Laura Alix is a reporter at American Banker.

-

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

By Laura AlixMay 15 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

By Laura AlixMay 14 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

By Laura AlixMay 14 -

The Southeastern regional bank said Thursday that it had hired Lee Byrd to a new role dedicated to protecting customers and the company itself from fraud.

By Laura AlixMay 9 -

A sharp disagreement between foreign and U.S. regulators is emerging on how far banking supervisors should go in asking financial institutions to stress test their loan and investment portfolios for any risks associated with climate change.

By Laura AlixMay 8 -

Lenders say they are seeing a rise in synthetic identity and other types of attempted fraud. Here’s what they are doing to thwart it.

By Laura AlixMay 7 -

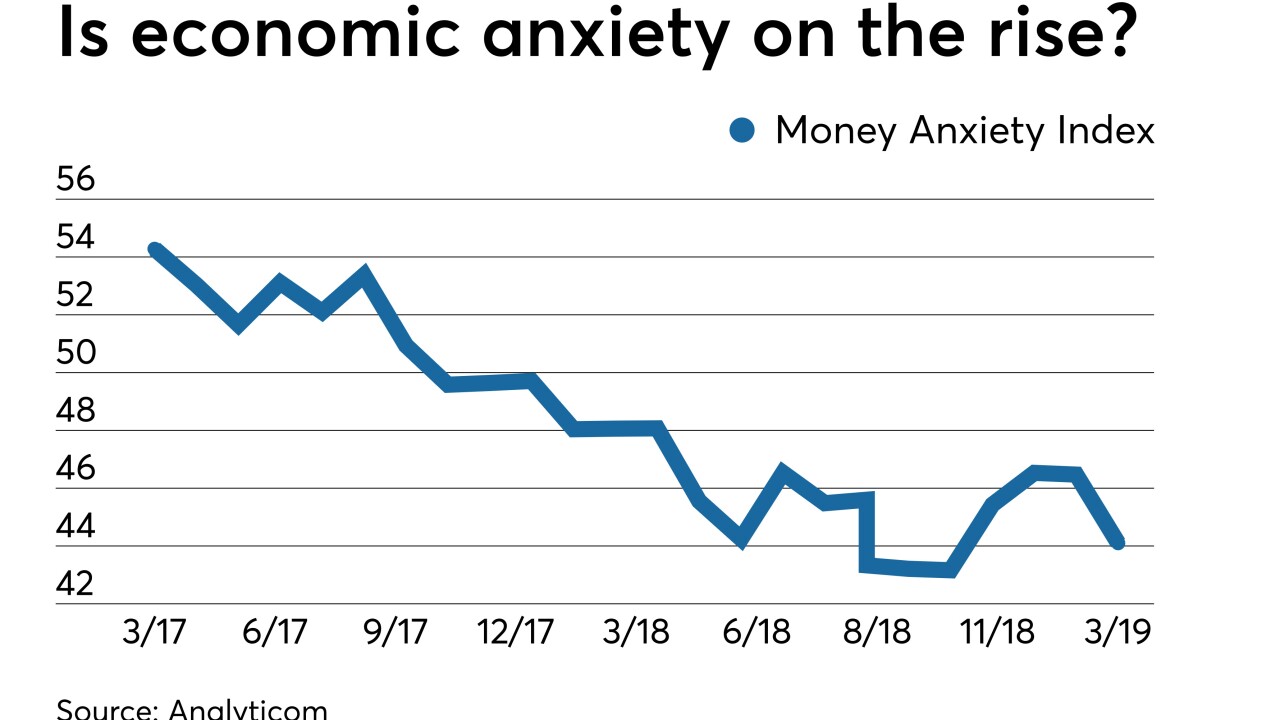

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

By Laura AlixMay 2 -

As chief operational risk officer, Carrie Lichter played a key role in bringing to life Fifth Third's high-tech war room, also known as the cyber fusion center.

By Laura AlixMay 1 -

The Birmingham, Ala., bank's profits fell 32% as its loan-loss provision tripled. The expense covered “isolated, one-off issues” in its commercial and consumer loan portfolios, CEO Javier Rodriguez Soler said.

By Laura AlixApril 29 -

Citigroup has hired Murli Buluswar as head of analytics and information management in its U.S. consumer banking segment. It also has promoted Tracey Warson from head of Citi Private Bank, North America, to chairman of the unit.

By Laura AlixApril 29 -

The Wisconsin bank's pending acquisition of 32 Huntington branches would boost its ability to make more loans, but like other banks it said deposit costs are cutting into margins.

By Laura AlixApril 25 -

The San Antonio bank reported 6.8% growth in loans, but Phil Green said he was unwilling to match overly generous prices and underwriting terms that he is seeing in the market.

By Laura AlixApril 25 -

In the months ahead, the Birmingham, Ala., bank will drop Compass from its name across all of its branches and digital properties. It’s part of a broader plan by its Spanish parent Banco Bilbao Vizcaya Argentaria to unify its brand worldwide.

By Laura AlixApril 24 -

Now that the Cincinnati company recently completed its first bank acquisition in over a decade, CEO Greg Carmichael is pushing ahead on tech hires and expansion outside its Midwestern core.

By Laura AlixApril 23 -

The Dallas company finally made the move that had long been expected: Curtis Farmer succeeds Ralph Babb as chief executive. However, Farmer will still report to Babb, who stays on as executive chairman.

By Laura AlixApril 23 -

Fifth Third bought MB Financial in the quarter and benefited from increases in corporate banking revenues and a slight improvement in credit quality.

By Laura AlixApril 23 -

The Salt Lake City bank saw growth across all lending categories and an improvement in credit quality. It also said it has finished the second of three stages in its multiyear conversion to new core-banking technology.

By Laura AlixApril 22 -

The bank is investing more in its digital capabilities, according to The Cincinnati Enquirer.

By Laura AlixApril 22 -

The two banks, which plan to complete their merger by early fall, have little geographic overlap, so they can keep lending teams in place and push for immediate loan growth, according to Craig Dahl.

By Laura AlixApril 22 -

The Rhode Island bank’s deposit costs nearly doubled in the first quarter, but CEO Bruce Van Saun says it has to go on the offensive to sustain loan growth.

By Laura AlixApril 18