Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

Stephen Calk is in the national media glare because his small Chicago-based bank made two enormous loans to Paul Manafort, President Trump's onetime campaign manager. Here’s a look at Calk's career and how he ended up in this spot.

By Kevin WackFebruary 23 -

The prepaid card issuer has bounced back from the hit it took after discontinuing a product that proved to be popular with fraudsters.

By Kevin WackFebruary 21 -

A community group has secured a grant from the W.K. Kellogg Foundation to probe banks’ small-business lending practices. It follows a 2017 pilot study in which the group found that white shoppers posing as business owners were three times more likely to be invited for follow-up appointments than their black counterparts and twice as likely to be offered help in completing loan applications.

By Kevin WackFebruary 21 -

The online lender continues to contend with the fallout of a 2016 scandal that led to the ouster of its founder and CEO.

By Kevin WackFebruary 20 -

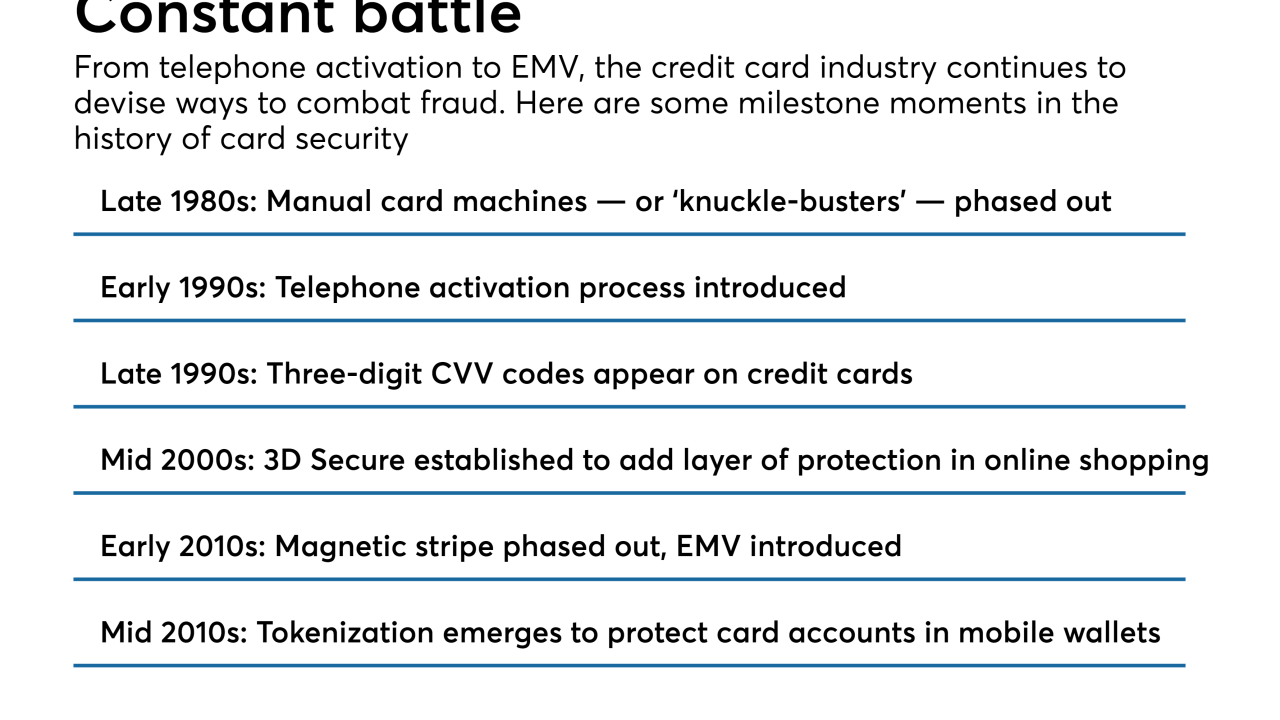

The card activation process is relatively low-tech, but since its introduction nearly three decades ago it has been hugely effective in preventing credit cards from falling into the wrong hands. Among its pioneers was Ash Gupta, American Express’ president of global credit risk, who is retiring next month.

By Kevin WackFebruary 16 -

The bank’s unsullied image took a hit when it admitted to misleading regulators regarding its efforts to combat money laundering.

By Kevin WackFebruary 15 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

By Kevin WackFebruary 15 -

The Pew Charitable Trusts has released a set of 10 standards for banks and credit unions that want to offer small loans to subprime customers. Among its ideas: keep monthly payments at or below 5% of the borrower’s paycheck and make loans available quickly through digital channels.

By Kevin WackFebruary 15 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

By Kevin WackFebruary 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

By Kevin WackFebruary 13