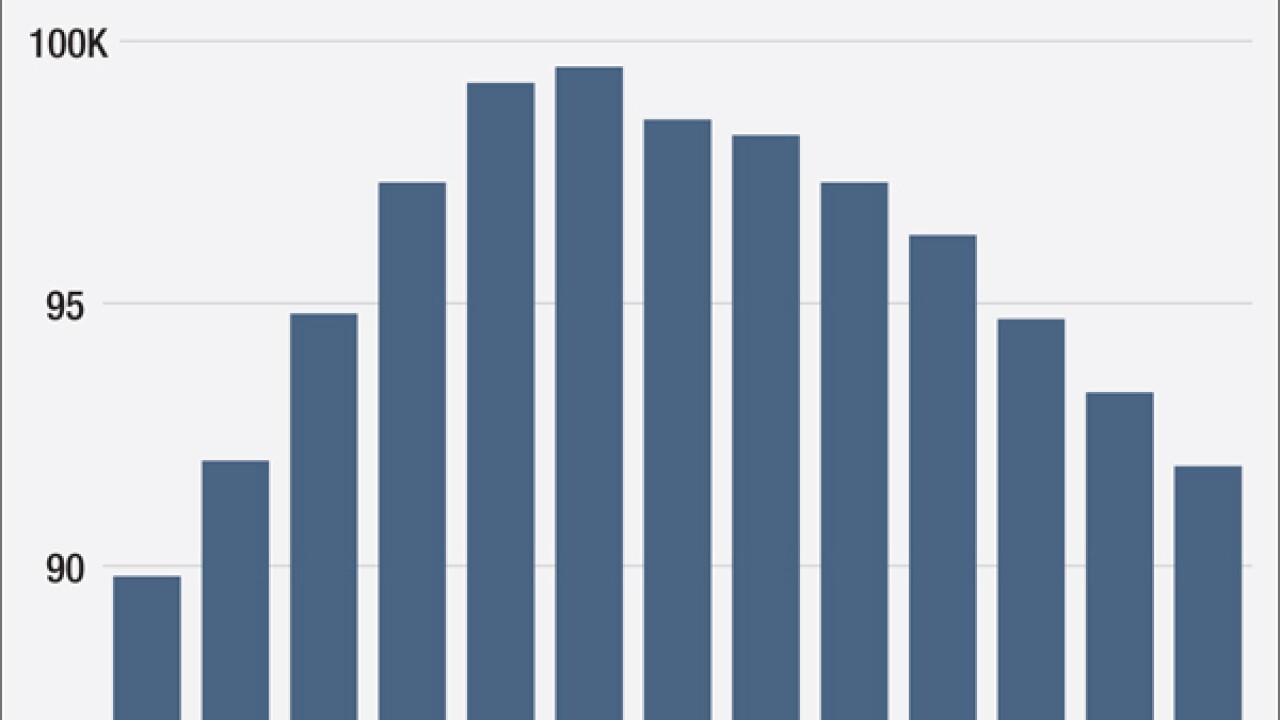

Total deposits at U.S. banks climbed nearly 6% year over year, to $11.3 trillion, even as the total number of banks and branches declined.

By Kevin WackOctober 3